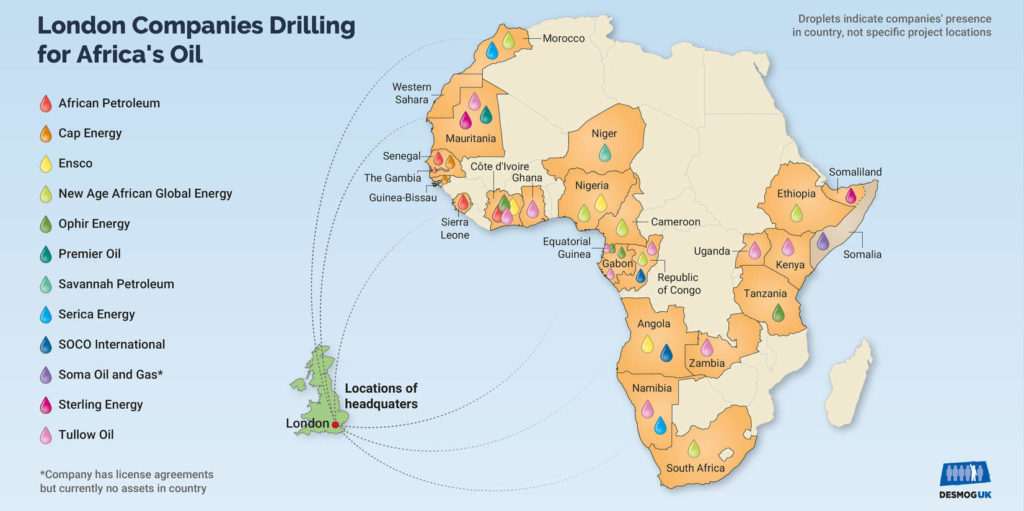

The UK government likes to boast about its credentials as a global climate leader. But a special DeSmog UK investigation reveals the extent of the dirty business taking place at the heart of London.

Small oil and gas companies using offshore accounts in tax havens are allowed to use the City’s financial services to make money by exploiting fossil fuels in some of the world’s most unstable regions with little scrutiny. Some of these companies are listed on London’s junior stock market – the Alternative Investment Market (AIM) – a “boys club” which operates a “light touch” regulation system that has won AIM a “casino” reputation.

Critics have long blamed the market’s self-governance system for failing to deal with allegations of widespread corruption and fraud on the exchange. Using the example of Sirius Petroleum – an oil investment company operating in Nigeria – DeSmog UK sheds some light on the flaws of London’s junior market and spells out the arguments for it to be reformed.

At a time when the UK wants the City of London to remain the world’s largest financial centre post-Brexit, DeSmog UK‘s investigation raises serious questions about the urgency for reform to root out corporate wrongdoing from the heart of its financial institutions.

Author: Chloe Farand

Editors: Mat Hope, Mike Small, Kyla Mandel, & Christine Ottery; Graphics: Sam Whitham; Other multimedia: Jill Russo

Image credit: Friends of the Earth International/Flickr/CC BY–SA 2.0