The arguments in favor of the Enbridge-proposed Northern Gateway Pipeline often stress the economic benefits the pipeline will bring to Canada. Economists and trade organizations emphasize the advantages of increased production in the tar sands for Albertans and the jobs produced during pipeline construction for British Columbians. Another supposed economic bonus is to come from strengthened trade relations with China, the largest foreign investor currently involved in Canada’s tar sands.

Yet as the current National Energy Board hearing takes place, a new message is surfacing, and it’s not of the ‘economic boon’ ilk. According to a number of analysts, energy experts and even industry players the pipeline will export more than just Canadian crude: it will also be shipping off Canadian jobs. And that, they say, coupled with China’s growing stake in the tar sands, is by no means in Canada’s long term economic interest.

Earlier this month, Alberta Premier Alison Redford gave her support for increased ‘foreign investment’ in the tar sands, during a visit to Beijing. Her endorsement appears as official consent of China’s $15.1 Billion (U.S.) offer to purchase Canada’s Nexen Inc. The deal, said to signify growing economic ties between nations, will give China’s state-owned CNOOC significant sway in the movement of oil from Canada to Asian markets.

“We have always believed foreign investment assisted us with growing our economy so we are encouraging that. We want to make sure it is done for the benefit of Alberta,” Ms. Redford said at the time. “We believe these transactions are the best for our economy.”

Yet China’s growing investment – all three of the country’s government-controlled companies have invested in the tar sands – raises concerns that Canada might cede some of its authority over to… actual foreign interests.

To compete with another nation’s economic interests would put Canadians at a disadvantage considering how our domestic energy supplies are developed, who has prioritized access to raw materials, and where those resources are refined for market.

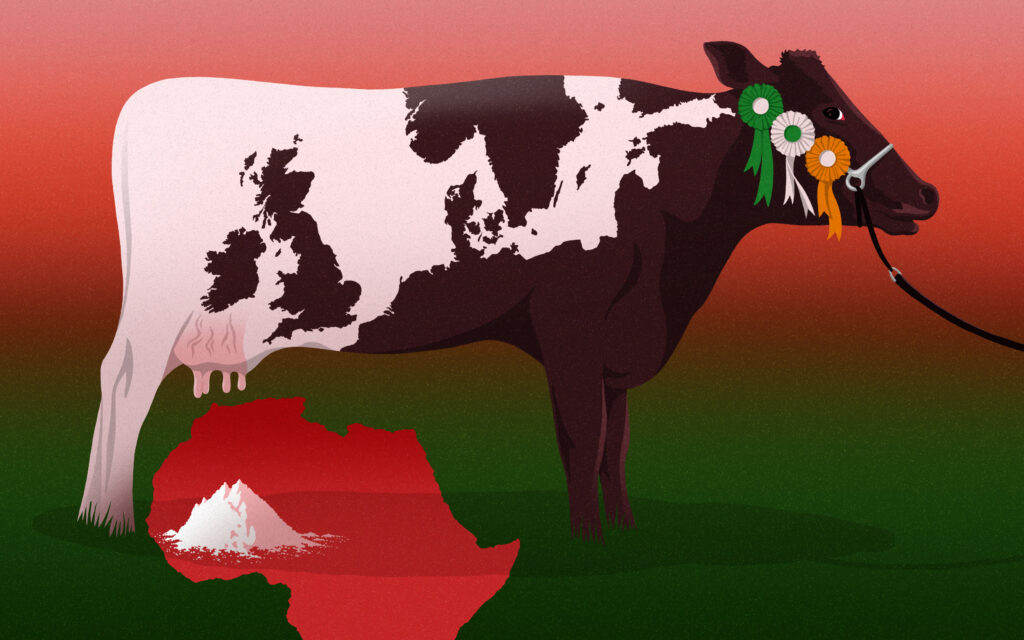

The Northern Gateway Pipeline is proposed to carry 525,000 barrels of Albertan diluted bitumen each day to the British Columbian coast to be loaded onto super tankers destined for the Asian market.

The unrefined crude will then be processed in Asian plants and delivered to local markets, which means local jobs. Such an arrangement guarantees that the refining jobs brought about by the development of Canadian resources are not going to Canadians.

Yet the thought of exporting Canada’s unprocessed oil to other nations is not hypothetical: unrefined crude is already shipped off to Asia and California via the Kinder Morgan TransMountain Pipeline in Vancouver’s Burrard Inlet. And Kinder Morgan’s oil exports have British Columbia’s sole refinery scrambling for oil to process, looking to buy from markets as far away as Saudi Arabia.

The Chevron refinery is located 2.5 kilometers from the Kinder Morgan pipeline, but finds itself competing with the international market for a domestic oil supply.

Last week The Globe and Mail put it this way:

“The refinery’s scramble for oil is perhaps the single best indication of the tremendous shift under way in the oil patch, as oil companies rapidly move to seize new export markets that pay higher prices for crude…The Chevron refinery, then, suddenly finds itself competing for oil with a much broader market. The impact has been dramatic. In November of 2010, the refinery received 51,609 barrels from the pipeline. In the first four months of 2012, it averaged 33,744. During that period, the pipeline was roughly 70 percent oversubscribed, as huge volumes of oil sought to find their way to Pacific markets.”

Chevron has sought to remedy the drop in supply by appealing to the National Energy Board for a “priority destination designation” that would put the refinery first in line for Canadian oil. The Board has seen fit to deny Chevron the designation a total of three times.

The refinery, which employs 460 people and provides B.C. with 30 percent of its transportation fuels, must now compete with global bidders to secure access to domestic oil supplies. It is a reality that jeopardizes the entire enterprise.

“It’s a significant issue for us, probably the largest one facing this refinery,” Ray Lord, Chevron spokesman, told The Globe and Mail. “The current situation is not sustainable for us and it certainly does threaten the refinery.”

Kinder Morgan is currently planning to expand their export pipeline, emphasizing – along with the proposed Northern Gateway Pipeline – the turning tide in Canada’s domestic energy strategy.

NDP energy critic Peter Julian says this is a strategy that just won’t work for Canada in the long term: “We need to ensure the resources we develop should have, as much as possible, value-added done in Canada. We are exporting raw bitumen, raw logs and raw minerals. The Conservative government’s plan is to export more in raw state. This is a real problem because when you look at the disastrous trade deficits that we are seeing now in large part because we have a government that is focused on raw exports rather than the development of value-added products.

We have lost half a million manufacturing jobs under the Conservatives’ watch and they want to fuel raw exports rather than development of refinery capacity and upgrading capacity. When we are exporting raw bitumen, we are exporting jobs. We don’t feel that the plan to carve out raw bitumen as fast as possible and ship it offshore is either environmentally sustainable or economically smart from a Canadian perspective.”

Overall, says Julian, who once worked as a laborer in a B.C. refinery, the country’s energy policy and economic security are intimately linked.

The emphasis, he says, should be on strengthening the Canadian economy in a way that does not jeopardize non-oil resources, like tourism and fisheries, and does not rely too heavily on the importance of emerging markets, like China. At least, not to the extent that Canadian domestic interests and authority are being crowded out.

“We are concerned with the growing foreign investment in Canada and what that might mean for the oil sands. We need a level playing field for these types of takeovers and ensure they take place if there is net benefit to Canada…We need to maximize the potential of our resources,” he said.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts