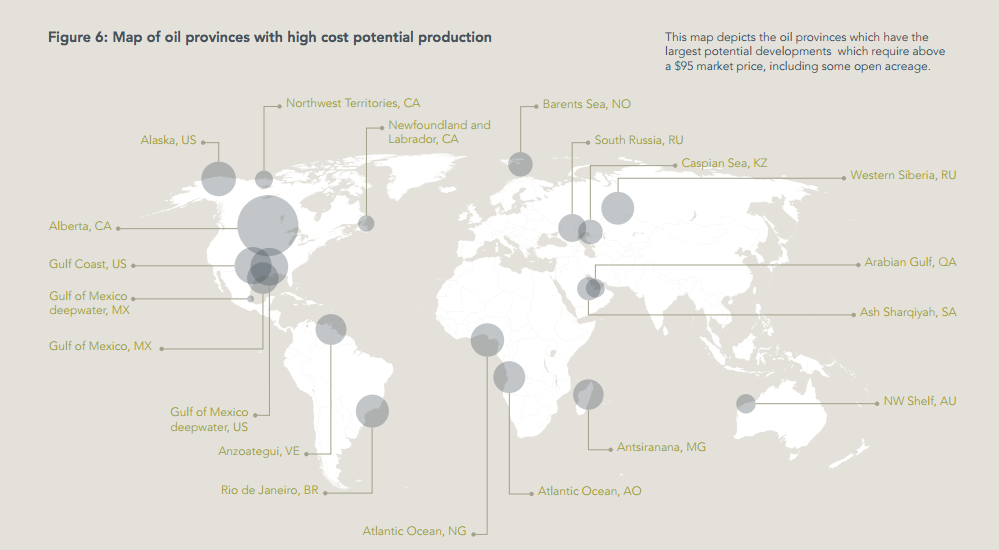

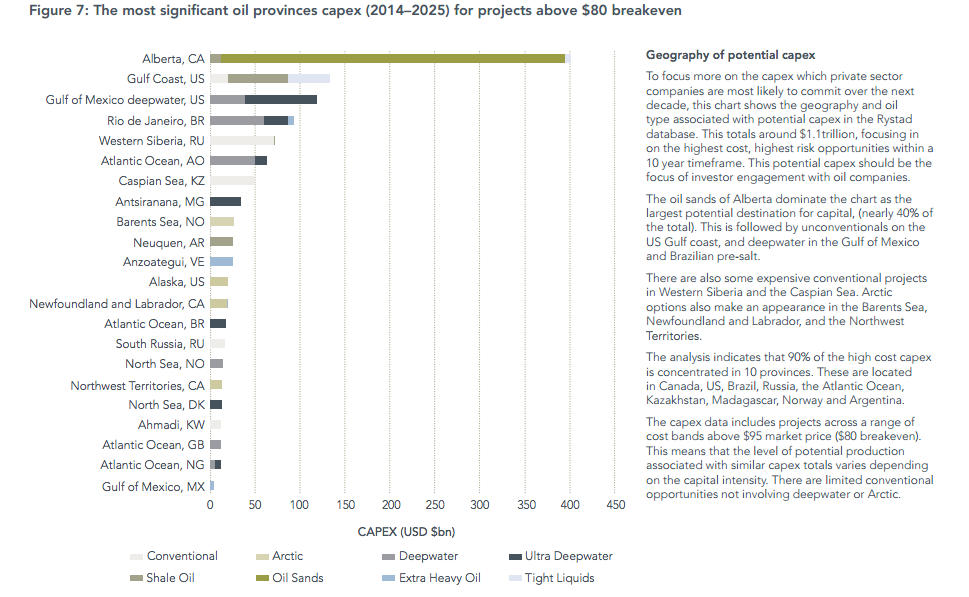

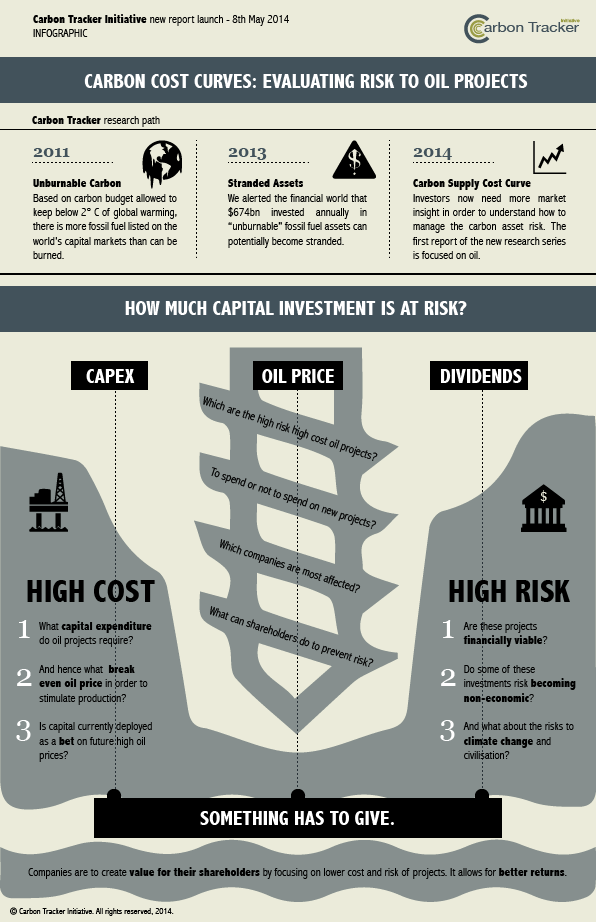

A total of $1.1 trillion USD earmarked for risky carbon-intensive oil sector investments need to be challenged by investors, according to a new report released today by the Carbon Tracker Initiative.

The research identifies oil reserves in the Arctic, oilsands and in deepwater deposits at the high end of the carbon/capital cost curve. Projects in this category “make neither economic nor climate sense” and won’t fit into a carbon-constrained world looking to limit oil-related emissions, Carbon Tracker states in a press release.

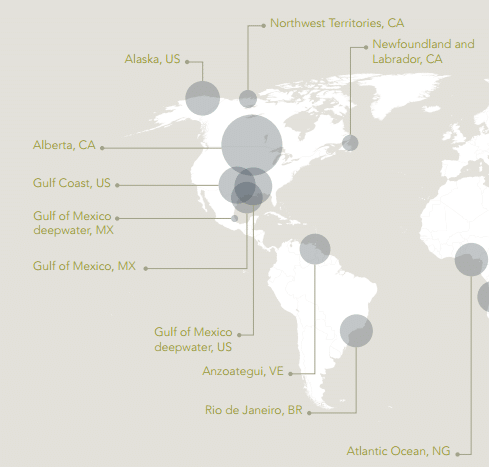

The report highlights the high risk of Alberta oilsands investment, noting the reserves “remain the prime candidate for avoiding high cost projects” due to the region’s landlocked position and limited access to market.

“The isolated nature of the [oilsands] market with uncertainty over export routes and cost inflation brings risk.”

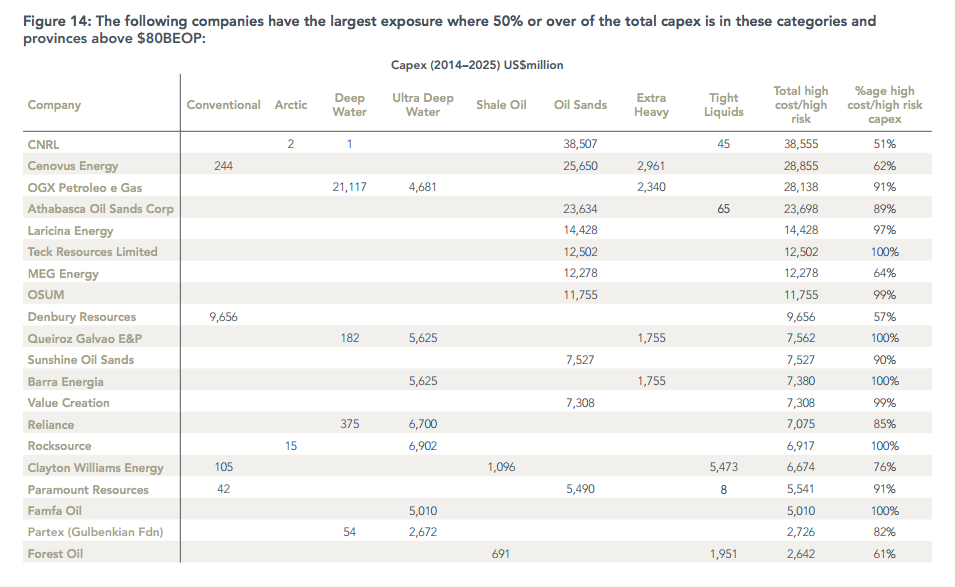

Oilsands major Canadian Natural Resources Limited (CNRL), the company responsible for the mysterious series of leaks at the Cold Lake oilsands deposit, has the largest total exposure to high-cost and high-risk oil investments, valued at a potential of more than $38 billion between now and 2025.

Production forecasts, the basis of capital investment decisions, often rely on business-as-usual assumptions of economic growth and energy demand. But given potential changes in cost, fossil fuel consumption and emission constraints, industry demand projections may need to be reconsidered.

The report’s authors recommend such projections be “stress-tested” for a variety of future scenarios.

Recent efforts by socially responsible investment firms, such as Trillium Asset Management, to limit environmentally egregious investments, as well as the growing divestment movement throw the future of especially expensive and carbon-intensive oil reserves like the Alberta oilsands into question. They face the very likely potential of becoming “stranded assets.”

Previous Carbon Tracker research suggests about two-thirds of the world’s proven fossil fuel reserves need to remain in the ground if international targets to remain under a 2 C temperature rise are to be met.

“For the first time, this report bridges the worlds of oil project economics — in terms of both the marginal cost of supply — and carbon, allowing investors to gauge where risk lies, given a range of demand scenarios,” Mark Fulton, adviser to Carbon Tracker Initiative and a former Head of Research at Deutsche Bank Climate Advisors, said.

“It makes it clear that investors have reason to engage companies on many high-cost and high-carbon-content projects.”

The report recommends investors identify companies investing the majority of their capital in high-cost projects, set thresholds for investor exposure and demand greater transparency and disclosure from industry.

The seven global “majors,” which include BP, Chevron, Shell, Exxon Mobil, Total, ConocoPhillips and Eni, represent the bulk of potential oil production and have high exposure to deposits in expensive locations with expensive-to-produce oil types, such as bitumen from the Alberta oilsands.

Several oil companies have taken steps to address their carbon investment risk. Most notably, Exxon Mobil recently announced they will begin reporting more fully on risky carbon assets in response to investor pressure.

Around $21 trillion of potential capital expenditure would need to be invested by the oil sector in high-risk projects by 2050 to keep the industry afloat, according to the report. But this investment “would not pay for itself in a world where demand is lower and that continues to take climate change and air quality seriously.”

“Many investors are concerned about the growing amount of capital that the oil companies have thrown at low-return, carbon-heavy projects,” Paul Spedding, a former-HSBC Oil & Gas Sector Analyst, said.

Major oil companies need to change their strategy, he added.

“As this report shows, returns are falling and costs are rising. To reverse this, a greater focus is needed on higher return, lower cost assets. If this means lower capital investment and higher dividends or buybacks, so much the better. This analysis is important as it provides the data investors need to challenge proposed investments on the basis of returns as well as carbon content.”

Image Credit: All images courtesy of Carbon Tracker Initiative.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts