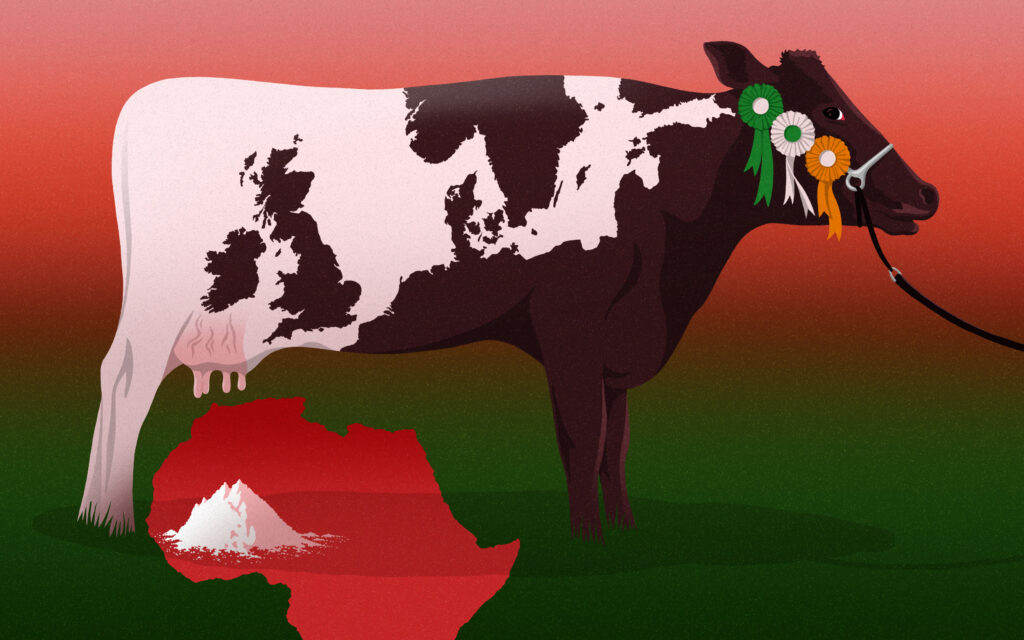

A new divestment campaign launched by ethical financial campaign group Move Your Money has revealed that the UK’s high street banks are investing large sums of customer’s money into the fossil fuel industry, regardless of polls suggesting this is not what the customer wants.

Launched this week, the Divest! campaign intends to convince customers of the top five high street banks, HSBC, Barclays, RBS, Lloyds Bank and Santander to take action against their account holder and to encourage divestment from unethical industries.

According to the latest survey taken on behalf of Move Your Money by Great British Money, “39% of adults in the UK would be unhappy if they found out their money was being used to fund fossil fuel developments, and over 1 in 3 of those surveyed (36%) said that they would like their bank to stop investing in fossil fuels.”

High street banks remain a major financer of the fossil fuel industry, regardless of irreversible evidence that these large institutions are actively engaging in environmentally damaging schemes.

By the end of 2012, for example, “HSBC financed €22 billion in oil, gas and coal extraction,” according to Move Your Money, and have already stated an interest to invest in fracking.

“Doubling divestments”

Moreover, Barclays invested €20 billion into fossil fuel development projects, and “now have a partnership with Third Energy, a fracking company with plans to frack in the North York Moors National Park.”

High street banks are also one of the largest lenders to the coal industry, the most carbon intensive human activity on the planet.

This is irespective of The Royal Bank of Scotland, Barclays and HSBC all having sustainability policies that promote ethical investments.

However, according to 350.org and highlighted in the campaigns publication, the numbers of institutions pledging to divest from fossil fuels has more than doubled from 74 to 181 this year. The combined asset size of 837 institutions committing to divest “amounts to more than $50 billion.”

Rockefeller Divest

These include some of the largest philanthropic funds like the Park Foundation and the Joseph Rowntree Charitable Trust. Each charity has individual assets of more than $300 million.

The most surprising news however comes from a recent announcement by the famously oil-rich Rockefeller Brothers Fund’s, who have decided to completely divest from all fossil fuel projects over the next five years, while actively engaging in the renewable energy industry.

Picture: Pete Markham via Flickr

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts