The Center for Media and Democracy (CMD) and Common Cause have filed an 18-page supplemental complaint to the U.S. Internal Revenue Service (IRS) which calls for a termination of the American Legislative Exchange Council (ALEC)‘s status as a 501(c)(3) non-profit organization and requests civil and criminal charges be brought against ALEC.

Eric Havian, an attorney at the firm Constantine Cannon, submitted over two dozen exhibits attached to the supplement demonstrating that ALEC operates much more like a corporate bill mill connecting corporate-friendly state legislators to lobbyists than it does a 501(c)(3) charitable organization. The submission is an update to the original complaint made by Common Cause back in 2012 and the 2013 supplement brought by CMD and Common Cause.

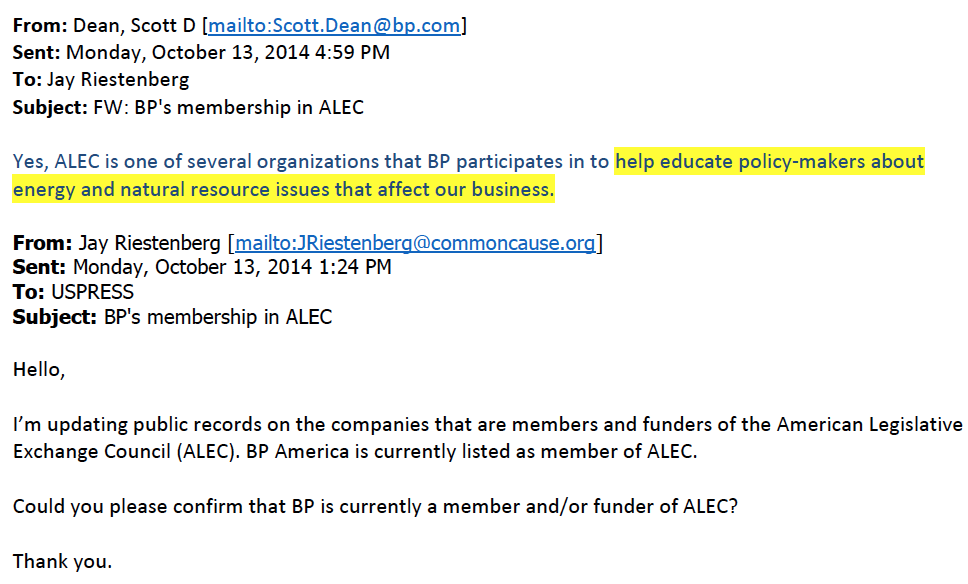

Among the exhibits cited in the supplement are examples of corporations themselves admitting that ALEC serves as a useful lobbying organ for their corporate bottom-lines. Those on the list of corporations include fossil fuel industry goliaths such as Chevron, BP, ExxonMobil, Duke Energy and Peabody Energy.

In a 1991 letter obtained by DeSmogBlog via University of California-San Francisco’s Legacy Tobacco Archives, ALEC‘s then-executive director Sam Brunelli openly bragged of much the same to a top Tobacco Institute lobbyist. Brunelli wrote that “winning is what ALEC is all about” and that joining it can have a “tremendous positive effect on the ‘bottom line’ of your company.”

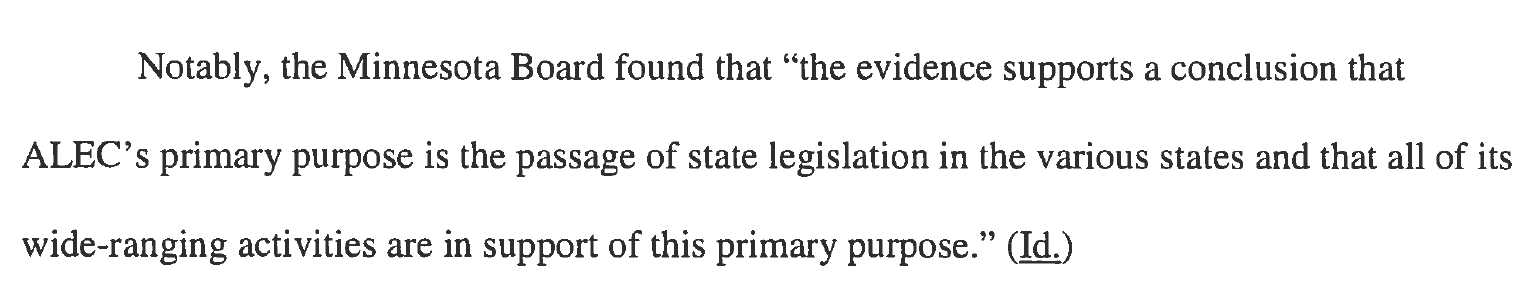

The IRS supplemental complaint also points to an important Minnesota Campaign Finance and Public Disclosure Board investigation published in February 2015 concluding that ALEC‘s “primary purpose” is to bring together legislators and lobbyists.

Image Credit: Common Cause

“Primary Purpose”

Havian’s central legal grievance with ALEC centers around the two words used in the Minnesota investigation: “primary purpose,” which he writes is “to influence legislation.”

A key legal requirement to maintain IRS 501(c)(3) status is that a non-profit must be “organized and operated exclusively for…charitable…and educational purposes…[and] no substantial part of [its activities] is carrying on propaganda, or otherwise attempting to influence legislation,” the supplemental complaint explains in citing the law.

On a press call, Common Cause executive director Miles Rapoport explained that his organization is not opposed to corporate lobbying at-large, but rather doing so under the tax-exempt cloak of a 501(c)(3) while masquerading it as “charity” to the IRS.

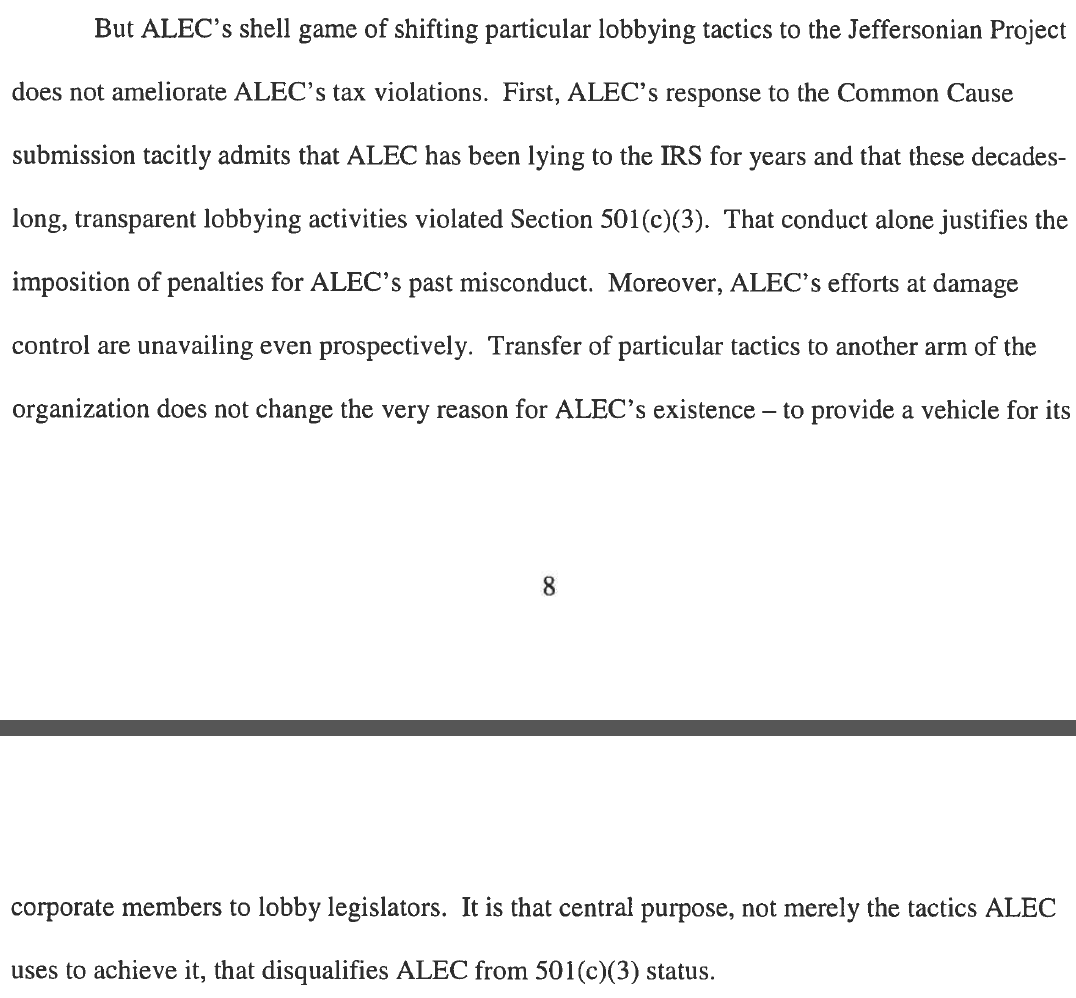

Jeffersonian Project

The supplemental complaint also provides an update and inside view on the IRS 501(c)(4) organization ALEC created in response to the initial 2012 IRS complaint.

Dubbed the Jeffersonian Project and reported on by DeSmogBlog in December 2013, the complaint argues the organization acts as a “shell game” for ALEC while using its 501(c)(3) to serve as the nuts-and-bolts epicenter of its influence peddling machine. The complaint also argues that it is a tacit admission, as we wrote back in December 2013, that ALEC has acted as a lobbying apparatus from day one.

Image Credit: Common Cause

“Legislator-Driven” or “Window Dressing”?

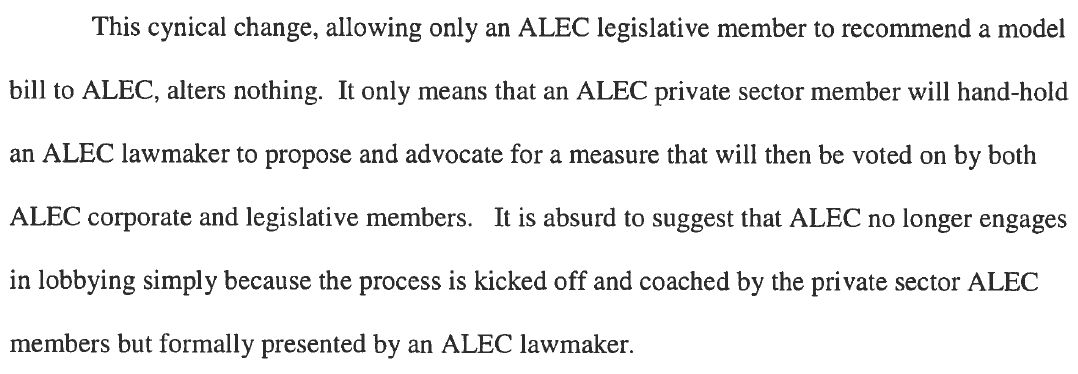

In defense of allegations that ALEC is abusing its 501(c)(3) charitable status, the organization has argued that its legislators are not carrying out agendas handed to them by corporate lobbyists. Rather, ALEC now claims it is “legislator-driven” because it implemented a policy that state-level legislators must introduce ALEC “model bills” at meetings and not corporate lobbyists or other private sector members.

But the supplemental complaint shows otherwise and says this is merely “window dressing” and CMD has previously called it “just a sham.” CMD and Common Cause pointed to numerous examples of ALEC private sector members emailing their legislative agendas to ALEC legislative members and offering suggestions for how to carry them out.

After detailing these examples, CMD and Common Cause called ALEC‘s “legislator-driven” claims a “cynical change” which at the end of the day “alters nothing.”

Image Credit: Common Cause

Lisa Graves, executive director for the Center for Media and Democracy, was similarly blunt on the press call and offered a metaphor: “If it looks like a duck and quacks like a duck, it’s a duck.”

So why doesn’t ALEC just drop its 501(c)(3) status and incorporate as a full-time 501(c)(4)? In an interview with DeSmogBlog, Havian said ALEC‘s corporate benefactors prefer the 501(c)(3) status over 501(c)(4) for tax reasons.

“Donations to a 501c4 are not tax deductible, and many organizations have rules limiting donations to c4s,” said Havian. “If ALEC were strictly a c4 they could lobby as long as they qualified as a social welfare organization.”

“Time for the IRS to Act”

Noting that three years has passed since the initial complaint was sent to the IRS by Common Cause, Rapoport said on the press call that it is “time for the IRS to act.” But why hasn’t it yet?

Havian told DeSmogBlog no one has ever brought a complaint of this kind against a 501(c)(3) non-profit, “particularly one so visible and controversial.”

He also said that generally speaking, the IRS never moves quickly on complaints and this ALEC complaint is no exception.

“That is one of the major shortcomings of the process. Having said that, this is one of the most clear-cut abuses I’ve ever seen,” he said. “It baffles me that it would take the IRS more than a cursory review to conclude that ALEC is a lobbying organization. It couldn’t be more clear.”

CMD and Common Cause have requested the IRS launch an immediate investigation into ALEC‘s alleged abuse of its 501(c)(3) status, revoke the 501(c)(3) status, “impose necessary civil and criminal penalties and collect unpaid back and present taxes for corporate lobbying that is inconsistent with ALEC‘s tax-exempt status.”

Though steep demands, Havian remains optimistic the IRS will move.

“I’m hopeful they will see that allowing ALEC to continue to claim c3 status undermines the purpose of providing tax exemptions for charitable groups and doing nothing could set a very bad precedent,” he stated. “Inaction in this case has serious consequences.”

ALEC did not immediately respond to a request for comment from DeSmogBlog.

Photo Credit: PathDoc | Shutterstock

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts