More than 500 institutions that manage $3.4 trillion in assets have now committed to divesting holdings in fossil fuels, divestment campaign groups announced today in Paris.

As recently as September 2014, just 181 institutions managing $50 billion in assets had made some sort of divestment commitment.

350.org and Divest-Invest, two of the key groups organizing the divestment movement, announced the new additions to the growing list of divestors this morning in Paris at the UN COP21 climate negotiations.

Some of the 500 institutions that have made commitments plan only to dump parts of their fossil fuel portfolios, the groups note. But the groups say the news nonetheless provides further evidence that investors are increasingly moving their money away from fossil fuels and into clean energy technologies.

“Wednesday’s announcement is another sign in the early days of the Paris Climate Summit that investors are reading the writing on the wall and dramatically shifting capital away from fossil fuels and towards clean, renewable energy,” the groups said in a statement.

Other big news out of COP21 certainly helps bolster that point: Bill Gates announced Monday that he has enlisted a group of 28 private investors to create a multi-billion dollar fund intended to accelerate innovation in clean energy technology, a project called the Breakthrough Energy Coalition.

Gates is personally putting up a $1 billion stake, and is joined by a veritable who’s who of tech titans, including Amazon’s Jeff Bezos, Facebook’s Mark Zuckerberg, LinkedIn’s Reid Hoffman, SalesForce’s Marc Benioff and Virgin’s Richard Branson.

One of the most notable new members of the divestment movement is Germany’s Allianz, Europe’s largest insurer, which announced last week it was taking steps to limit its exposure to the climate risks posed by coal investments.

Deliberately tying the announcement to the Paris talks, Allianz said it would divest some €630 million (about $670 million) of its capital investments in coal while reinvesting over €4 billion ($4.25 billion) into wind energy over the next 6 months.

According to the Guardian, Allianz investment chief Andreas Gruber said that the firm is convinced investments in dirty energy will not pay off, saying, “We want to support the negotiations at the climate summit in Paris in December, but also send a signal to our industry and the capital markets.”

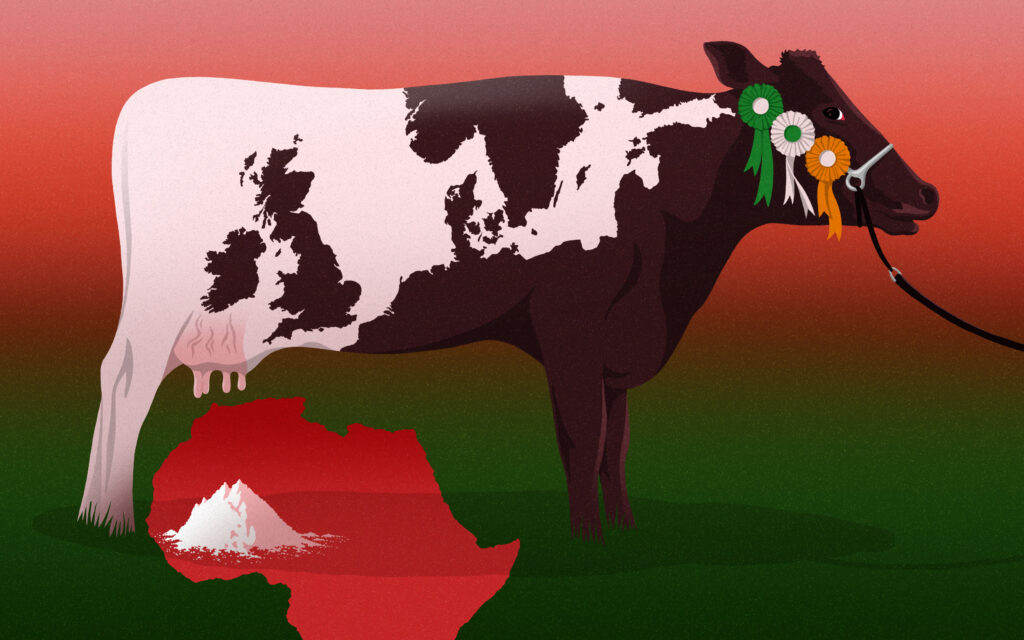

Investors aren’t alone in wanting to see the world move away from fossil fuels, 350.org and Divest-Invest say.

“Other voices, including many of the world’s most vulnerable countries, are demanding that the Paris agreement send a clear signal that the age of fossil fuels has come to an end and the dawn of renewables is irreversible,” they said in their statement.

Image Credit: GoFossilFree.org

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts