This is a guest post by Giles Parkinson, crossposted from RenewEconomy.

Leading investment bank Morgan Stanley believes the Australian energy market is seriously underestimating the grow of solar and battery storage, and says the technology will be installed at rates four times quicker than the incumbent energy industry expects.

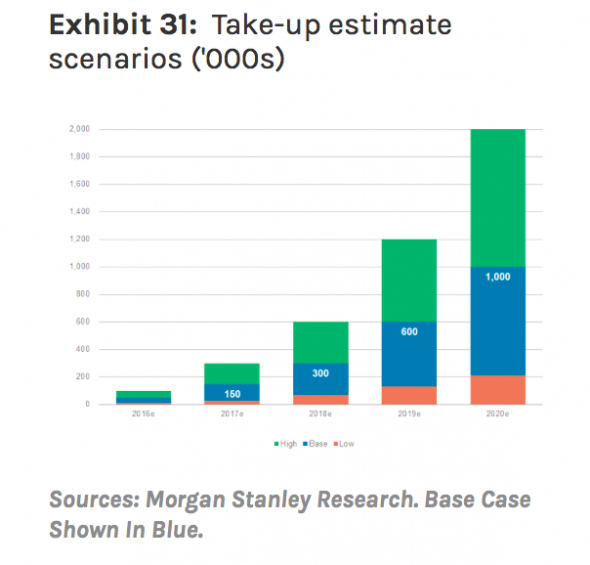

In a new detailed report, Asia Insight: Solar and batteries, Morgan Stanley expects the market for battery storage to grow from about 2,000 Australian homes now to one million by 2020. But its “high case” suggests the take-up could be double that – up to two million homes by 2020.

“We think most incumbent utilities downplay the earnings risks from solar and battery take-up, and the market has not yet priced in the retail and wholesale market effects,” the company analysts write in their report.

The findings of Morgan Stanley are almost diametrically opposed to most in the industry – the incumbent utilities and regulators included. It admits itself that its estimates are by far the most aggressive on the “street” (meaning investment banks).

Last week, the Australian Energy Market Operator predicted 6.6GWh of battery storage in Australia by 2035. That’s the figure that Morgan Stanley says will be reached by 2020, although AEMO’s trajectory corresponds with Morgan Stanley’s “low uptake” scenario.

Most utilities still downplay battery storage as a “medium term” opportunity, saying the “payback” would not occur for another five years at least. Some say 10 years. One state regulator even refused to consider battery storage in its current regulatory approval because it didn’t think the technology “had arrived”.

Morgan Stanley last year released a ground breaking report that provided one of the most optimistic outlooks for battery storage in Australia, which is considered to be a testing ground for the world because of its high electricity prices, excellent sunshine, and its high number of solar households.

That is one reason why the likes of Tesla, Enphase, and Redflow are using Australia as the launch-pad for their global products, and numerous other battery storage and software developers are targeting the country, including Samsung, Panasonic, Sonnen, Ecoult, Reposit, and Redback.

Morgan Stanley said then that it thought 2.4 million households would adopt battery storage. It says that after another year of assessing real world products, costs, tariffs (and tariff directions), business models, and another of its commissioned surveys on consumer behaviour, its belief has been reinforced.

This is despite the fact that its survey (right) points to a slight decrease in the number of people interested in battery storage. But it puts that down to a lack of knowledge about battery storage costs.

Solar stays strong

Morgan Stanley believes that the solar market will remain strong, that electricity tariffs will remain high and that consumers will be attracted to the battery storage technology.

Battery storage installation costs, Morgan Stanley believes, are likely to fall by 40 per cent within two years, and changing business models and tariffs mean that these could be revenue positive by that time. (We go into this in more detail in this article here).

That 40 per cent fall is likely to trigger the start of the “mainstream” market in 2018, a “tipping point” for the market that is expected to double the following year as costs fall further, more retrofits on existing solar systems occur and as consumers start to access payments for network services.

The potential for these network services, such as dealing with peak demand and avoiding network upgrades, are already being recognised by numerous trials being undertaken in Queensland, Victoria, South Australia, and Western Australia.

That market will grow further with further cost reductions, more network service payments, the rollout of retailer control business models and financing securitisation, meaning the easy access to cheap finance. NSW and Victoria will be the biggest markets.

The impact on incumbent utilities could be significant, because as more households adopt solar and battery storage, that takes away from demand from the grid.

Morgan Stanley believes that the impact on retail earnings for Origin and AGL could grow to $50-90 million in fiscal 2020, as households use less electricity from the grid. Wholesale prices will also remain flat as battery storage flattens load shapes, meaning less peak pricing.

The bank congratulates AGL and Origin for their “New Energy” strategies which focus on providing solar and battery storage to their customers. It says they are targeting the “easy adopter” market – customers who want to adopt new technologies, but who want a trusted retail brand to provide a professional sales experience, and stand behind the installation.

But it says this strategy is more about reducing customer retention costs than creating earnings growth, which is why it has only modestly trimmed its earnings reduction impact from last year.

It has even downgraded AGL Energy on the basis of its forecasts – to underweight from equal weight, citing flat demand, the growth of battery storage and new entrants, and more renewables as key factors. It says while AGL and Origin are pushing into solar and storage, it will not be enough to hold revenues, only reigning in customer retention costs.

“Rooftop solar (with or without batteries) is a direct substitute for grid power, and we think the industry response is at best a defence strategy, not a driver of earnings growth,” the analysts write.

“Put simply, the retailer might gain ~A$400/customer from sales, financing and reduced cost-to-retain, but lose ~A$400/customer per annum in lost grid energy sales.

“We think the impact of solar and batteries will play out in a slow and steady fashion over time until reaching a tipping point in the next few years, showing up as unexpected drops in electricity demand (e.g., hollowed out load duration cures) and lower average wholesale electricity prices and caps (which reflect volatility).”

What could go wrong with the Morgan Stanley estimates?

Part of it could be technical issues and installation problems, an issue widely recognised by the industry who fear that lack of standards, and the entry into the market of “cowboys” and cheap and low quality gear could cause problems. One “thermal runaway” event (otherwise known as a fire), could affect public confidence and interest.

It notes also that cost savings could be eroded because of a slow response by pricing regulators, and policy regulators may also be slow in introducing a a number of rule changes needed to facilitate some of the battery applications.

Main image: A wall-mounted Tesla home battery. Credit: Tesla

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts