As Bloomberg put it recently, today “crude oil gushes out of the U.S. like never before.” U.S. exports of crude oil just hit a new record: nearly two million barrels per day. And while at DeSmog we predicted that “lifting the oil export ban will result in large increases in fracking for oil in the U.S.,” most industry experts at the time were making very different claims.

“It’s universally agreed in the short term that we won’t see a flood of ships leaving for foreign ports because the economics aren’t right,” Sandy Fielden, director of energy analytics at respected consulting firm RBN Energy, said in December 2015, just before the ban on crude oil export lifted. Fielden was explaining why lifting that ban wouldn’t result in a sizable and ongoing rush to export American crude.

Columbia University’s Center on Global Energy Policy (CGEP) was instrumental in pushing to lift this export ban. The CGEP report, “Navigating the U.S. Crude Oil Export Debate,” co-authored by the center’s leader Jason Bordoff, said, “we estimate lifting current crude export restrictions could increase U.S. crude production anywhere between 0 and 1.2 million barrels per day on average between now and 2025.”

Zero increase by 2025? Could they have really believed that?

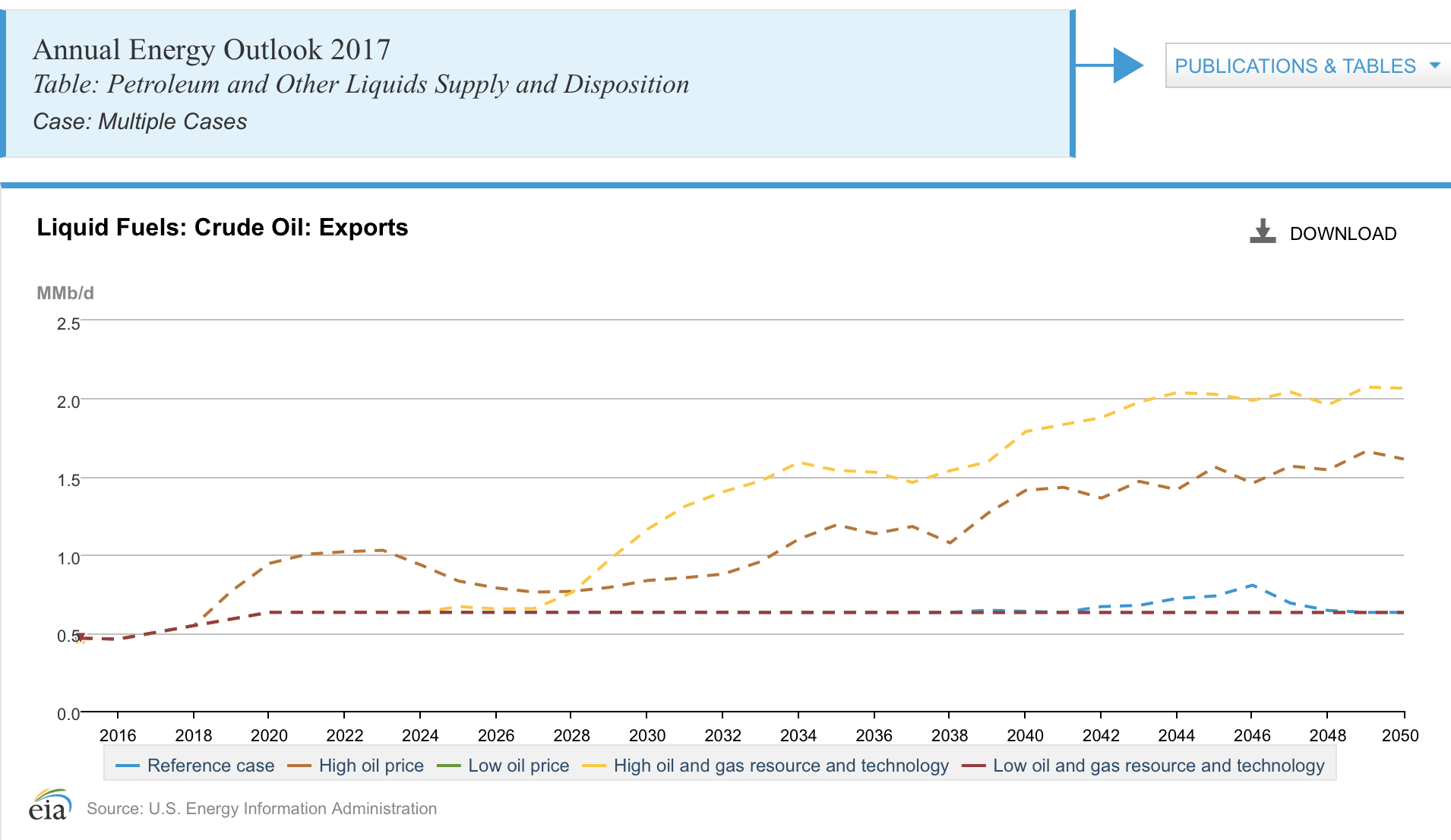

The U.S. Energy Information Administration (EIA) had its most optimistic prediction for U.S. oil exports reaching two million barrels per day by 2050. They were only off by three-plus decades.

Industry champion IHS predicted “U.S. crude oil exports reaching 1.4m b/d by 2020.” And Forbes ran a piece titled, “Why lifting America’s ban on oil exports won’t matter,” in which the author argued that it wasn’t economically feasible to export oil from the U.S.

And yet, here we are in 2017: All of them proven wrong in short order. The EIA, for its part, is consistently criticized for its “forecasting flaws” which have produced predictions that are “reliably and obviously wrong.” Researchers have regularly acknowledged that predicting energy markets is really, really hard and often goes “wildly wrong.”

Wrong on Amounts, Wrong on Destination

In addition to being wrong about how quickly oil companies and commodities traders would begin exporting U.S. crude oil, energy experts also got wrong where that oil would go. Harold Hamm, CEO of Continental Resources and major Trump donor, testified in Congress that it was unlikely U.S. oil would be exported to China. And he was wrong. As Bloomberg notes, “[m]uch of the U.S. outflow is going to Asia.”

To be fair, Hamm was one of the few people predicting explosive growth in the U.S. fracking industry should the export ban be lifted. He just was not right about where that oil would be going.

Yet it seems pretty obvious to anyone who could do math. American oil consumption has been flat and is not predicted to increase. Meanwhile, China’s consumption is growing rapidly at twice the rate of just a year ago.

If you are in the business of selling oil, China is the biggest potential growth market. And now, without the export ban in the way, American shale reserves can be fracked using government subsidies and commodities traders can sell oil to the highest bidder.

Commodities Traders Don’t Care About You

These days the justifications for lifting the ban look a lot more like myths — or an outright gift to the U.S. oil industry.

The first myth was that lifting the ban was in the name of U.S. national security. But this is easily debunked because where oil goes is up to commodities traders. The largest traders like Vitol and Trafigura are global companies with no interest in aligning with American security priorities.

The second myth was that the oil wouldn’t be going to China, just to strategic American allies. But that’s not true either: U.S. crude oil is flowing to countries like China and Venezuela — the latter nation not exactly a strategic ally at this point. But traders need to trade, so the oil goes to the highest bidder.

The third myth was that the oil industry was motivated to lift the ban out of consideration for the average American, in order to “help consumers” by lowering prices at the pump.

However, that would require belief that commodities traders care about anything other than making money at any cost. Remember Enron? At least they were an American company.

But as we have heard on recordings of Enron traders, released by CBS News in 2004, that is not necessarily the case either. Do these traders sound like people whose priorities are the well-being of their fellow Americans?

“He just f—s California,” says one Enron employee. “He steals money from California to the tune of about a million.”

“Will you rephrase that?” asks a second employee.

“OK, he, um, he arbitrages the California market to the tune of a million bucks or two a day,” replies the first.

That was the case for Enron more than a decade ago. Is the industry that different today? Back then, we heard nothing about national security, the American consumer, or whether or not it makes sense to sell U.S. oil to a country like China. Is the energy industry having those conversations today?

In December of 2015 we posed the following question on DeSmog:

Will December 2015 be remembered by energy historians for the historic outcome of the COP21 talks in Paris, or will it be better known as the time in history when U.S. politicians once again caved to the oil industry and unleashed decades of fracking on the country and the climate?

Current evidence would seem to support the latter, particularly as the Trump administration continues making moves to lessen U.S. support for the Paris climate accord. And it looks like the “experts” are now agreeing with DeSmog.

The Houston Chronicle recently reported: “The volume of U.S. crude exports should rise to 3 million a day by 2025, driven by Permian production and pipeline growth, said Kurt Barrow, vice president of oil markets for IHS Markit.” That is quite a bit higher than the IHS estimate (1.4 million barrels a day by 2020) before the ban was lifted.

That article also notes that “[t]he most bullish projections have the U.S. exporting more crude oil than it imports as soon as 2019.” That means the U.S. would be exporting approximately five million barrels per day, less than two years from now.

But we know how accurate those kinds of predictions are.

Main image: Oil industry Credit: Rennett Stowe, CC BY 2.0

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts