Argentina’s President Alberto Fernandez takes office in the midst of an economic crisis. Like his predecessor, he has made fracking a centerpiece of the country’s economic revival.

Argentina has some of the largest natural gas and oil reserves in the world and “possibly the most prospective outside of North America,” according to the U.S. Energy Information Administration. If some other country is going to successfully replicate the U.S. shale revolution, most experts put Argentina pretty high on that list. While the U.S. shale industry is showing its age, Argentina’s Vaca Muerta shale is in its early stages, with only 4 percent of the acreage developed thus far.

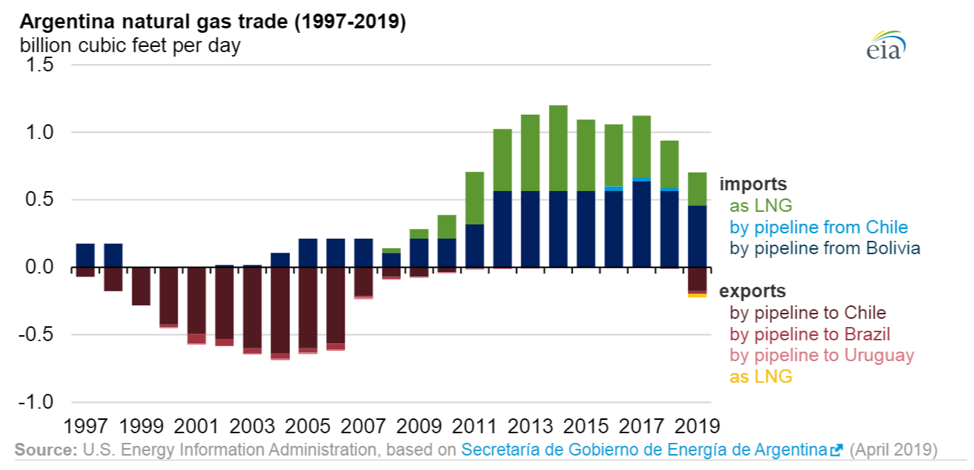

The country feels a sense of urgency. Declining conventional production from older oil and gas fields has meant that Argentina has become a net importer of fuels over the past decade. Meanwhile, Argentina’s economy has deteriorated badly due to a toxic cocktail of debt, austerity, inflation, and an unstable currency.

For these reasons — a growing energy deficit, a worsening economic situation, and large oil and gas reserves trapped underground — there is enormous political support for kick-starting an American-style fracking boom in Argentina.

It has taken on a level of political significance that outstrips its immediate economic potential. In Argentina, Vaca Muerta is treated as the country’s chance at salvation, with fracking seen as doing everything at once — creating jobs, reducing the debt burden, plugging the energy deficit and turning Argentina into a major player on the global oil and gas stage.

Billboards now line the roads of Añelo promoting oil and gas production in the Vaca Muerta shale (“Here, there’s a future.”). Credit: Eduardo Carrera

The sense of importance is noticeable on the ground as well. Entering the heart of Vaca Muerta in Neuquén, one is greeted by convoys of trucks, drilling rigs, and flares belching thick plumes of black smoke. Lining the roads are billboards linking fracking to future prosperity and greatness, evoking a sense of national pride.

The town of Añelo, which was a small agricultural village not too long ago, has become the industry’s staging ground because of its location less than four miles from Vaca Muerta’s most important drilling operation. Its population has tripled in the last decade, and by 2023, Añelo, currently at 8,000 people, is planning to balloon to a city of 25,000.

Today, there are new grocery stores, restaurants, a casino, and rows of provincially constructed housing for oil workers. Man camps sit on the outskirts. Some roads remain unpaved, and the incessant traffic and dust have become defining features of Añelo. It resembles any oil boomtown, buckling under the weight of rapid growth.

Man camp located on the outskirts of Añelo, Argentina. Credit: Nick Cunningham

U.S. Government Pushes Fracking Expansion

During the Obama administration, the U.S. State Department tried to spread the gospel of fracking around the world. In many countries, the efforts fizzled due to a combination of high costs, falling oil prices, and local resistance. Fracking bans proliferated, particularly in Europe, and after some initial excitement, the industry largely abandoned far-flung locales and doubled-down on the U.S.

Even as the aggressive State Department campaign to export fracking abroad largely fell by the wayside, the U.S. government has not entirely given up on the effort. In September, the U.S. Overseas Private Investment Corporation (OPIC), an agency of the U.S. government that offers international financing, approved a $300 million loan to Vista Oil & Gas, an Argentina-focused oil company, to help it expand drilling, along with another $150 million to Aleph Midstream, a company aiming to build gathering lines and processing facilities to carry the oil and gas to market.

Vista is headed up by a man named Miguel Galuccio, who is the former CEO of the state-controlled Argentine oil company, YPF. Galuccio has been a regular fixture on Bloomberg News in the last year, wooing American investors and talking up the massive potential of the Vaca Muerta shale. He is charismatic and disarming, often smiling while convincingly making the case that Argentina is sitting on the next Permian basin.

Oil and gas production in the Vaca Muerta has been reliant on government support that has waxed and waned as Argentina has grappled with financial turmoil. Credit: Eduardo Carrera

“I have an international career. So, I have produced oil in Russia, in China, in Saudi Arabia, in Iran,” Galuccio said on Bloomberg TV in April 2019. “We, oilmen, we look at resources. Here we have a huge potential of resources.”

The Argentine government has a national energy plan that calls for doubling oil production to 1 million barrels per day by 2023, with half of that destined for export, while also doubling natural gas output to 9.2 billion cubic feet per day.

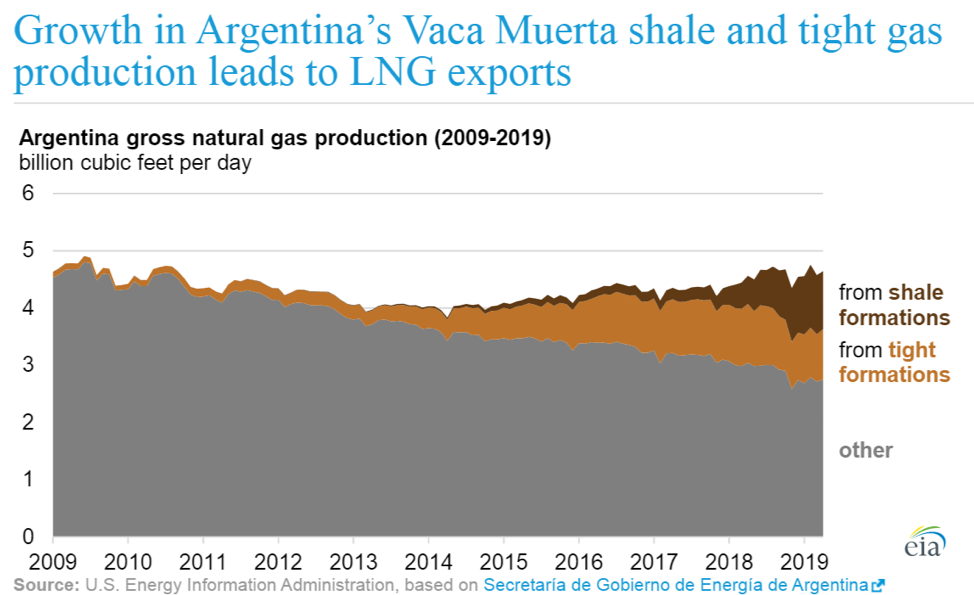

After years of false starts, unconventional oil and gas production in Argentina started to climb over the past year. Oil and gas output from the Vaca Muerta now accounts for roughly 19 and 25 percent of the country’s overall production, respectively, up from negligible levels a decade ago.

The OPIC loan will help Vista drill 110 wells, while the loan to Aleph Midstream will expand transportation and processing infrastructure intended to serve Vista. Both firms are backed by a New York private equity company, Riverstone Holdings.

On September 10, a group of 21 members of the U.S. House of Representatives wrote a scathing letter to OPIC, urging the agency to reject the financing. It would be “economic malpractice” to invest in new oil and gas reserves that might wind up as “stranded assets” as the world moves away from fossil fuels, they wrote. “Further, because of the high financial and political risk of fracking in Argentina, global oil and gas companies are relying on unsustainable government subsidies to exploit fossil fuels in a country plagued by macroeconomic instability and staggering debt.”

A companion letter from a group of nine U.S. Senators, including presidential candidates Cory Booker and Bernie Sanders, voiced similar concerns. But, a day later, OPIC approved the combined $450 million in loans to the two companies.

Argentina natural gas trade, 1997-2019. Credit: U.S. Energy Information Administration, based on data from Secretaria de Gobierno de Energía de Argentina

Fracking Runs Into Trouble

In order to get Vaca Muerta off of the ground, the Argentine government fixed natural gas prices at $7.50 per million British thermal units (MMBtu) in 2018 for any gas produced above a certain baseline level. In essence, the government promised the industry artificially high prices at public expense, with the logic being that the subsidies would be phased out over several years.

Production has climbed since last year as companies rushed to take advantage of the subsidies. But, more recently, drilling activity fell back. Stress on the budget forced the government to trim the gas subsidies in early 2019. And even the modest increase in gas production — with output still far below medium-term targets — led to a localized glut and low prices.

Growth in Argentina’s Vaca Muerta shale and tight gas production leads to LNG exports. Credit: U.S. Energy Information Administration, based on data from Secretaria de Gobierno de Energía de Argentina

Then, the country was hit by financial turmoil in August, which led the government to temporarily freeze retail fuel prices, compelling oil companies to sell at below-market prices. For instance, Vista Oil & Gas said that its average sale price prior to the freeze was $55.50 per barrel, not far off prices on the international market. In the second half of the third quarter, however, Vista’s oil was only fetching $42.50.

Because the industry was effectively forced to sell at a loss, drilling activity in the Vaca Muerta plunged by 54 percent in the months following the freeze. The industry scrapped a dozen rigs and laid off 1,200 workers, with more job cuts likely. Companies pulled back on drilling, idling equipment and essentially hitting the pause button until the incoming President offered more clarity on the pricing policy.

Drilling activity picked up in November after the price freeze ended, but the sudden slowdown suggests the financial case for fracking in Vaca Muerta is “not solid,” according to Jorge Lapeña, a former Secretary of Energy for Argentina and current President of IAE Mosconi, a Buenos Aires-based think tank. “If you stop everything, it’s because the economics of the Vaca Muerta are at their limit,” he told DeSmog.

The Financial Risks of Fracking

Astute followers of the American fracking experience will already recognize some similarities. Debt-financed drilling rapidly increased production in the U.S. but also crashed prices. Time and again, the financial losses mounted and companies returned to Wall Street for more capital, peddling stories to investors about how they just needed a little more time to figure things out.

Convoys of trucks clog unpaved roads in Argentina’s Vaca Muerta shale region, where oil and gas companies hope to bring a U.S.-style “shale revolution” to the nation. Credit: Eduardo Carrera

But the profits never arrived. Over the past decade, the 40 largest independent oil and gas companies burned through $200 billion more than they earned. Roughly 200 oil and gas companies in North America have declared bankruptcy since 2015. There has even been a rise in “Chapter 22s,” a reference to companies going through Chapter 11 bankruptcy more than once.

The worst may yet lie ahead: an estimated $137 billion in debt held by North American oil and gas companies comes due between 2020 and 2022, the result of a wave of financing that was taken out during the 2014-2016 market downturn.

“The business case for fracking has not been proven. It produces a lot of natural gas and oil. It doesn’t produce cash,” said Kathy Hipple, a Financial Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA). “What we know is that it sucks in cash and produces a lot of bankruptcies.”

More recently, operational problems have become harder to ignore. Companies are running out of the choicest spots to drill. The promise of densely drilling wells together has disappointed. Thousands of wells are not producing as much oil as the industry promised.

“I personally think that we are going to discover massive amounts of fraud in the shale industry,” Hipple said. “That there have been probably a lot of overly robust assumptions that everyone has known were overly robust.”

The U.S. fracking experience offers a cautionary tale. For Argentina, the obstacles standing in the industry’s way are even more formidable.

The Treater waste disposal site, which is sited near the oil boomtown of Añelo and receives toxic waste from shale drillers in the Vaca Muerta. Credit: Eduardo Carrera

Currency volatility, high inflation and capital controls make long-term investments risky. On-again, off-again subsidies have helped boost production, but they are not fiscally sustainable. Gas producers are receiving “an immense subsidy,” Lapeña of IAE Mosconi said. “Three times the value of Henry Hub. Three times!” (Henry Hub refers to the main natural gas benchmark price in the United States, which plays an important role as a global reference point. It is against this price point that drillers in Argentina need to compete.) The industry has cried foul any time Argentina’s generous subsidies have been trimmed or its terms altered, but in any event, the subsidies are scheduled to be phased out in the next few years.

There are also daunting logistical challenges. Neuquén, a remote province where much of the drilling takes place, is far from big population centers and has no easy access to global markets. A lot of new infrastructure needs to be built from scratch. The government cannot afford the outlays, and the industry has little interest in paying for the roads, storage facilities, rail, and long-distance pipelines that it needs.

After the currency collapsed in August, Argentina’s government postponed a planned auction for the construction of a major gas pipeline amid economic uncertainty. The pipeline, which would run more than 600 miles, would connect gas from the Vaca Muerta in Neuquén to an area near Buenos Aires and also to Bahia Blanca, a port city on the Atlantic Coast. However, because of the economic crisis, borrowing costs have soared, making financing a long distance pipeline exceedingly difficult.

In November, the auction was delayed again, pushing it off until March 2020. “Until the pipeline is built, it won’t be necessary to drill more gas wells,” Sean Rooney, the head of Argentina operations for Royal Dutch Shell, said at an industry conference in November.

In short, costs are higher when compared to the U.S. and the investment risk is greater. The timing is also terrible. U.S. shale was able to unprofitably drill for years because Wall Street showered fracking companies with money. Argentina is hoping to replicate the shale bonanza at a time when investors are growing distrustful of the industry. The Vaca Muerta won’t have nearly as much capital at its disposal as did the drillers of Texas and North Dakota.

Argentine oil company YPF‘s frac sand facility. YPF‘s and Chevron’s Loma Campana site is the Vaca Muerta’s most important drilling operation. Credit: Eduardo Carrera

The case for oil in Vaca Muerta is a bit more economically viable than for gas, but even the oil prospects need to be radically scaled down, according to Lapeña. “Here they say the Vaca Muerta is equal to the Permian. It’s not like that. We are not equal to the United States,” Lapeña said. “It’s a naïve idea.”

National Priority

Against the backdrop of economic crisis, the Vaca Muerta is seen across the political spectrum as one of the few solutions readily available for Argentina. After all, the nation is sitting on some of the world’s largest deposits of oil and gas. Finding a way to successfully export fossil fuels would bring in desperately needed hard currency. That’s why the political support to expand drilling is so strong.

This is what Galuccio, CEO of Vista Oil & Gas, tells investors and shareholders who are growing anxious. He was peppered with questions by analysts about the political situation on the company’s third quarter earnings call, but he tried to reassure them.

“Whoever is in the driving seat in the next period will require investment, would require U.S. dollars. And the source — there’s one new source of potential of U.S. dollars for the country — are investment in Vaca Muerta and proceeds that come in from export like crude oil,” Galuccio said on the call. He was confident that President Macri’s loss, and the return of the populist Peronists, would not change this national priority. “The Peronist Party showed very much interest,” Galuccio added.

When DeSmog asked OPIC about the risk of lending to an industry with such a poor financial track record, the agency dismissed the concern. “OPIC conducts rigorous due diligence, including a robust credit review, on all potential investments to assess their commercial viability and payment capacity.” Vista’s stock price fell by more than 40 percent since it staged an initial public offering (IPO) in July, although more recently it has regained some ground. Vista did not respond to repeated requests for comment.

Developing the Vaca Muerta enjoys strong support from the government, as well as from the broader public, but that doesn’t make it any less risky. “We are, today, more expensive than the U.S., no doubt about it,” Galuccio admitted in a Bloomberg interview in September.

Given the poor financial track record of fracking in the U.S., that doesn’t inspire confidence. “If the United States has not demonstrated that it can be profitable, then Argentina is even farther away. Especially for gas,” Lapeña of IAE Mosconi said.

This reporting was made possible in part by funding from Periodistas por el Planeta.

Main image: State-controlled Argentine oil company YPF is a major player in developing the Vaca Muerta shale. Credit: Eduardo Carrera

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts