On Monday, October 5, a ship left Cameron LNG, a liquefied natural gas (LNG) terminal shut down by Hurricane Laura, the powerful storm that made landfall on August 27 near Cameron, Louisiana, about 15 miles south of the plant. That tanker ship carried the first load of cargo shipped by Cameron LNG since Hurricane Laura struck more than five weeks earlier.

On Friday, Hurricane Delta is currently expected to make landfall in Louisiana, with forecasters predicting that it may strike in the same region as Laura. Authorities in nearby Cameron told the Weather Channel their community hadn’t issued a new mandatory evacuation order and didn’t plan to — because the town still remains under the mandatory evacuation order from Hurricane Laura.

For LNG‘s financial backers, downtime due to hurricanes represents another layer of risk and uncertainty brought to the forefront in a difficult year that’s seen many proposed projects delayed or deferred.

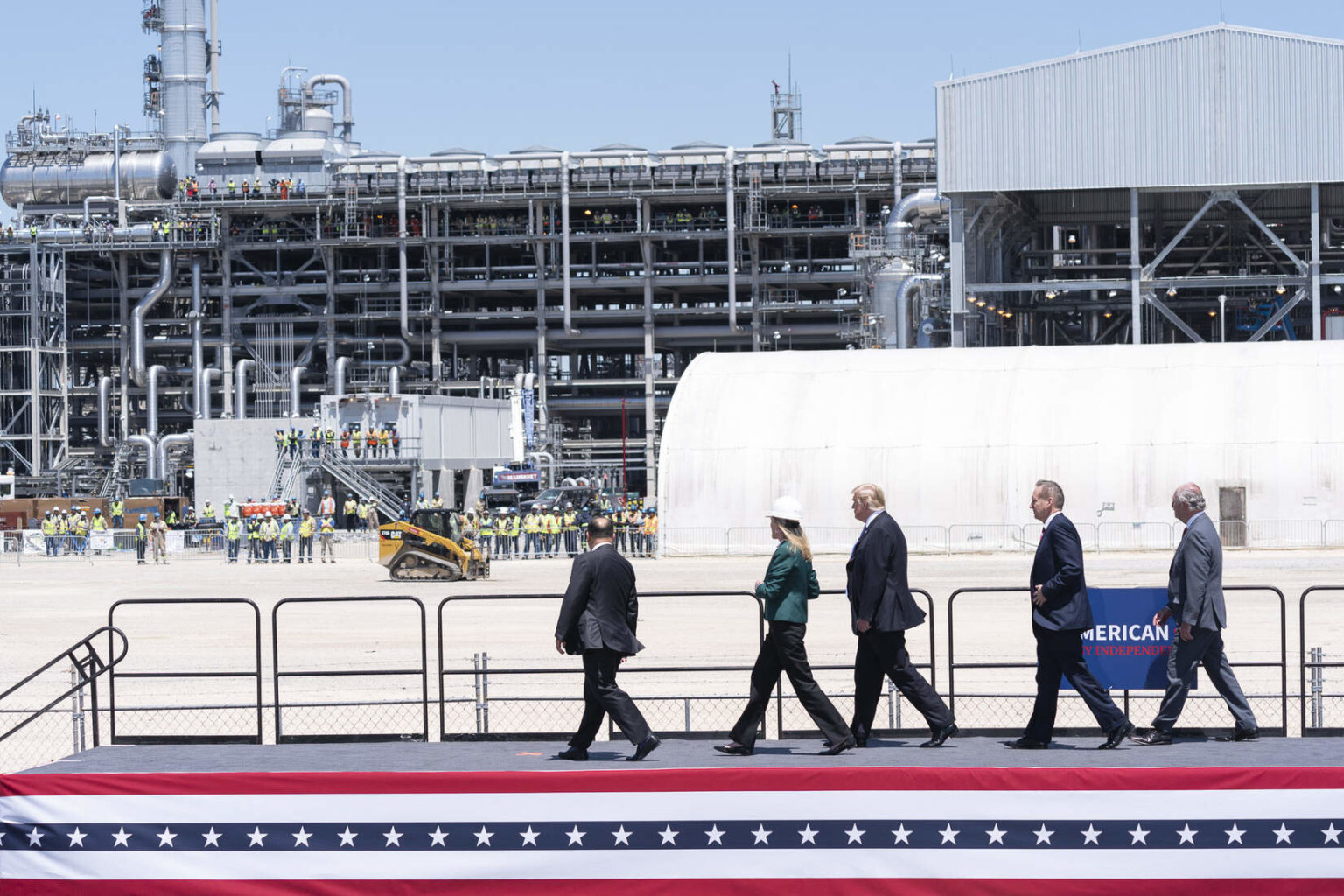

Visited by President Trump while under construction in 2019, Cameron LNG had barely finished opening when Laura knocked it offline this year.

Sempra Energy, and three partners, had announced in August 2014 that they would build the plant. Six years later, the $10 billion project reached full operation (and cash flow rates) in mid-August this year — roughly two weeks before Hurricane Laura struck.

The Cameron LNG plant itself suffered relatively little damage from the storm, its owners said afterwards — but electrical power wasn’t restored until last week, and it took an additional week for the ship channel to be cleared for tanker transit, all of which added to its owners’ difficulties involved in getting the plant, located right off the Gulf Coast, back up and running.

Cameron LNG’s stuttering start up highlights just one slice of the uncertainty that investors in new LNG terminals face — risks that have been compounded by the COVID-19 pandemic, this year’s collapse in demand for oil and gas, as well as natural gas’s history of wild price swings that long predates the pandemic.

Many LNG export projects are built or proposed for the U.S. Gulf Coast, which this year is being battered by hurricanes that are unusually frequent and intensifying rapidly, a phenomenon long-predicted by climate scientists and that is linked to a warming climate. It’s a problem that scientists predict is likely to become more significant in coming years, as projections show hurricanes are likely to become even more severe.

Cameron LNG statement about doing a controlled shutdown this morning because of approaching hurricane Delta. #Natgas #LNG pic.twitter.com/b1dr6QTCau

— RonH (@Ronh999) October 8, 2020

Industry advocates often argue that, given the risk of hurricanes, it makes sense to build projects off the Gulf Coast as well.

But hurricanes aren’t the only risk factor LNG export projects face; some factors imperil projects both on the Gulf Coast and away from it.

Natural gas price swings may be here to stay, despite the glut of shale gas production from fracking that had pushed prices lower in recent years. “Historical volatility has surged to levels not seen since late 2018,” Bloomberg reported October 5, describing natural gas prices, “and implied volatility, a measure of how dramatic price swings may be going forward, is the highest in data going back to 2010.”

Equivalent of Building 16 New Coal Plants

To export natural gas and transport it beyond North America, it must be chilled to extremely low temperatures, to the point when it transforms from gas to liquid, and then loaded into sea-borne tanker ships. Building a terminal to process, liquefy, and ship that gas is no small job: Terminals often cost billions of dollars and take years to build.

Right now, there are six LNG terminals operating in the U.S., according to a new report by the environmental nonprofit Environmental Integrity Project (EIP): one in Maryland, one in Georgia, and four along the Gulf Coast. Two more LNG terminals along the Gulf Coast are under construction. All were first permitted by regulators within the past decade, as the shale rush produced gas gluts across the United States.

State and federal regulators have permitted more than a dozen other LNG projects over the past five years — but, the EIP report finds, at least 10 of the planned LNG projects are now fully or partially delayed. “On top of these six projects postponed since March 2020 are another four that were experiencing significant delays before the pandemic,” the report, titled “Troubled Waters for LNG,” notes.

Hanging in the balance right now are 17 projects — 12 new LNG terminals and 5 expansions — that would be permitted to emit more than 67 million tons of greenhouse gases each year, EIP found. “That’s more climate-warming pollution than is released from 16 coal-fired power plants operating around the clock for a year,” the report finds.

Those projects already grappling with delays represent more than two-thirds of the greenhouse gas pollution at stake.

‘Just Not Going to Happen’

Those stakes — as well as other dangerous air pollution created by LNG plants — have driven environmentalists to oppose the projects and recommend that regulators take a close look at the economics of the remaining proposed LNG plants.

“Basically, they got greedy and overexpanded, made plans to build too much,” Anne Rolfes of the nonprofit Louisiana Bucket Brigade said at a press conference about the new report on October 5. “This consistent extension of permits relies on a belief in the project’s viability, relies on a belief in the financing. But these projects can’t be built in any economically sound way.”

An LNG tanker ship, called the Arctic Voyager, on August 12, 2018. Credit: kees torn, CC BY–SA 2.0

Industry financial analysts are also calling the economics of many proposed LNG projects into question. “It wasn’t long ago that the economics of LNG exports were practically a no-brainer,” David Braziel, director of finance at RBN Energy, said at the DUG Permian shale industry conference this month. “But when oil prices collapsed, COVID-19 lockdowns decimated worldwide gas demand and international gas prices plummeted, all those second wave LNG projects that were working on commercial commitments have been officially delayed and the reality is, they’re just not going to happen.”

“The project delays and deferrals underscore the level of uncertainty brought on by poor market conditions this year,” Braziel said, “as feed gas into the terminals has dropped from 9 bcf [billion cubic feet of gas] a day as recently as March to about half that now.” Braziel also noted that the slowdown has “major implications” for the pipeline industry and for shale drilling companies.

Permits ‘Aged Out’

There may also be new legal challenges ahead for LNG projects that have been delayed repeatedly. The new EIP report lists 14 LNG terminals that have secured their federal authorizations or their Clean Air Act permits but haven’t yet started construction. But those permits don’t last forever, said Eric Schaeffer, director of the Environmental Integrity Project, noting that construction usually must start within a “reasonable” time, often defined as 18 to 36 months from the time that permits were issued.

For those projects — such as Driftwood LNG and Lake Charles LNG, both in Calcasieu, Louisiana, and the Port Arthur LNG and Rio Grande LNG projects in Texas — time may be running out.

“Those permits have aged out,” Shaeffer said. “They ought to be withdrawn.”

And those battles may be looming regardless of who becomes president in November. “States have the authority to do that,” Shaeffer noted.

On the Fenceline

The pandemic has also increased the public health risks associated with LNG terminals, EIP’s new report finds.

“Once fully-constructed and operational, all of the LNG terminals inventoried in this report would have the potential to increase annual emissions by up to 4,900 tons of microscopic soot-like particles (particulate matter, or PM2.5), 31,600 tons of nitrogen oxides (NOx), 1,500 tons of sulfur dioxide (SO2), 53,800 tons of carbon monoxide (CO), and 28,100 tons of volatile organic compounds (VOCs),” the report says. “Several studies have shown that long-term exposure to air pollution increases the risk of illness and death from COVID-19.”

Those concerns hit home for community organizers in Port Arthur, Texas, near the Louisiana border and in a region sometimes referred to as “cancer alley,” where, for example, plans to build the Port Arthur LNG plant have run up against a delayed final investment decision and a 20-year sales agreement that’s now on hold.

Dusk shot of an industrial scene along the road from Port Arthur to Sabine Pass, Texas. Credit: Carol M. Highsmith, public domain

“We’ve suffered greatly in our community from environmental releases over time and also from disasters,” said John Beard, chair of the Port Arthur Community Action Network in Port Arthur, at Monday’s press conference, noting that 70 percent of the people living near the proposed LNG plant are considered economically disadvantaged. “It’s a very difficult decision, cause many people look at the jobs and look at the opportunities but those jobs and opportunities don’t come to citizens in Port Arthur, they don’t come to the people on the fenceline.”

“And so once again, we’re faced with what’s been said in the old song, ‘I can do bad all by myself,’” he said, “so why do we need it?”

Main image: President Donald J. Trump participates in a walking tour of Cameron LNG Export Terminal on May 14, 2019, in Hackberry, Louisiana. Credit: The White House/Shealah Craighead, public domainSubscribe to our newsletter

Stay up to date with DeSmog news and alerts