A liquified natural gas import terminal that could become one of Europe’s largest such facilities has received financing from a dozen European and Asian banks, many of which have existing climate pledges.

A list of the 12 banks financing the proposed Stade LNG Terminal in Germany was created by Reclaim Finance, a Paris-based research organization focused on decarbonizing financial flow, and shared exclusively with DeSmog. The list includes French lender Credit Agricole, which received praise for pulling out of LNG projects in Mozambique and Papua New Guinea this year. Dutch lender ING Bank, which claims not to finance new oil and gas production, is also among the financiers of Stade LNG, according to Reclaim.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts

“Banks must take steps to end finance for new LNG infrastructure, with strict restrictions on project financing for both export and import LNG terminals,” said Andréa Hernandez, an analyst with Reclaim who researched the banks involved in the deal. “Banks that are serious about delivering their net zero commitments must also stop supporting companies developing new fossil fuel facilities, including LNG.”

In December 2022, Hanseatic Energy Hub submitted its application for the Stade LNG Terminal, which would receive LNG from tank ships filled by two Venture Global export facilities in Louisiana. Those two facilities — one under construction in Plaquemines Parish and the CP2 LNG terminal proposed in Cameron Parish — are expected to get fracked gas from Texas and north Louisiana. In March, Hanseatic Energy Hub secured $1.8 billion in funding for the land-based Stade LNG.

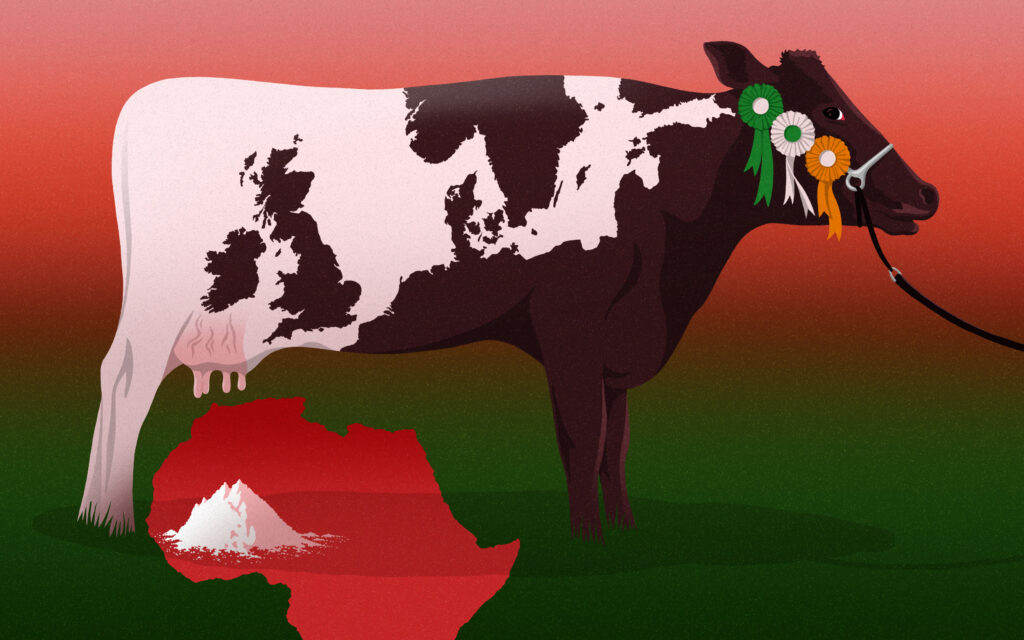

While Hanseatic Energy Hub has advertised Stade LNG as a “zero-emission terminal,” research shows that the carbon footprint of U.S. LNG exports could be worse for the climate than coal. Venture Global’s terminal in Cameron Parish exceeded its air pollution limits most days during its first year of operation, according to a report by the Louisiana Bucket Brigade.

Hanseatic Energy Hub would not comment on the specific supply chains that would feed the Stade LNG Terminal. But Energie Baden-Württemberg (EnBW) and Securing Energy for Europe (SEFE) have booked import rights with the import terminal, and both EnBW and SEFE have signed long-term contracts to buy their LNG from Venture Global.

“A couple of weeks ago, after several years of preparation, the European Union issued a regulation on methane emissions that applies to the supply chains of all gas imports to Europe and ensures that methane emissions along the entire value chain will be close to zero,” the Hanseatic Energy Hub wrote in an emailed statement to DeSmog. Hanseatic Energy Hub directed questions to Charlie Grüneberg, a spokesperson for Zukunft Gas, the leading voice of the German gas industry. Grüneberg clarified that the EU-wide methane regulation finalized in May will result in a methane transparency database where U.S. exporters will report their methane emissions so that importers can make informed decisions about their LNG.

Reclaim disputed the assertion that the new regulation would ensure methane emissions from LNG will be close to zero.

“While methane mitigation measures are essential for existing operations and facilities, they should not be used as an excuse to develop new LNG infrastructure, especially in a European context where we are heading towards overcapacity,” Hernandez wrote in an email. “Let’s not forget that the IPCC mentions that every new project jeopardizes our chances of limiting global warming to 1.5°C.”

Société Générale, which withdrew from a deal with Rio Grande LNG last year, citing climate commitments, also provided credit for the Stade LNG project, according to Reclaim. Other banks in on the deal, according to Reclaim, include BNP Paribas, Banco Sabadell, BBVA, ABN AMRO Bank, Standard Chartered Bank, Korea Development Bank, Mizuho Bank, Sumitomo Mitsui Banking Corp., and UniCredit. Contacted by DeSmog for comment, none of the banks responded to explain their financial backing of the Stade LNG Terminal. BBVA and Société Générale said they could not comment on specific projects or deals.

James Hiatt, a Lake Charles resident and founder of For a Better Bayou, said it was hypocritical of European countries that have banned fracking — like France and Germany — to buy fracked gas from the United States. “They’re exporting that to us. We are the ones that are dealing with all the environmental and economic disasters of fracking,” he said.

Hiatt lives in southwest Louisiana, near where several LNG facilities are planned, including Venture Global’s CP2. The area was devastated by back-to-back hurricanes in 2020, wildfires in 2023, and tornadoes in April and May. He questioned why any company would want to go into business with Venture Global, since the corporation’s Calcasieu Pass facility hasn’t yet delivered on any of its long-term contracts for LNG.

The facility’s commissioning period has lasted for more than two years. Its long-term contract obligations don’t kick in until the facility is deemed fully operational, which has allowed Venture Global to cash in on higher prices on the spot market. Last year, BP and Shell filed for arbitration against Venture Global over the delays.

Hiatt and other Louisiana organizers filed an objection to the Stade LNG permit last year. Everywhere Hiatt looks in his community, he said, bears the marks of climate change.

“You don’t have to wait for the hurricanes: A regular spring storm is now a supercharged weather event,” he said. “We went out to see some of the damage after that April storm and it was hard to tell if this was new damage or hurricane damage from years ago.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts