Assume you are an existing JP Morgan (JPM) customer, or you are interested in the bank’s sustainable-investment strategy. Googling the words “sustainable” and “JP Morgan” will bring up a number of blog posts from the JPM website, along with others on specialised media outlets that relay the company’s press releases.

One article published on the company’s website in October 2020 is titled “JPMorgan Chase Adopts Paris-Aligned Financing Commitment.”

The investment firm declared that it would align not only its investments but also its operational footprint with the Paris Climate Agreement. “We are focused on doing our part to support the transition by helping our clients achieve their net zero objectives,” the article explained. “Net zero” means eliminating all greenhouse-gas emissions by reducing and offsetting them.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts

Another webpage titled “Environmental Sustainability” was followed by a video in which an external speaker explained how the company plans to advance clean energy solutions. The article was followed by a video in which an external speaker explained how the company plans to advance clean energy solutions, contribute to sustainable development, and help drive a “stronger, more inclusive” economy.

ESG Today, a specialist media outlet, republished the news under the headline “JP Morgan Commits to Paris-Aligned Financing; Will Reach Carbon Neutrality This Year.”

In 2021, the year that the European Regulation on Sustainable Finance (SFDR) came into force, JP Morgan Asset Management, a branch of JPM Chase, became one of the inaugural members of the Net Zero Asset Managers Initiative. In May of that year, Jamie Dimon, CEO of JP Morgan, wrote a post on the LinkedIn social platform. He said: “We must all remain committed to addressing climate change; it continues to be one of the most critical issues of our time.”

Based on these statements and its marketing of funds with names such as “US Research Enhanced Index Eq ESG” and “Global Income Sustainable” funds, it is tempting to see JPM’s commitment to the Paris Agreement as genuine and consistent.

However, our data tell a different story.

| Glossary |

| When it comes to reducing greenhouse gas emissions, companies usually set one of two types of goal: an absolute target or an intensity-based target. An absolute target means the company commits to reducing its total emissions. In contrast, an intensity target measures emissions relative to another factor, such as revenue. However, a company could increase its revenue and demonstrate lower carbon intensity without actually reducing its emissions, particularly with regard to Scope 3 emissions. |

JP Morgan’s “green” investment in fossil fuel

As of March 2025, JPM Chase subsidiary JP Morgan Asset Management was investing more than $4 billion (around €3.5 billion) in the fossil majors through European-regulated “green” investments. This figure has increased in recent years. However, since May 2025, it has had to remove the words “ESG” and “sustainable” from the names of several funds, such as those mentioned previously. New guidelines ban such terms in the nomenclature of funds that invest in fossil fuels. Nevertheless, JPM is allowed to continue claiming to use terms such as “ESG” and “sustainable” on its website and in its prospectuses. The European Securities and Markets Authority’s guidelines only focus on the naming of the fund rather than their description or objectives (1).

One of the objectives of the Paris Climate Agreement is to “align financial flows with a pathway to low greenhouse gas emissions and climate-resilient development.” An Emissions Gap Report published by the United Nations Environmental Programme in 2024 warned that, without more ambitious cuts to greenhouse-gas emissions, the world is on track for a temperature increase of between 2.6°C and 3.1°C this century. Such a rise would take us well outside the boundaries of the Paris Agreement (1.5°C).

Experts estimate that 68 percent of global CO₂ emissions are caused by the fossil-fuel industry. According to an Influence Map report, most fossil-fuel firms extracted more hydrocarbons in the seven years following the Paris Agreement than in the seven years before. In this way they have been exacerbating rather than mitigating the problem.

Despite the urgent need to direct investment towards renewable energy, the financial industry has chosen to invest in oil majors by means of so-called “green” investments. Financial-services firms have typically claimed that they are aligning their investment strategies with the Paris Agreement – but are they?

While publicly supporting the agreement, it appears that JP Morgan continued to fund some of the world’s most polluting oil giants through investments marketed as “green.”

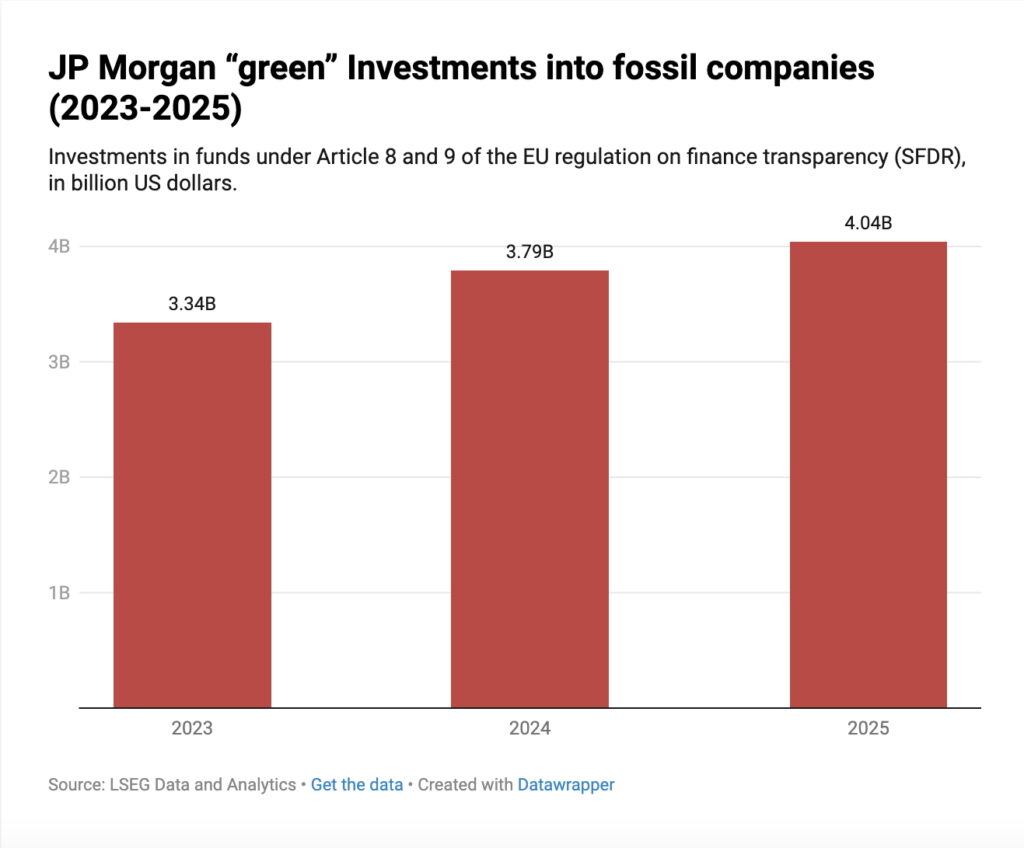

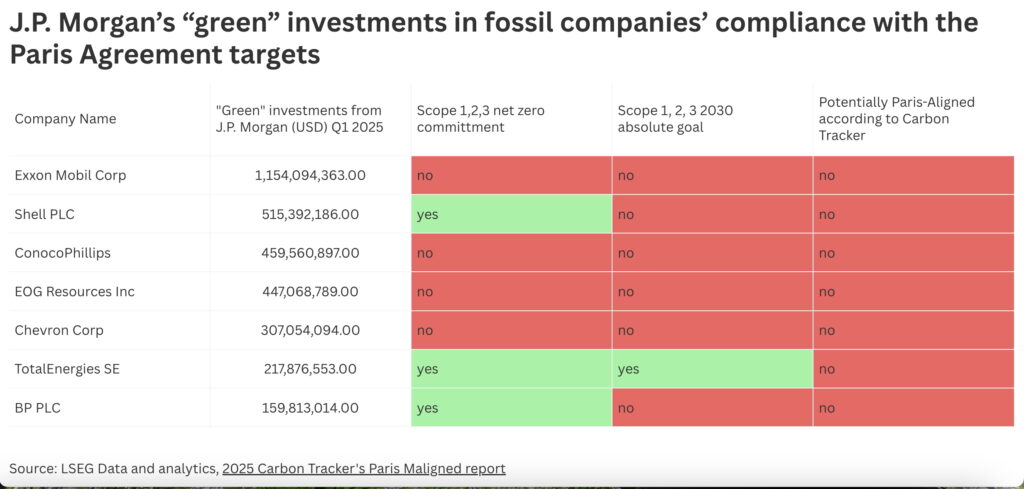

According to data from the London Stock Exchange Data & Analytics, JP Morgan has in fact increased its investments in fossil fuels through green funds in recent years, from $3.3 billion in 2023 to $4 billion at the start of 2025. The fossil majors attracting the largest proportion of green investments from the US investment firm are ExxonMobil ($1.1 billion), Shell ($515 million), ConocoPhillips ($460 million), EOG Resources ($447 million), Chevron ($307 million), TotalEnergies ($218 million) and BP ($159 million).

Are Big Oil’s net zero ambitions aligned with the Paris Agreement?

“None of these major oil and gas companies have emissions targets that can be considered Paris-aligned,” Olivia Bisel, an associate analyst at the London think tank Carbon Tracker, told Voxeurop.

We analysed the net-zero targets of the companies in which JP Morgan has the majority of its “green” investments to check if they are Paris-aligned.

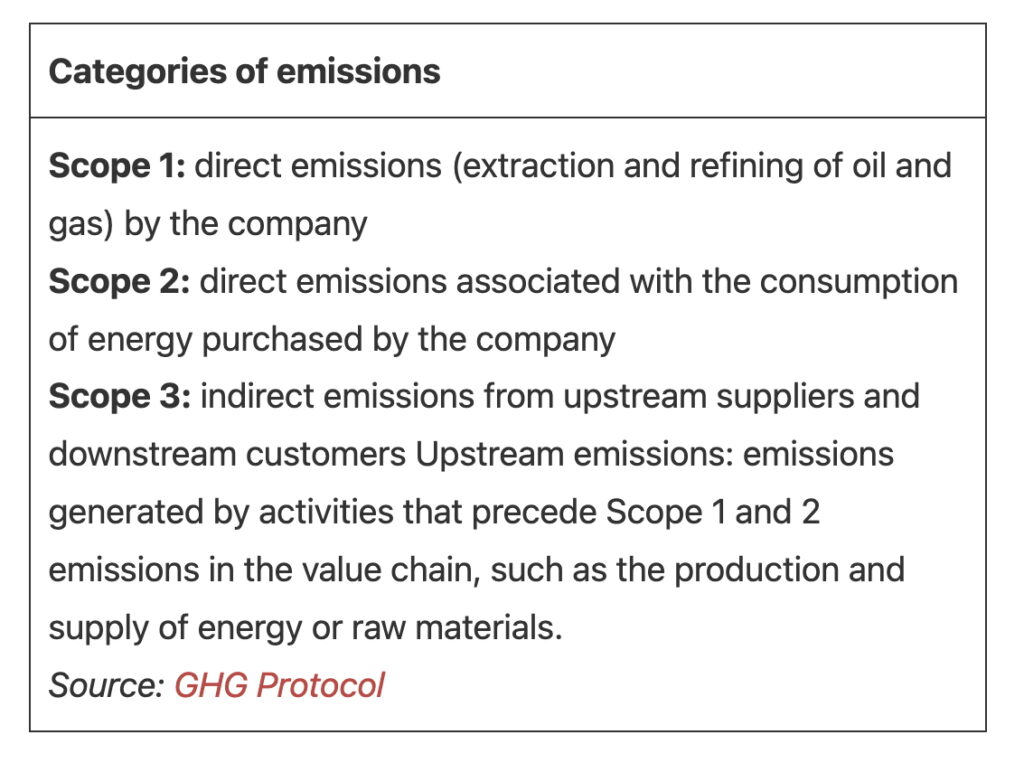

To understand how seriously the oil and gas industry is taking its transition targets, we need to know how its emissions are composed and classified. The GHG Protocol is an international standard for reporting companies’ emissions, which are categorised into three groups known as “Scopes.”

Scope 1 and 2 emissions cover what a company emits directly, such as from its own operations and the power it purchased. For oil and gas firms, Scope 3 means indirect emissions, which includes those of suppliers. This may mean equipment manufacture, oilfield services, and refining, as well as the pollution caused by customers burning the oil company’s product in cars, planes, or power plants. Scope 3 emissions can represent over 90% of a company’s total.

“On the North American front, oil and gas companies continue to exclude Scope 3 emissions, which neglect the vast majority of the full-lifecycle emissions of oil and gas,” says Bisel.

According to Carbon Tracker’s Absolute Impact report, ExxonMobil, ConocoPhillips and EOG are failing to set any 2050 emissions targets that cover Scope 3 emissions. However, even companies disclosing Scope 3 targets may not be considered Paris-aligned.

“While European leaders such as TotalEnergies, BP and Shell do have a Scope 3 target, which is a step in the right direction, these do not cover the full scope of their business activities,” observes Bisel. “Shell, for example, does not include an absolute 2030 goal. BP has also removed its 2030 absolute goal of covering its full-lifecycle emissions, which is a notable regression, as are its emissions targets. It is vital for companies to set a near-term absolute target. Otherwise they cannot credibly track towards net zero by 2050.”

Most oil and gas companies set intensity targets, which compare emissions to revenues, rather than absolute emissions targets. This approach can be misleading, since a company can reduce its carbon intensity while still increasing its total emissions, particularly those in Scope 3. These scopes include the emissions produced in the production of a good or service during its entire “life cycle,” from the extraction of raw materials to its end-of-life. According to experts, very few companies have set full-lifecycle absolute targets for 2030. These will be essential for a credible path to net zero by 2050.

JP Morgan Asset Management funds in fossil companies

Page 1 of 2

| Company name | Fund under article 8 and 9 SFDR value Held in USD Q1 2025 |

|---|---|

| Exxon Mobil Corp | 1,154,094,363 |

| Shell PLC | 515,392,186 |

| ConocoPhillips | 459,560,898 |

| EOG Resources Inc | 447,068,789 |

| Chevron Corp | 307,054,094 |

| Mitsubishi UFJ Financial Group Inc | 244,724,243 |

| TotalEnergies SE | 217,876,553 |

| BP PLC | 159,813,014 |

| Itochu Corp | 137,529,204 |

| Glencore PLC | 52,468,716 |

| BHP Group Ltd | 43,664,934 |

| Saudi Arabian Oil Co | 32,991,063 |

| Equinor ASA | 31,127,410 |

| OMV AG | 25,539,934 |

| Aker BP ASA | 23,634,905 |

| Canadian Natural Resources Ltd | 20,669,684 |

| Suncor Energy Inc | 18,875,559 |

| EQT Corp | 17,537,911 |

| RWE AG | 14,441,881 |

| Gulfport Energy Corp | 13,596,565 |

Table: VoxeuropSource: LSEG Data and Analytics. Get the data. Created with Datawrapper

How does JP Morgan justify its “green” investments in Big Oil?

This boost to JP Morgan’s “green” investments in the fossil-fuel industry coincides with its decision to quit the Net Zero Asset Managers Initiative in March 2025. Less than a year before, the investment firm was boasting about its participation in the climate coalition – while at the same time investing $3.8 billion in the hydrocarbons sector via green funds.

An article on the JPM website, seen by Voxeurop but since removed, was headlined: “Net zero targets: Streamlining Portfolio Decarbonisation.” We retrieved the deleted article (today replaced with an “Error 404 Page Not Found” message). It stated: “As a member of the Net Zero Asset Managers Initiative, J.P. Morgan Asset Management is committed to working with our clients on their decarbonisation goals.”

Elsewhere on JP Morgan’s website, under the rubric “How we’re making an impact,”, one can read: “Leveraging our expertise and balance sheet, we aim to provide strategic advice and financing solutions to help our clients achieve their decarbonisation goals.”

Individual investors tend to believe that holding shares in these companies allows them to influence the firms’ pursuit of climate goals. By owning shares, they can vote at the company’s meetings and influence the corporate agenda.

To reach the objectives of the Paris Agreements, the International Energy Agency has urged that no further investment be made in new fossil-fuel production. However, ExxonMobil, a company supported by JP Morgan via green funds, is involved in new exploration activities. It operates 16 existing sites that will generate over one gigatonne of CO₂ (1 billion tonnes) during their lifetime. These projects have been labelled “carbon bombs.”

In an interview with Business Insider magazine, Yo Takatsuki, JPMorgan Asset Management’s global head of investment stewardship (and himself a former journalist), was categorical about his company’s duty: “I think an aspect of stewardship, as well as [of] being a good journalist, is being able to ask the difficult question and hold companies to account. These people need to be held to account for the actions they take.

However, J.P. Morgan’s stewardship report tells a different story: “We have […] prioritised engaging with demand-side companies (i.e. users of fossil fuels), as we deem this to be a more effective way of mitigating climate-related transition risks and ensuring investment returns in these cases.”

The ExxonMobil stewardship report makes no mention of decarbonisation or divestment from carbon-bomb projects or exploratory activities. For instance, the oil giant has not clearly committed to reducing its Scope 3 emissions as a way of getting to net zero. As we have seen, this indirect pollution is the main source of greenhouse-gas emissions for oil companies.

JP Morgan has approached ExxonMobil to request greater clarity on the costs of its legal obligations to clean up local sites once its projects (oil, gas, or mining) have been completed. The request relates to JP Morgan’s “Asset Retirement Obligations” under a net-zero emissions scenario by 2050. In its stewardship report, JP Morgan explains that those disclosures would help investors, since the current information about the company’s long-term costs and accounting assumptions is too opaque for them to understand the real risks.

As a decarbonisation strategy, will this be enough to reach the Paris goals?

“Disclosures are an important starting point for investors to understand the climate impact and financial risks of their investment portfolio companies,” comments Carbon Tracker’s Olivia Bisel. “However, they don’t guarantee that a company is aligning with the Paris Agreement goals. Rather than engaging in disclosures, asset managers that claim to be Paris-aligned or pursuing that pathway should be taking substantive action. It’s only through actual action by oil and gas companies that emissions will be reduced. […] Investors cannot claim to be Paris-aligned if their investment portfolio is not fully aligned as well.”

Analysis of data and reports by Voxeurop found no evidence that JP Morgan has been encouraging the fossil-fuel companies it finances to move towards decarbonisation. However, in one of its sustainability disclosures, in the “Paris Agreement” section, the investment firm continues to disclose with a one-year old document its membership in the Net Zero Asset Managers initiative, despite having left it on the 21st of March 2025. “JPMAM will measure its progress towards its targets by the proportion of companies in which it invests that have set their own credible net zero targets,” it writes.

“If JP Morgan Asset Management is serious about engaging in decarbonisation, it needs to set clear red lines, based on climate science,” says Lara Cuvelier, of the NGO Reclaim Finance. “And the science is clear that there is no room for new oil and gas projects in a net-zero scenario. It is unclear how its current strategy helps drive decarbonisation.”

To date, JP Morgan Asset Management declined to comment.

- The fund “US Research Enhanced Index Eq ESG” is now “US Research Enhanced Index Equity Active UCITS ETF.” It still claims to be promoting an ESG approach on its main webpage.

This article is published in collaboration with IrpiMedia; it is part of Voxeurop’s investigation into green finance and was produced with the support of the European Media Information Fund (EMIF).

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts