Claim to be verified: BlackRock offers its global clients sustainable investment products, which allegedly exclude fossil fuels.

Context: In the first quarter of 2025 only, the world’s largest asset manager invested US$3 billion in fossil-fuel companies through its funds defined as sustainable. BlackRock promotes them with language that is potentially misleading and likely to leave unwary investors believing that such products exclude fossil fuels.

In 2016, Larry Fink, CEO of investment firm BlackRock, had no doubts about the importance of environmental, social, and governance (ESG): “Over the long term, ESG issues – ranging from climate change to diversity to board effectiveness – have real and quantifiable financial impacts”, he wrote in a letter on corporate governance in 2016.

The CEO of the world’s largest asset-management company has since changed his mind: “The reason I backed away from using the term ESG is that it means something different to everyone. It’s so undefined that it’s become unmentionable”, Fink said in 2023, as a guest on the Wall Street Journal podcast “Free Expression”. In the same podcast, he added: “If you want to invest in hydrocarbons, we will select the best hydrocarbon companies in the world for you. If you want to invest in a more decarbonized portfolio, we’re going to try to find the best economic portfolio that will achieve your financial goal.”

BlackRock manages US$11.6 trillion of investments. The firm has drastically changed its ESG and sustainable-investing policies in recent years. In its 2020 letter to clients, BlackRock used the term “ESG” 26 times and made a bold assertion: “We believe that sustainability must become our new standard for investing.” It also pledged to launch a product “that allows clients to invest in companies with the highest ESG scores, using our most extensive exclusion criteria, including one for fossil fuels.”

These commitments were widely covered in the international media. In January 2020, the specialist magazine UK Investor headlined: “BlackRock to focus on ESG and climate change in 2020”. CNBC wrote: “BlackRock, a $7 trillion asset manager, puts climate change at the heart of its investment strategy for 2021.” The specialist publication ESG Today asked: “BlackRock is betting everything on sustainability: Why is this important?”

| Glossary |

| The European Regulation on sustainability-related disclosures in the financial services sector (known as SFDR) introduces two categories of green investments: those that merely promote “environmental and/or social characteristics” (Article 8), known in the jargon as “light green”, and those that must be properly “sustainable” (Article 9), known as “dark green”. In both cases, certain additional details must be provided to the consumer/investor, namely: (1) information about how these characteristics are met and (2) if a benchmark is indicated, an explanation of how that benchmark is consistent with the advertised characteristics. While asset managers can independently define the criteria by which they consider a fund to promote “environmental and/or social characteristics”, “Article 9” funds must meet more stringent criteria regarding renewable energy, greenhouse gas emissions, etc. However, by exploiting semantic ambiguities, some managers still choose to sell funds that do not fall under Article 9 but rather under Article 8, while nonetheless labelling them as “sustainable and responsible” (i.e. dark green) investments. |

To stay with the gambling theme, was BlackRock bluffing? In its 2025 letter, there is no reference to sustainability, ESG, or the Paris Climate Agreement. The company has left Net Zero Asset Managers, a global initiative launched in 2020 to promote net-zero 2050 projects. Following the departure of other major players such as JP Morgan, Net Zero Asset Managers has suspended its activities.

Yet, notwithstanding the ESG labels, the climate promises, and the pledges of “sustainability”, BlackRock continues to offer products that funnel money to the hydrocarbons giants.

BlackRock’s “sustainable” investments in fossil fuels

From 2023 to 2025, BlackRock invested an annual average of US$2.3 billion in the fossil-fuel majors through its ESG funds. The supposedly “green” funds we initially identified are those that make reference to the EU Sustainable Finance Regulation (SFDR), which came into force in 2021. Articles 8 and 9 of the SFDR concern the promotion of “environmental or social” objectives and “sustainable investments”, respectively.https://datawrapper.dwcdn.net/zNmlR/2/

In markets where sustainable finance is not regulated, BlackRock promotes funds that are entirely outside the SFDR definitions as “ESG”, “sustainable” and (energy) “transition”. These amounted to US$1.8 billion in the first quarter of 2025. The fact that sustainable finance is almost wholly unregulated in countries such as the United States allows BlackRock to use notably audacious names for products which continue to channel money to Big Oil. Examples include “iShares ESG Aware”, “iShares Global Clean Energy”, and “BlackRock Sustainable Advantage”.https://datawrapper.dwcdn.net/02UAz/4/

A US investor might thus be sold a BlackRock “Carbon Transition Readiness” fund that has funnelled more than ten million dollars to fossil giants including BP, Equinor, Shell, Eni, and TotalEnergies. The “Climate Conscious and Transition” fund, meanwhile, has pumped US$65 million into Chevron, ConocoPhillips, EOG, Exxon, and Occidental Petroleum.

Among the so-called “carbon majors” in which BlackRock invests through its supposedly green funds are many of the same names: TotalEnergies, Shell, Equinor, Chevron, Eni, and Repsol. All are heavy emitters of greenhouse gases responsible for global warming. None, as we showed in the previous article in this series, is currently on track with its Paris Agreement targets.https://datawrapper.dwcdn.net/lRahP/4/

BlackRock appears to be disrespecting its own criteria

Contrary to Larry Fink’s statements in the Wall Street Journal podcast, our fact-checking reveals that over 20 funds classified as Article 8 or 9 (the “green” fund categories under EU regulations) have stakes in the oil giants. This despite the fact that their prospectuses contain commitments on ESG or decarbonisations, and may even openly renounce fossil-fuel investments.

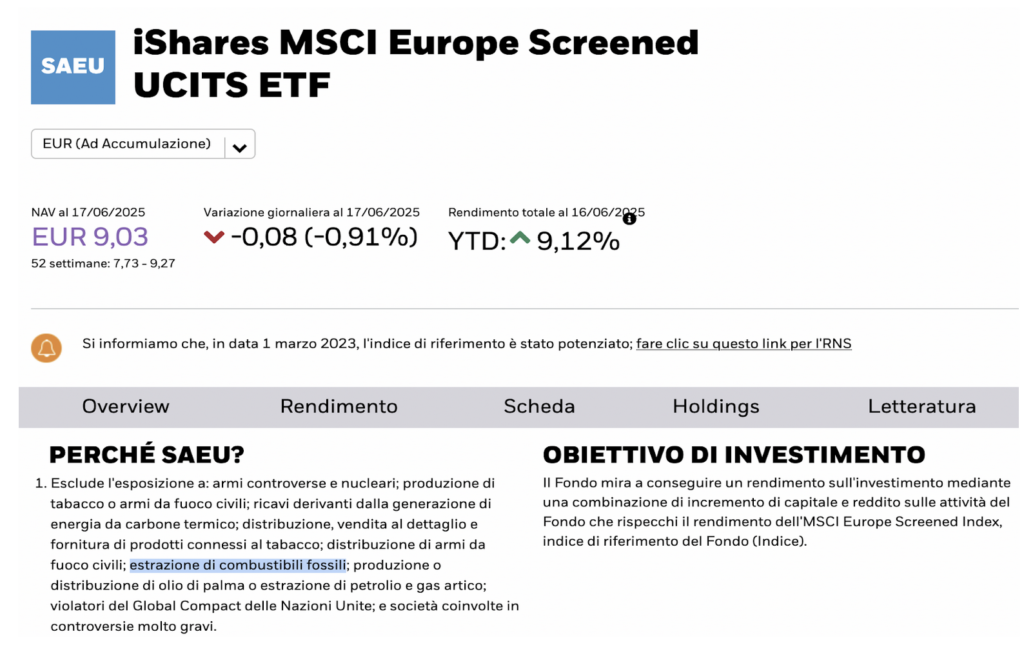

For example, the iShares MSCI Europe Screened UCITS ETF (exchange-traded fund) explicitly states in the first lines of its description that it excludes exposure to “fossil-fuel extraction”. A BlackRock client who is not sufficiently versed in interpreting such claims might therefore reasonably expect companies such as Shell, TotalEnergies, and Eni to be excluded.

A closer look at the fund’s sustainability information shows that it is passively managed and follows the MSCI Europe Screened Index, aiming to promote environmental and social standards. This means the fund uses MSCI’s own rules for excluding certain companies — MSCI being one of the largest global financial firms.

To understand what these exclusion rules are, investors must go to MSCI’s website and read the ESG (Environmental, Social and Governance) methodology behind the index. While it initially appears that oil and gas are excluded, the detailed rules reveal otherwise. The index doesn’t exclude all fossil fuel companies. Instead, it only leaves out those earning more than 5% of their revenue from specific controversial sources: coal, unconventional oil and gas (like fracking or tar sands), palm oil, Arctic drilling, or companies that violate the UN Global Compact’s voluntary sustainability principles.

In short, the index allows most fossil fuel companies unless they cross certain thresholds. That’s why BlackRock, which uses this index, can claim in its prospectus to exclude fossil fuel extraction — but then clarify in other documents that it relies on MSCI’s criteria. In fact, BlackRock refers readers to MSCI’s methodology page for details — but that page leads to a 404 error.

This index, like many others we examined, claims to exclude companies involved in hydrocarbon extraction. However, it later clarifies that the exclusion applies only to “unconventional” projects, such as tar sands and Arctic drilling.

Despite this, many of the companies the funds invest in are still involved in these very activities. A detailed look at the rules and factsheets shows that there is often flexibility under vague categories like “other investments.” This loophole allows the funds to legally maintain their “sustainable” label, even while investing in companies that contradict it.

In its sustainability report, meanwhile, BlackRock makes a confusing claim that might raise eyebrows among the more attentive clients: “This Fund promotes environmental or social characteristics, but does not aim to invest sustainably.” The statement seems to conflict with the very description of the investment, which talks of “a meaningful approach” to sustainable investing.

To further protect itself, BlackRock makes clear that any sustainability conditions “do not change a fund’s investment objective or limit its investment universe, and there is no indication that a fund will adopt investment strategies focused on ESG factors, impact, or exclusion criteria”. BlackRock thus effectively contradicts its own promise to exclude fossil fuels.

In the first quarter of 2025, such nominally “green” funds held fossil-fuel assets worth more than US$1 billion.

Reviewing our findings, Nicolas Koch, from the NGO Sustainable Finance Observatory, comments: “We cannot expect customers to read all the information, and it is likely that most of them will be easily misled by statements that certain activities are completely excluded, when in fact they are not. However, the SFDR represents a major victory in terms of transparency in this regard. It should provide the necessary information to intermediaries, such as financial advisors, who could easily exclude this fund thanks to the SFDR.”https://datawrapper.dwcdn.net/F5AuF/5/

In its “green” funds that specifically claim to exclude hydrocarbons from their portfolios, BlackRock holds fossil-fuel investments worth a total of US$850 million. The first lines of their prospectuses, in addition to mentioning the exclusion criteria, state that the investments are designed to reduce carbon impacts.

In August 2024, the European Securities and Markets Authority (ESMA) introduced stricter rules on the use of sustainability-related terms in fund names. These rules prohibit funds with significant fossil fuel holdings from using labels like “green,” “ESG,” or “sustainable.” The regulation took effect on 21 May 2025.

Before that date, the iShares MSCI Europe Screened UCITS ETF included “ESG” in its name, despite holding US$177 million in fossil fuel companies. As of now, it still holds around US$156 million in firms like Shell, TotalEnergies, Eni, Equinor, EQT, Aker, and OMV. Yet, the fund claims it is designed for investors who want to “exclude controversial sectors and reduce carbon intensity.”

In the first quarter of 2025, the iShares MSCI EMU ESG Enhanced CTB UCITS ETF fund invested US$160 million in fossil-fuel assets. It carries the CTB label, referring to the Carbon Transition Benchmark, meaning that it should promote decarbonisation standards. According to the new guidelines of the ESMA, BlackRock is required to demonstrate in its sustainability reporting how its investments are “on a clear and measurable path towards social or environmental transition”.

In its sustainability disclosures, BlackRock states that it doesn’t practise “engagement” with companies. The term refers to the interaction between asset managers and companies in which they hold equity stakes through “green” funds, where the aim is to positively influence their ESG and climate policies. According to a report by the European Commission’s sustainable-finance platform, such engagement can have positive impacts on companies, and this should be measured and shared with clients. BlackRock has chosen a different path. According to its disclosures, it “does not directly engage with companies, focusing instead on the quality of ESG data (it is committed to engaging directly with data and index providers to ensure better analysis and stability of ESG metrics)”.

“This is not a good way to generate impact and offer a more decarbonised investment portfolio”, says Sustainable Finance Observatory’s Nicolas Koch. NGO ShareAction’s latest report reveals that BlackRock has reduced its support for ESG resolutions at shareholder meetings to almost zero percent, and its commitment to sustainability is not sufficient to be considered credible. “Therefore, for any impact-oriented retail investor who has purchased iShares ESG ETFs in the past or is considering purchasing them in the future, there is a clear recommendation: avoid these products and move toward funds that engage in credible dialogue with companies”, concludes Koch.

To date, none of the carbon majors, including those in which BlackRock’s green funds invest, appear to have energy-transition plans consistent with international climate goals

Robert Clarke, an expert at Client Earth, a nonprofit legal and environmental organisation, makes a similar point:

“There is a huge question mark over impact claims. This is another category of potential ‘transition-washing’. Many funds have been rebranded from ‘ESG’ or ‘sustainable’ to ‘transition funds’, highlighting a subset of them that focus on transition strategies. But the problem here is: what happens if a fund is labeled a transition fund but the investments are not consistent? An example of this, in our view, is continued investment in the expansion of fossil fuels, which is simply incompatible with the transition.”

To date, none of the carbon majors, including those in which BlackRock’s green funds invest, appear to have energy-transition plans consistent with international climate goals. In fact, many seem to have watered down their climate strategies over the past year, as reported in a Carbon Tracker report published in April 2025.

Specialists agree that engagement with companies and voting at shareholder meetings are the most effective mechanisms for ensuring that “sustainable” investments have an impact. A recent report by the Sustainable Finance Observatory shows that 51 percent of European investors want their investments to have an impact.

We asked ESMA whether it considers BlackRock’s statements on sustainability to be contradictory. “The supervisory authority of the related fund will have to determine whether it intends to investigate whether the disclosure may be unclear, incorrect, or misleading to investors”, a spokesperson said.

“BlackRock operates in one of the most highly regulated industries in the world, and our funds, their prospectuses, and their supporting documents, adhere to all applicable regulations,” a spokesperson for the bank told Voxeurop. He added: “For our sustainable range, this includes those governing sustainable investing. iShares ETF holdings are published daily to provide investors with full transparency into where their investments go, and our leading sustainable fund range offers a spectrum of exposures allowing our clients to choose how to meet their own individual investment goals.”

BlackRock accused of greenwashing by Client Earth

The obvious incompatibility between the names of “sustainable” funds and their Big Carbon investments was tackled head on by the environmental group Client Earth in October 2024.

The organisation filed a legal complaint with the French financial supervisory authority, the AMF, challenging BlackRock’s labelling of certain consumer-oriented funds as “sustainable”. It singled out products such as the BSF Systematic Sustainable Global Equity Fund, pointing out that such funds had channelled €1 billion to the fossil-fuel sector.

In its action, Client Earth argued that such labels mislead consumers and may violate EU regulations. “There are rules that require communications to be fair, clear, and not misleading”, said Robert Clarke. “It should be the responsibility of the regulatory authorities [of the country] where the funds are marketed to take action to combat greenwashing, not only in fund names but also in prospectuses, in order to protect their investment sector. At present, national authorities are failing to take action.” In the wake of the complaint, BlackRock has changed the names or exclusion criteria of several of its funds.

🤝 This article is published in collaboration with IrpiMedia; it is part of Voxeurop’s investigation into green finance and was produced with the support of the European Media Information Fund (EMIF)

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts