In 1944, German war planners apparently dismissed reports about the staggering scale of U.S. wartime production. The newly constructed Willow Run plant operated by the Ford Motor Company in Michigan eventually produced a B-24 bomber every hour, 24 hours a day. This mile-long factory consumed 16 million pounds of aluminum each month and employed 42,000 workers.

The four-engine B-24 could carry four tons of bombs over 1,500 miles with an operational ceiling almost as high as Mount Everest. German high command did not want to believe that such a complex aircraft made from over a million separate parts could be constructed so quickly by a workforce comprised largely of women and African Americans. Luftwaffe leader Hermann Göring reportedly remarked, “the Americans cannot build aeroplanes. They are very good at refrigerators and razor blades.”

The hubris and prejudice of wartime German leadership prevented them from recognizing the scale and speed of American industrial might they were facing.

Eighty years later, is a similar dynamic playing out in North America, as political and business leaders cannot yet comprehend the scale of the energy transition unfolding beyond their borders?

Fight for the future

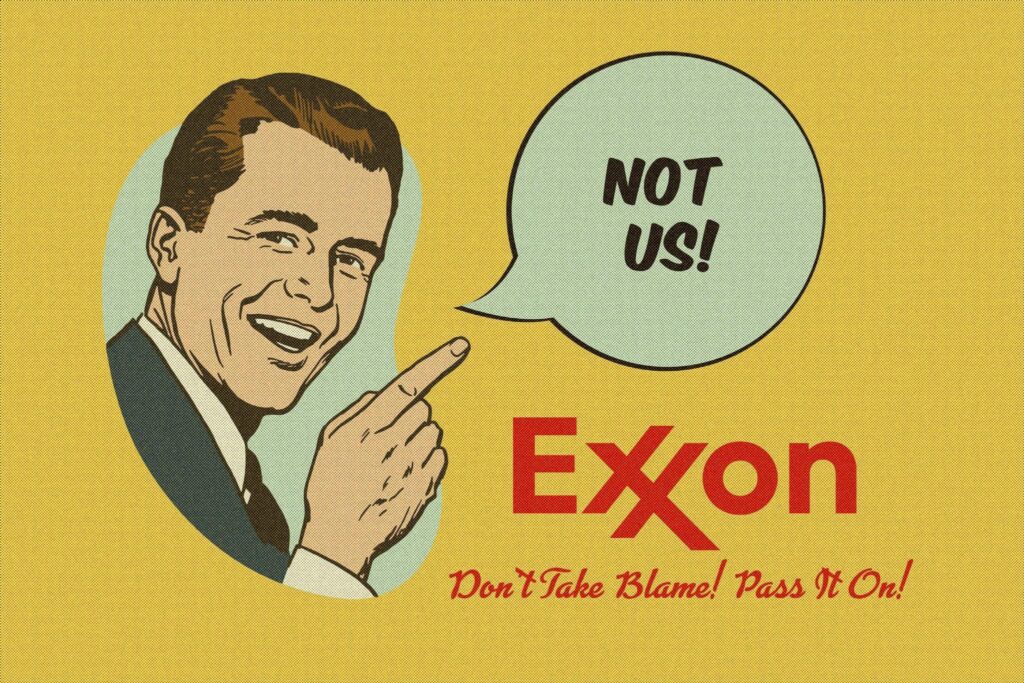

Obviously, this is not World War II, and the conventional energy sector are not Nazis. That said, a similar willful blindness seems to be driving what passes for energy policy, particularly around protecting the oil and gas industry.

U.S. President Donald Trump recently raged at the United Nations that climate change was “the greatest con job ever perpetrated on the world.” He warned European allies, “if you don’t get away from the green energy scam, your country is going to fail.”

Alberta Premier Danielle Smith recently directed her energy minister to somehow double bitumen production by 2035 and facilitate the approval of five new oil pipelines. Canada currently has seven liquified natural gas (LNG) projects in various stages of development totaling $109 billion in potential capital costs. Our stated national goal is to become a global energy superpower, driving spending on extractive infrastructure scheduled to come online to coincide with a massive projected glut in global LNG supply and peak oil demand.

Who is going to buy all that oil and gas? China and the Global South have been the presumed market for fossil fuel demand in the coming decades. However, the pace of renewable energy deployment in Asia is reminiscent of the wartime production achieved by North American factories 80 years ago.

Global mobilization

China is rapidly electrifying their entire economy, replacing coal, oil and natural gas with a booming renewable technology sector currently worth $1.9 trillion, or about 10 percent of their GDP. This level of clean energy investment is growing three times faster than the Chinese economy overall and leaving other economic powers in the rear-view mirror.

Chinese wind and solar generating capacity more than doubled from 2021 to 2024, overtaking coal as an energy source in early 2025. Battery deployment last year was more than the U.S. and Europe combined. The pace of this transformation is accelerating with Chinese wind and solar investments in the first half of 2025 more than double the same period in 2024.

Other presumed Asian markets for Canadian LNG exports are also embracing cheaper renewables from China that continue to fall in price. India’s solar installations soared 70 percent in the last year while gas generation declined by a third. Recent reports from Bloomberg show that solar and batteries in the Philippines are already cheaper than imported LNG and will be almost 40 percent cheaper by 2030. Bloomberg found similar trends for Thailand and Malaysia.

While Canadians have been debating the wisdom of investing billions in LNG export infrastructure, a similar debate is unfolding in developing countries around expensive LNG import and generation facilities. Sixty percent of planned new gas-fired capacity is slated for Asia. If all of these proposals move forward, Southeast Asia alone would double gas-fired generation and increase LNG import infrastructure by 80 percent at a capital cost of $220 billion.

Many of these same countries are now questioning those investments given that wind and solar projects in development in the region could supply two-thirds of projected growth demand by 2030 at a lower cost.

Producing and consuming countries are now contending with common issues. Similar to the situation in Canada, 81 gigawatts of highly hyped LNG projects were cancelled in Asia between 2022 and 2023 due to poor economics. Powerful vested interests on the other side of the Pacific are likewise pressuring countries in Southeast Asia to make enormous LNG investments. Japan in particular has been hyping inflated projections for LNG demand that would benefit Japanese shipping companies and corporate institutions.

Nations in the Global South are also learning that relying on LNG imports from other countries can dangerously undermine their energy security. Pakistan had signed LNG supply contracts that were abruptly cancelled by Swiss-based Gunvor Group after the Russian invasion of Ukraine spiked global gas prices in 2022. According to Bloomberg, Gunvor redirected those LNG shipments to Europe for a tidy $400 million profit. Pakistan has since pivoted towards renewables and is now forced to re-sell LNG shipments they are still obligated to purchase, often at a loss.

Winning strategy

Meanwhile in North America we regularly see media reports that the energy transition is overblown or global electric vehicle sales are slumping. Really? Electric vehicle sales grew by over 26 percent in the last 12 months and represented almost half of increased car sales around the world. EV adoption in the U.S. is flat due to incentives eliminated by the Trump administration, but the rest of the world still accounts for 80 percent of global oil demand.

China and the Global South are already charting their own futures based on cheap efficient renewables. Bland assurances from the Wall Street Journal, or political arm-twisting from First World governments will not stem this technological tide. wartime Germany — despite briefly dominating much western Europe — learned the hard way that wishful thinking and hubris are not a winning strategy.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts