Canadians have been bombarded with media stories promoting a common and simplistic theme equating more oil production with greater Canadian prosperity. But what if the opposite was true?

Lost in the oil-friendly media cacophony was a recent report by the International Institute for Sustainable Development (IISD) — an award-winning independent think tank — showing that as the world reaches peak global oil demand in 2029, Canada could increase long-term public revenues by instead curtailing additional production.

This finding is analytical antimatter to the pro-oil commentary Canadians have been marinating in for months.

A quick glance at Canada’s major news outlets shows overwhelmingly positive coverage for new fossil fuel pipelines or the country becoming an “energy superpower.” During the month of July alone, readers of the Globe and Mail were saturated with articles such as:

- To be an energy superpower, Canada must set aside flawed green ideology;

- Canada has a rare chance to be an energy superpower. Let’s not squander it;

- Majority of Canadians support building new oil infrastructure, poll shows; and

- Yes, absolutely – Canada needs more oil and gas pipelines to our coasts

Not to be outdone on oil patch cheer leading, the CBC, Toronto Star and Financial Post also offered up their own pro-pipeline content.

It is therefore unsurprising that the detailed and timely analysis by the IISD was largely ignored by mainstream Canadian media outlets. The Alberta oil industry knows if they are ever going to get another pipeline built, this is their last best chance. The recently passed bill C-5 grants the federal cabinet sweeping new powers to fast-track infrastructure megaprojects deemed to be in the “national interest.” As the nation waits to see which proposals make the cut, the oil patch and their allies have cranked up the media hype to eleven.

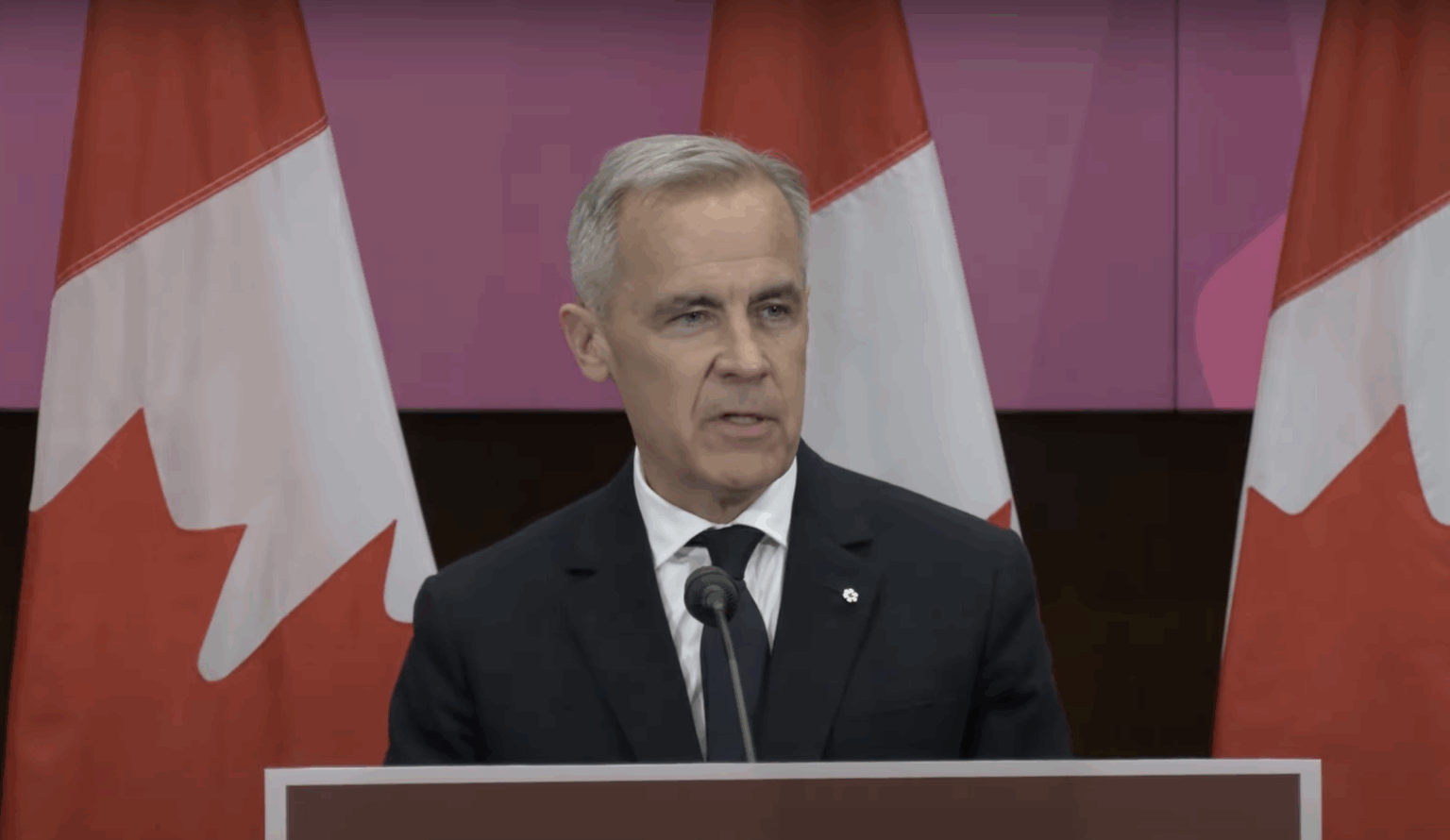

But as the Carney government is apparently considering another expensive and contentious investment in yesterday’s fuel, perhaps some thoughtful facts-based analysis is exactly what is needed.

Missing from the Mainstream

The IISD report looked at future scenarios based on oil demand projections from the International Energy Agency (IEA) and global market modeling from Rystad Energy. The main findings included:

- Up to two-thirds of future oil and gas capital investments out to 2040 are at risk of becoming stranded assets if we limit climate heating to an already dangerous level of 1.5 degrees Celsius. This proportion of squandered investments could be higher if much hyped carbon capture technologies fail to deliver.

- Almost 40 percent of future fossil fuel investments will be uneconomic under current and announced climate policies. Small wonder then that the oil patch and their operatives have been laser-focused on demanding roll backs of climate regulations while hyping increased production.

- The best way to economically leverage Canada’s oil and gas industry is to limit production expansion while investing remaining resource revenues in booming clean energy sectors such as wind, solar and battery storage.

This 79 page analysis runs counter to the pro-oil commentary that increased production always leads to greater prosperity. While the immense media megaphone of the oil patch is effectively used to hype the sector’s economic importance, figures in the IISD report are somewhat more humbling.

Oil and gas extraction currently contributes only three percent to Canada’s GDP and provides less than one percent of government revenues and jobs. Automation has already eliminated over 25,000 oil and gas sector jobs between 2014 and 2021 and those job losses are projected to continue, wiping out about 30 percent of the remaining oil patch workforce by 2040.

The IISD report also reveals that doubling down on increased production will lead to less government revenue as the energy transition accelerates. Even in the absence of new or announced climate policies, public returns from fossil fuel extraction would be $3 billion higher if we avoided investing in infrastructure that later became stranded assets. In a previous life, Mark Carney was one of the loudest voices cautioning against investing in infrastructure that would become worthless in a climate-constrained economy.

Banks in Trouble

Perhaps even more worrisome is the massive exposure of Canadian banks to potentially bad debts owed by the oil patch and the wider implications for financial contagion. The IISD report warns:

“Seventeen percent of the corporate lending and bond and equity underwriting at the Big Five Canadian banks — CIBC, TD Bank, Scotiabank, RBC, and BMO — is to fossil fuels, with 68% of that exposure being to Canada-based oil and gas companies. An assessment by the Bank of Canada and the Office of the Superintendent of Financial Institutions (2022) estimates that the probability of default in 2050 will increase by 150% for conventional oil extraction and 400% for oil sands, compared to current levels.”

Does this sound like a sound investment in the future Canadian economy?

A rush to the exits by investors in Alberta’s bitumen extraction giants would trigger an increase in corporate borrowing costs, accelerating the exposure of Canada’s largest banks to billions in risky assets. This could in turn tank Canadian consumer confidence, increase interest rates and undermine the wider economy. Prime Minister Carney — who has frontline experience dealing with past financial crises — should take note not to sow the seeds of a future financial calamity.

If our country is to meet the mounting challenges faced by an uncertain future, we need to focus on credible fact-based information – not industry sponsored hype. The oil patch of course will relentlessly advocate for their interests – especially in the home stretch of implementing bill C-5. At this pivotal moment, the Canadian media does a disservice to the nation by amplifying spoon-fed industry narratives at the expense of actual sound analysis.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts