The Canada Pension Plan Investment Board (CPPIB) is financing — and profiting from — U.S. President Donald Trump’s fossil fuel and AI development agenda, DeSmog has learned.

The CPPIB has invested billions in fossil fuel expansion in the U.S. since Trump’s return to office. It has partnered with private equity firms to acquire American oil and gas producers, and financed AI companies like Elon Musk’s xAI.

The CCPIB is an independent investment management organization responsible for managing the Canada Pension Plan (CPP), Canada’s largest public pension. It was created by an Act of Parliament in 1997, and is accountable to Canada’s Parliament. The CPPIB’s primary responsibility is to ensure the CPP maximizes its long term revenues with minimal risk.

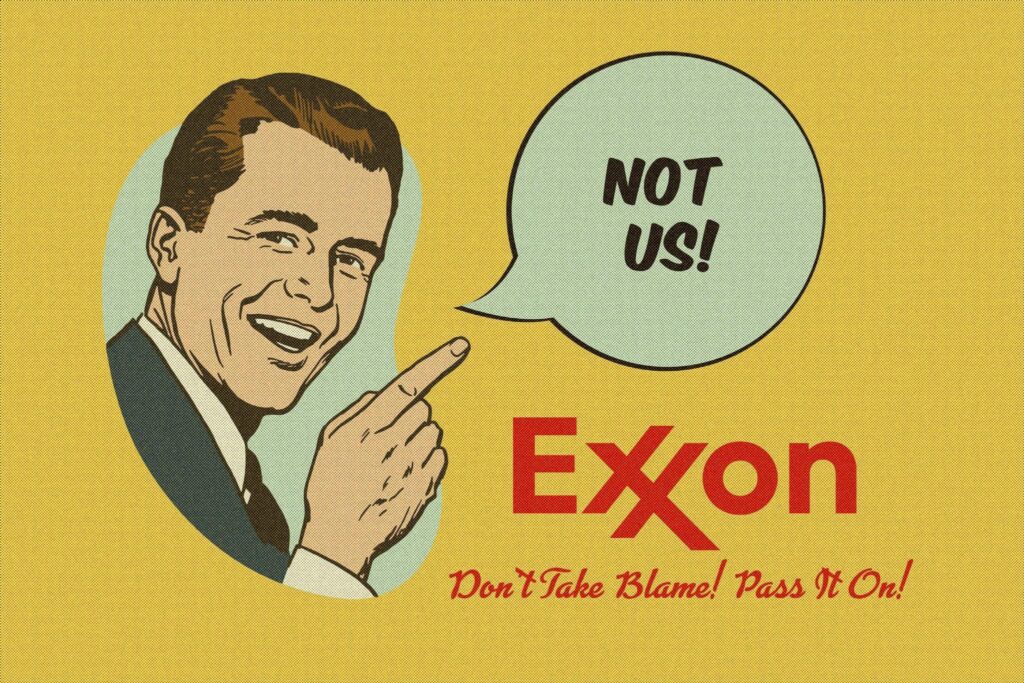

The CPPIB has a policy on sustainable investing, updated in May 2025, that recognizes climate change as a serious risk, and which encourages adapting its investment strategy to evolving decarbonization pathways and investing “for a whole economy transition required by climate change.” However, the same policy indicates the CPPIB’s belief “that accelerating the global energy transition requires a sophisticated, long-term approach rather than blanket divestment.”

In response to Canadian Prime Minister Mark Carney’s pledges to fast-track major infrastructure projects, CPPIB CEO John Graham stated in September 2025 that the CPPIB was keen to invest in major projects, particularly in the energy sector. As reported by the Financial Post, Graham singled out fossil fuel pipelines, saying “Here in Canada, we like pipelines. We like oil and gas pipelines.”

Its recent investments in the U.S. fossil fuel and AI sectors are a growing concern to pension fund watchdogs, which argue that at a time when the US is actively waging a trade war against Canada and destabilizing the climate, the CPPIB is providing capital to allow it to happen.

“As the U.S. government wages economic warfare against Canadian industry, upends the international rules-based order, and threatens to annex Canada, CPPIB appears content to continue gambling the Canada Pension Plan on risky U.S.-based companies,” said Patrick DeRochie, Senior Manager with Shift Action, a charitable organization dedicated to protecting pensions and the environment from investments in the fossil fuel sector, in a statement to DeSmog.

“With so many Canadians boycotting U.S. products and companies while coping with the economic shocks triggered by our volatile neighbor to the south, I think many Canadians would be shocked to learn where CPPIB has invested some of their hard-earned retirement savings during this time of turbulence and uncertainty,” said DeRochie.

CPPIB didn’t respond to a request for comment.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts

CPPIB’s Failing Climate Grade

The CPPIB operates at an arm’s length from the Canadian government and is accountable to it, but operates under the guidance of an independent Board of Directors. It manages assets totaling C$777.5 billion, from 22 million contributors to the CPP. The CPPIB has recently invested in or entered into joint ventures with firms involved in sectors as diverse as American outpatient medical facilities, the Japanese hospitality sector, and the AI sector.

The CPPIB received its worst grade to date in Shift Action’s latest climate report card, dropping to a D grade overall and coming in second to last in the non-profit group’s annual ranking of Canadian pension funds’ climate policies. The CPPIB’s performance fell in four out of six categories, earning failing grades when it came to meeting Paris Agreement aligned targets, intermediate targets, and for not excluding fossil fuels.

Part of the rationale for that low grade is that the CPPIB has major investments in American fossil fuel companies, AI companies, and fossil fuel companies seeking to power America’s AI expansion.

The CPPIB invested US$300 million last year in xAI, specifically to construct a gas-powered AI data centre in a low-income Black neighborhood in Memphis, Tennessee. The xAI facilities in Memphis have been cited as examples of environmental racism by advocacy groups and have been recorded emitting massive quantities of pollution. Most recently, xAI was in the news because its AI chatbot product Grok was flooding the Internet with pornographic and sexualized images of women and children. In response to the Toronto Star’s questions about why the CPPIB was investing in xAI, a spokesperson said the CPPIB wasn’t endorsing how Grok was being used.

The CPPIB recently spent $1.2 billion to acquire a roughly 25 percent stake in Tallgrass Energy, a pipeline company invited to the White House to participate in discussions about the exploitation of Venezuela’s oil industry.

Tallgrass Energy has 16,000 kilometre’s worth of pipelines and terminals across 14 states. A managing director of the CPPIB’s ‘sustainable energies’ group sits on Tallgrass’ board.

Tallgrass is also focused on developing fossil fuel infrastructure to capitalize on the AI boom. The company has proposed a new pipeline from the Permian Basin to support new data centres and gas plants across the United States. The company has also partnered with the AI infrastructure company Crusoe to build an AI-focused data centre that would be powered primarily by natural gas and “future renewable resources.”

“It appears that CPPIB is betting that the expansion of AI infrastructure will drive an increase in demand for fossil gas, and is planning to finance and profit from gas-fired data centres,” said DeRochie.

During a November 2024 meeting, CPPIB CEO John Graham described how “the demand for energy globally is not declining” and AI is “further driving the demand for energy.” Graham further stated that the CPPIB needs to “continue to support the oil and gas industry” because the “industry has a long track record of delivering energy into the economy in a very safe and economical way.”

The CPPIB has committed hundreds of millions to VoltaGrid, a Houston-based company that specializes in modular natural gas systems for data centres and fossil fuel operations. The company regularly misidentifies natural gas as a “low-emission” solution for the AI and data centre sectors, yet is part of CPPIB’s “Sustainable Energies” portfolio. Moreover, a CPPIB managing director sits on VoltaGrid’s board.

The company’s CEO, Nathan Ough,is a Republican donor who has eagerly embraced Donald Trump’s “drill, baby, drill” agenda. VoltaGrid isn’t merely supportive of Trump’s focus on gas-powered data centre expansion, but also collaborates with companies owned by major Trump donors, including Oracle and Energy Transfer. The company is also involved in a controversial project to build a gas plant to power a data centre in Saint John, New Brunswick. Responding to this criticism, Ough responded that VoltaGrid is 51 percent Canadian-owned and that its finances are “banked in large part out of Canada.”

Shift Action further notes that the CPPIB in general is overweighted with American investments: approximately 47 percent of its portfolio is invested in the U.S., a percentage that far exceeds their share of the global economy.

Several fossil fuel companies owned by the CPPIB sit on the U.S. Department of Energy’s National Petroleum Council (NPC). These include The Williams Companies, AlphaGen, and California Resources Corp. Though not backed by the CPPIB, two other Canadian fossil fuel companies — Enbridge and TC Energy — also sit on the NPC. These companies are involved in oil and gas production, transporting fracked gas, and operate fossil fuel power plants in six states.

According to Shift Action, the CPPIB reported that it invested US$807 million in fossil fuel expansion in the U.S. in the final quarter of 2024. This includes a US$300 million investment in Salamanca Infrastructure LLC, which owns midstream energy assets in the United States, more than US$200 million to fund pipeline assets that transport fossil gas in Pennsylvania, Ohio, and West Virginia, and three co-investments with Quantum Capital Group, a Houston-based private equity firm focused on the energy sector.

These investments included stakes ranging from 10 to 29 percent in three different firms involved in fossil fuel exploration. The CPPIB’s commitment to Quantum Capital Group / Quantum Energy Partners has been steadily growing since its first investment of US$200 million in 2008, followed by another US$300 million in 2014. In 2024, it committed US$500 million to Quantum despite the fact that the company stated the investment would be used to support the US’ conventional energy industry.

“For a national pension manager meant to ensure the long-term retirement security of 22 million Canadians, CPPIB sure has a strange way of investing in our best interests and avoiding undue risks of loss,” said DeRochie. “You would think that the risks of American aggression, catastrophic climate change, and Trump-aligned tech oligarchs would give the CPPIB pause before making these investment decisions.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts