For the first time in 76 years, a piece of Mexico’s oil and gas infrastructure has been sold to a foreign investor, and the deal will help bring fracked gas from Texas’s Eagle Ford shale region into Mexico. In this first major deal since the country’s landmark energy reforms, Pemex—the state-owned oil company that had kept domain over the country’s vast petroleum and natural gas reserves since they were nationalized back in 1938—sold a 45-percent stake of a prospective natural gas pipeline project to the United States-based investment funds BlackRock and First Reserve.

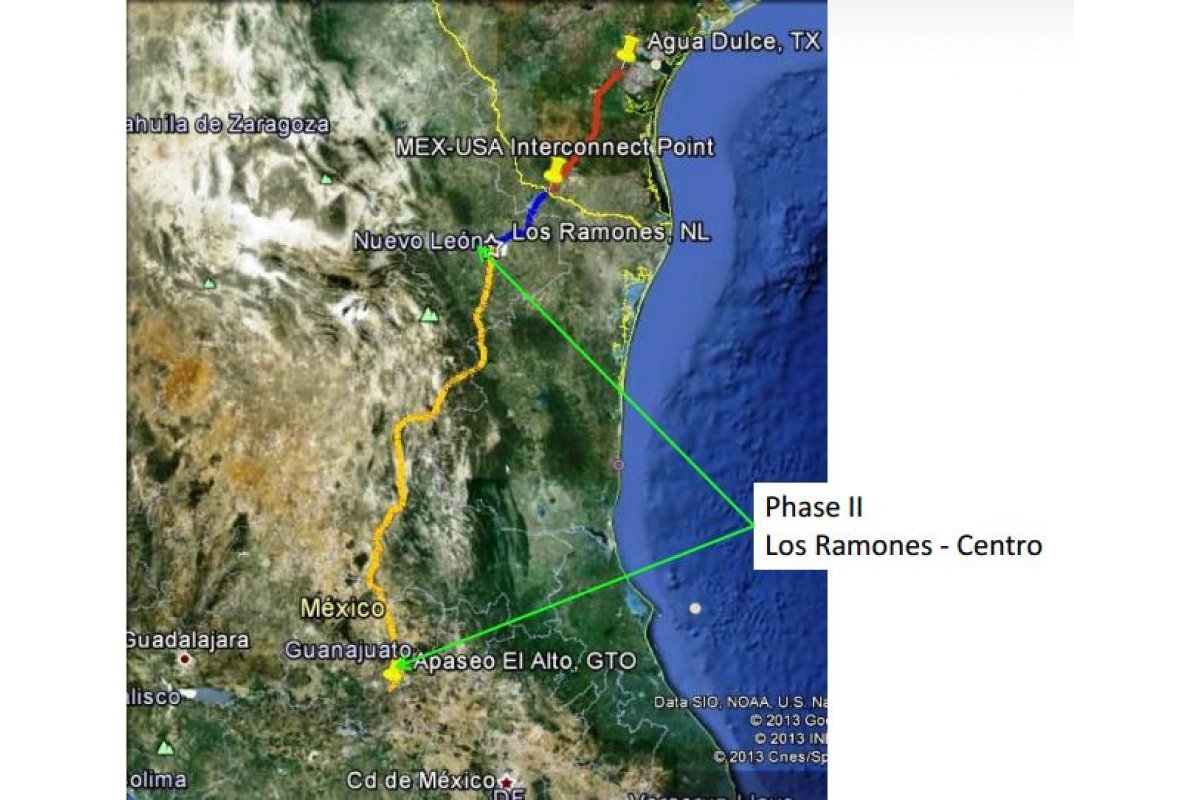

The $900 million sale provides Pemex the capital to build out 462 miles of natural gas pipeline that make up the second phase of this major, midstream infrastructure project. Across its entirety, Las Ramones project will funnel natural gas from Texas’s Eagle Ford shale down to the demand-hungry industrial parks of Central Mexico.

Credit: Pemex

This deal “is the first large step in monetizing assets and bringing partners to midstream,” said Pemex CEO Emilio Lozoya. “It symbolizes what Pemex will be seen doing in the coming months: bringing partners into the value chain.”

At CERAWeek in Houston in late April, Enrique Ochoa Reza, director of Mexico’s Federal Electricity Commision (CFE), noted the significance of the deal. Ochoa Reza cited the irony of Mexico’s historic inability to tap into either Mexico’s vast natural gas reserves or U.S. exports, and the sudden access to both. “We didn’t have enough natural gas pipelines to receive that natural gas, and we didn’t have the reforms that would allow us to extract that natural gas from our soil,” said Ochoa Reza. “Now we have both elements, and CFE is promoting the construction of more natural gas pipelines.”

Ochoa Reza announced plans to expand natural gas pipelines in Mexico by 75 percent by the end of 2018.

Just the beginning

Just a couple of weeks after the Las Ramones deal was formalized, Pemex and First Reserve announced another, bigger venture—a $1 billion investment to fund energy infrastructure throughout the country.

Meanwhile, a Mexican company called IEnova, is working on three other natural gas pipelines, including the first phase of Las Ramones.Though IEnova is based in Mexico and listed on the Mexican stock exchange, it is a subsidiary of Sempra Energy, the San Diego-based natural gas company. And now that the reforms have passed and foreign investment is welcome, Sempra is showing interest in directly dealing in Mexican projects.

Besides the new constructions, Pemex will spin off tens of thousands of kilometers of pipelines and other midstream infrastructure to other private companies. Meanwhile, the upstream holdings—the actual oil and gas reserves and resources—are opening up for private investment for the first time since resources were nationalized.

No contracts for exploration or extraction have been awarded yet, but this summer will welcome a new chapter in this crude oil and gas bonanza.

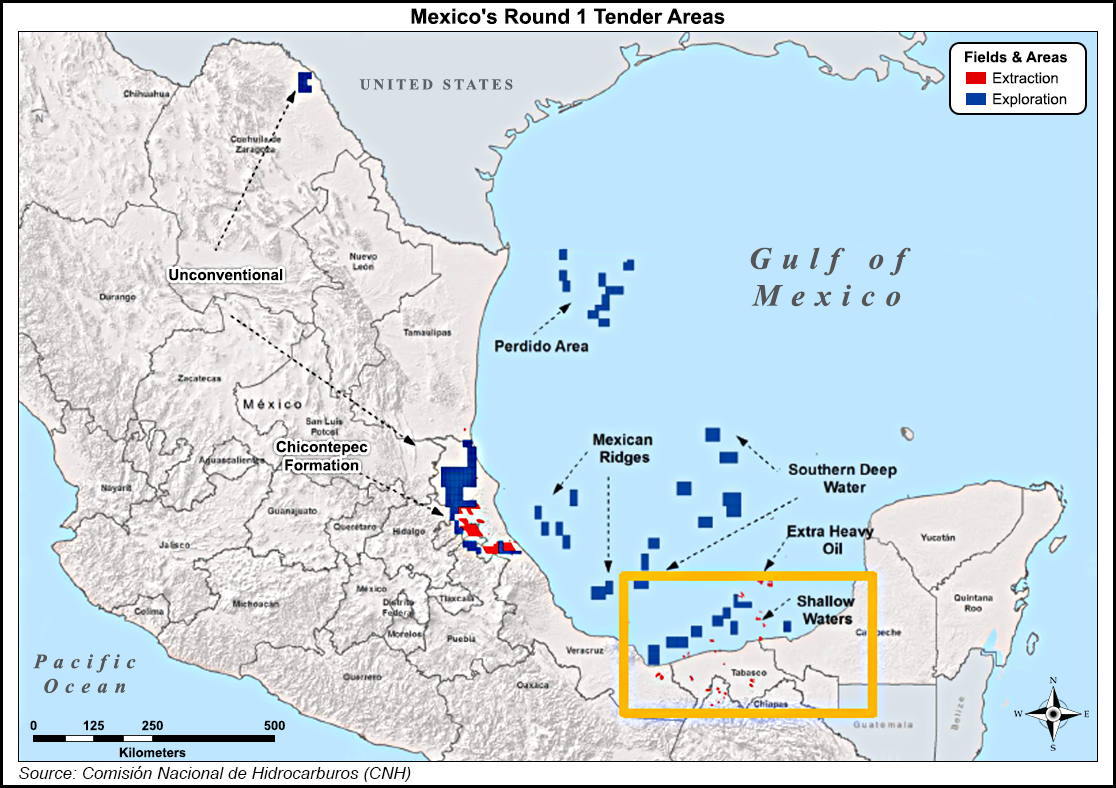

The very first upstream contracts will be awarded on July 15th, for 14 shallow-water offshore exploration areas. In all, 34 companies have qualified to bid, though they aren’t public.

The second set of contracts, these ones for actual oil production in nine shallow-water offshore fields, will be awarded on September 30th.

In the meantime, Pemex is opening up the bidding process for dozens of onshore fields, deepwater contracts, the drooled-over Chicontepec oil field, and then “unconventionals,” likely to mean shale fields that would have to be fracked.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts