This DeSmog UK epic history post remembers how Northern Rock, the first bank run in the UK since Victorian times, crashed with Matt Ridley at the helm.

Matt Ridley is an Eton- and Oxford-educated member of the British aristocracy with a sprawling 8,500-acre estate and a loving family. He is a talented and popular science writer and is a member of the influential Science and Technology Committee in the House of Lords.

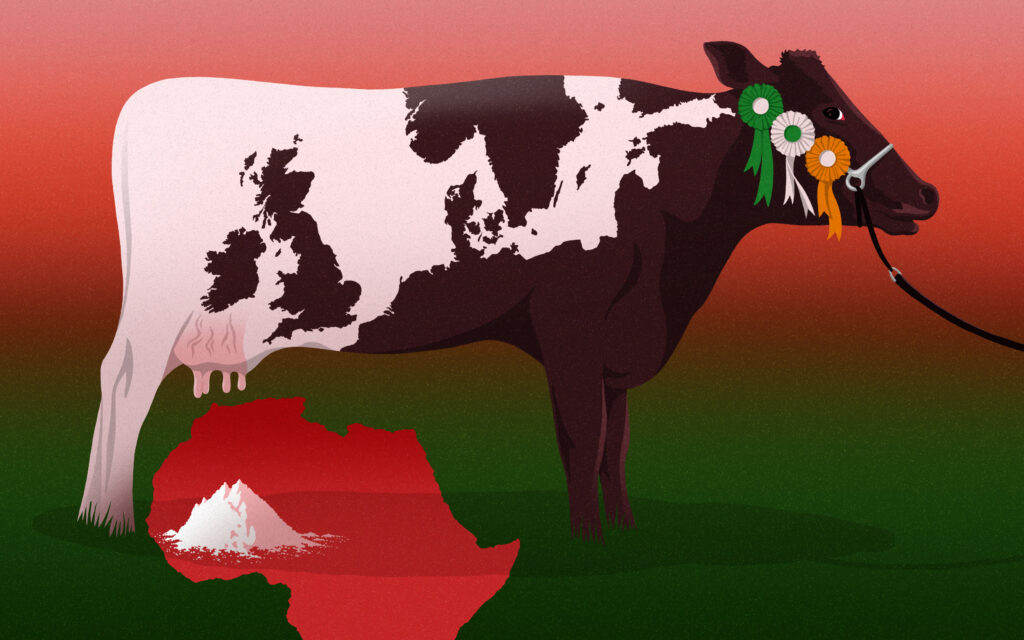

Ridley wants us to trust him with our future: the future of the entire planet. We must ignore the increasingly concerned warnings of the world’s leading climate scientists that rising temperatures will lead to mass starvation through famine and water stress, and perhaps then civil war.

The graduate in zoology has been attacking climate science since 1996 when, as a Telegraph columnist, he repeated the denier claims of the Environment Unit of the Institute of Economic Affairs, which is, in turn, funded by oil, tobacco and pharmaceutical companies.

Trust Me

The Viscount has perused the literature and spoken to those in the know; he has his ear to the ground, and whispers into the ears of newspaper proprietors including Rupert Murdoch and politicians including family member Owen Paterson. Relax, he says, trust me. The risks are not that high, everything will likely go on as usual: no reason to fear the future.

This is exactly what he would have told thousands of working class families across the North of England when they trusted their savings with, or took out mortgages from, Northern Rock, the regional mutual that had been transformed under Ridley into a thrusting financial powerhouse.

Ridley is a keen supporter of neoliberal economics – the belief that markets are self-correcting and based on the actions of logical agents all working in their own self-interest. Modern free market economics – relied on by banks modelling risk – rests on the assumption that everyone knows the price of everything, and prices include the cost of future events.

According to this economic model, crises do not happen and banks cannot fail. The whizz-kids on Wall Street understood the markets, all knowledge was perfect, risk had been measured and sold to insurance companies, and everything would likely go on as usual, no reason to fear the future.

Neoliberal Experiment

Northern Rock demutualised in October 1997, which meant it was no longer owned and accountable to its members. This was made possible by the deregulation of the markets masterminded by Nigel Lawson as Tory chancellor.

The company was at the leading edge of “a neoliberal experiment that, in the name of individual freedom, was constructed to revive the flagging fortunes of capitalism following an extended period of stalled growth during the 1970s.”

The Rock had assets of £15.8 billion at that time but within a decade had grown six-fold with £101 billion in assets on its books – mostly secured lending on families’ homes. Things were going incredibly well. Until they weren’t.

The company was taking out very short-term loans cheaply on the international markets and then using the cash to lend mortgages sometimes lasting more than 30 years. They would then sell these mortgages to the international markets (before any defaults) in what is now widely known as “securitisation”.

Mortgage Crisis

Then, on 9 August 2007, the traders at the Rock noticed a “dislocation in the market”. The sub-prime mortgage crisis in the United States was starting to unfold, liquidity in the international markets crystallised as lenders got spooked, and people stopped offering cheap loans to Ridley and his bank.

Ridley, giving evidence to a parliamentary inquiry, told of how he had assumed that lenders would still offer cash to his “quality” bank once the crisis of toxic loans became apparent. He also never expected an international crisis of the markets, feeling safer by borrowing from the US, Europe, the Far East and beyond.

“We deliberately diversified our funding platform,” he whimpered. “The idea that all markets would close simultaneously was unforeseen by any major authority.” Mistakes were made, it seems, but not by Ridley.

Profit Warning

Mervyn King, then Governor of the Bank of England, seemed less than sympathetic to this blamestorming. Ridley and his bank had failed to take out adequate insurance against a liquidity crisis, unlike Countrywide in the United States, which had allowed for some possibility of market failure.

The share price of Northern Rock had been sliding throughout the year but the firm was forced to put out a profit warning on 27 June 2007, resulting in the bank losing 10 percent of its value over night. In less than a month, its shares lost a third of their value.

Ridley was absolutely humiliated. “On 30 August 2007, Sir Ian Gibson, senior independent director at Northern Rock, asked for, and received, agreement by each member of the board of Northern Rock to resign should such resignations be needed,” read the House of Commons investigation report.

Panic set in. The BBC reported at 8.30pm on September 13 that year that Northern Rock had asked for and been granted emergency funding from the Bank of England, to prevent insolvency and collapse.

“That day,” the House of Commons recalled, “long queues began to form outside some of Northern Rock’s branches; later its website collapsed and its phone lines were reported to be jammed. The first bank run in the United Kingdom since Victorian times was underway.”

Ridley Resigns

Ridley did not appeal to his depositors to put the interests of their friendly mutual ahead of their own panic and self-interest. He did not have the charisma of James Stewart’s George Bailey in It’s a Wonderful Life. More to the point, Ridley had advocated free markets, self-interest, and that greed is good.

And his bank collapsed. Ridley announced his resignation on 19 October:

“The directors of Northern Rock were the principle authors of the difficulties that the company has faced since August 2007. It is right that members of the Board of Northern Rock have been replaced, although haphazardly since the company became dependent on liquidity support from the Bank of England.

“The high-risk, reckless business strategy of Northern Rock, with its reliance on short and medium term wholesale funding and an absence of sufficient insurance and a failure to arrange standby facility or cover that risk, meant it was unable to cope…”

Virgin Money

The bank was taken into Government ownership, the most profound humiliation for the staunch advocate of the free market and attacker of the nanny state. It owed the government £26.9 billion by the end of the year.

The government later sold the firm to Richard Branson’s company for £747 million and it was rebranded Virgin Money, with £73 million paid a few months later. The taxpayer – through the government – suffered an immediate loss of the same magnitude while still owning the “toxic” part of the bank that was creaking with bad debts. The social costs were unprecedented.

Matt Ridley said at the time: “I enormously regret what happened at Northern Rock. It’s an incredibly painful memory for me, and it’s something that I will live with for the rest of my life. I have nothing but remorse for my role in what happened. I’ve apologised and explained as much as I can…”

Unfortunately for everyone else on this planet, this regret did not translate into a humbleness about his inability to understand capitalism, the international markets, risk, uncertainty, and – one might argue – reason.

Up next in the DeSmog UK epic history series: how neoliberalism almost broke capitalism (and what this might tell us about free markets and the environment).

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts