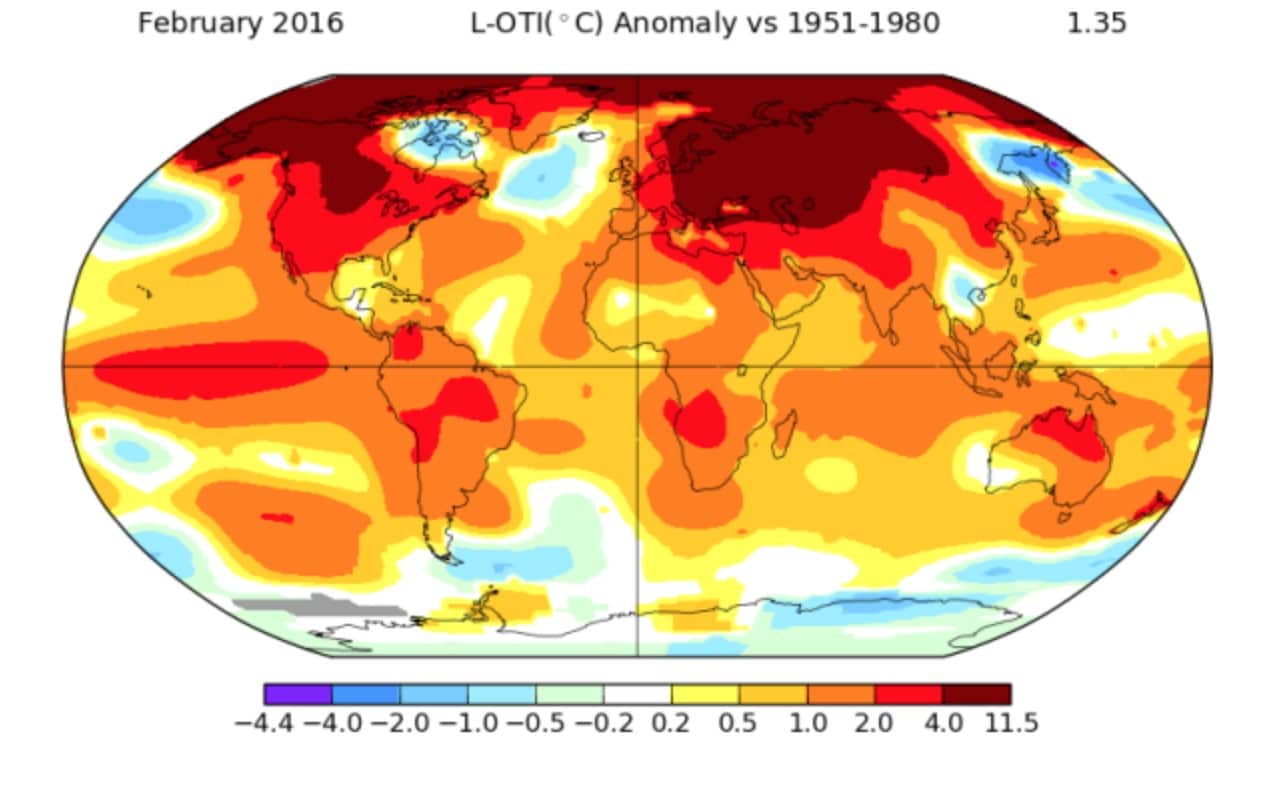

Earlier this month Bill McKibben wrote that “Across the northern hemisphere, the temperature, if only for a few hours, apparently crossed a line: it was more than two degrees Celsius above “normal” for the first time in recorded history.”

Of course this comes on the heels of February breaking temperature records in such a stunning fashion that it resulted in a comment from NASA climate scientist Gavin Schmidt of simply – “Wow.”

Seeing as the Paris climate agreement set a goal of limiting global warming to two degrees Celsius above “normal” this would appear to stress the urgency of addressing climate change and ending our dependence on fossil fuels.

That’s why many investors in oil companies are now asking the companies to address this reality by stress testing their portfolios against a scenario where the two degree goal is achieved. The only way to achieve this goal is to leave a significant amount of oil company assets “stranded” or “in the ground.”

According to Ceres, a non-profit group that mobilizes investors to address climate change, investors have filed a record number of shareholder resolutions this year with major U.S. energy companies asking them to disclose their strategies for competing in a global economy that is shifting towards clean energy and away from fossil fuels.

The resolutions include requests that companies like ExxonMobil and Chevron ‘stress test’ their business plans against the Paris accord’s goal to reduce carbon pollution in order to limit global temperature rise to below two degrees Celsius.

Ceres also notes that several European based oil companies have already taken the approach of stress testing a two degree scenario, including Shell, BP, Statoil and Total.

However, American companies are choosing to ignore the issue.

“These resolutions are a powerful signal that the world is shifting to a clean energy, low-carbon global economy, and that fossil fuel companies need to be ready,” said Mindy Lubber, president of Ceres. “The Paris agreement has fundamentally altered the way businesses think about the financial risks of climate change, yet many U.S. energy firms are standing still as the world changes.”

Carbon Tracker recently released the report Full Disclosure: Why Chevron Needs to Stress-Test the Business at Two-Degrees which detailed many of Chevron’s questionable assumptions about fossil fuel use in the future – and how they are essentially standing still while the world changes.

Chevron and Exxon have both made public statements that essentially say, ‘The world population will continue to burn as much oil as it can – and we will happily sell it to them.’

Carbon Tracker’s report cites a 2015 Chevron Proxy Statement where Chevron makes this case.

“Chevron’s production and resources will be needed to meet projected global energy demand, even in a carbon-constrained future. The GHG emissions both under our operational control and from the products we sell are the result of meeting that energy demand.”

This is similar to the statement made by Exxon explaining how it doesn’t believe any fossil fuel assets will ever be stranded in a document titled, “Energy and Carbon – Managing the Risks.”

“We believe producing these assets is essential to meeting growing energy demand worldwide, and in preventing consumers – especially those in the least developed and most vulnerable economies – from themselves becoming stranded in the global pursuit of higher living standards and greater economic opportunity.”

So essentially Exxon’s approach to “managing the risks” to the climate by burning fossil fuels is to ignore any risks.

However, on the heels of COP21 — and as each month brings new record temperatures — many major investors appear to be willing to address reality.

“The worldwide commitment to limiting global warming means that our global economy is increasingly a lower carbon economy,” said New York State Comptroller Thomas P. DiNapoli, head of the New York state pension fund controlling over $180 billion in assets. “We need to know that companies like Exxon are prepared to meet this challenge and are taking steps to protect the long-term value of our investments.”

As global temperatures climb it appears that companies like Chevron and Exxon will resist any scenario that doesn’t involve pumping every last barrel out of the ground in every country around the world.

After decades spent funding climate denial it is no surprise that companies like Exxon are refusing to address a two degree limit as the future. Hopefully investor pressure won’t allow them several more decades of denial about the future of fossil fuel use.

Blog image: NASA

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts