Council pension funds across the UK have invested billions in companies involved with fracking, new data claims. Authorities in areas where the controversial practice is set to take place also have millions invested such companies.

Some of the funds also have investments in companies with close ties to members of President Trump’s administration, which is currently embarking on a major climate and environmental regulation roll-back.

New data from campaign groups Platform, 350.org, and Friends of the Earth claims council pension funds across the UK collectively have over £9 billion in companies involved with fracking.

Below are the top 10 pension funds invested in fracking by the proportion of their fund:

Dumfries and Galloway council’s pension fund has the largest portion of its investments in companies involved with fracking, with almost seven percent invested, according to the data.

Greater Manchester council’s fund has £989 million invested in fracking activities – the largest overall investment, and second largest by proportion of its fund.

Lancashire County Council, home to the UK’s only functioning fracking site at Preston New Road, has £186 million invested in fracking activities through its pension fund, according to the data.

After tremors were felt during testing at the site in 2012, an 18-month moratorium was placed on fracking across the UK. Cuadrilla Resources has been subject to daily protests since it restarted operations in 2017.

It’s not the only council with fracking sites and pension fund investments in fracking activities, according to the data.

Third Energy has a controversial fracking site at Kirby Misperton in North Yorkshire, while the council’s fund has £81 million invested in other companies fracking across the world.

West Sussex’s fund has £119 million invested in companies with fracking activities. The county is home to the controversial Balcombe site, which Cuadrilla Resources tried and failed to frack in 2013. The company was given the go-ahead to restart testing at the site in January 2018, despite opposition from the local community.

A spokesperson for Dumfries and Galloway council said the fund’s main responsibility was “to ensure that scheme members and their dependants receive all benefits as and when they become payable.”

“In view of the principal objectives the Pensions Sub Committee take the view that non-financial factors should not drive the investment process at the cost of financial return on the Fund.”

A spokesperson for West Sussex said that while its pension fund had not divested from fossil fuels,its investment managers were tasked to “consider, amongst other factors, the effects of social, environmental and governance issues on the performance of a company.”

Lancashire County Council pointed out that its fund had around £346 million invested in “green energy projects”, and that it did not recognise the figures, adding:

“The Local Pensions Partnership manages the authority’s pension fund along with those of a number of other organisations. Decisions about investments are therefore not made by Lancashire County Council.”

“The Pension Fund’s assets are invested in line with responsible investment policies which seek to ensure a wide range of risk are considered and this includes the risks of climate change.”

A spokesperson for the Isle of Wight council, whose pension fund appears in the top 10 fracking investors, told DeSmog UK:

“The Isle of Wight Council Pension Fund has a fiduciary duty to ensure it has sufficient funds available to pay pensions.”

“In light of that obligation, and in order to maximise investment return, the fund has a diverse range of investments and does not restrict investment managers from choosing certain stocks including oil, gas, and coal companies as well as renewable energy opportunities. The investment strategy is regularly monitored.”

Other local authorities mentioned in the article have been contacted for comment.

Fracking Majors

Much of the pension funds’ investments are through major oil companies such as Shell and BP, who have fracking interests in the US, China, the Middle East, South America and Australia.

Neither company has tried to frack the UK yet, with BP CEO Bob Dudley stating it would “attract the wrong kind of attention”.

Fracking is a controversial practice in the UK, with many local residents objecting to the plans in their areas.

The government’s own polling has repeatedly shown little support for the practice. The fracking question was recently removed from the survey, days after the government gave Cuadrilla the go-ahead to frack for the first time in the UK since 2011.

Sakina Sheikh, Divestment Campaigner with Platform said in a statement:

“The devastating fires and record temperatures this summer have brought the impacts of climate change home. Neither local communities nor our climate can afford for the fracking industry to win. Our councils are providing everyday support to the frackers, it’s time to stop. It’s time to divest from fossil fuels.”

Deirdre Duff, divestment campaigner with Friends of the Earth, added:

“UK councils should know better than to invest in fracking companies. These companies are inflicting their fracking operations on communities around the world, and this can have significant impacts.”

“Many UK councils have rightly opposed fracking in their own area – however it is shocking that they still support the global fracking industry. We should remember too that the climate change caused by fracking will affect us all, no matter where the fracking is conducted.”

Trump Links

Some of the council’s pension funds are invested in companies with close ties to President Trump, who last year announced he would make it much easier to frack in the US’s national parks.

Six council’s pension funds have investments in Texas-based Anadarko Petroleum, which reportedly gave $100,000 towards Trump’s inauguration.

Hampshire and the London Pension Fund Authority have investments in US company Devon Energy, according to the data. The Oklahoma-based company has close ties to Trump’s first Environmental Protection Agency chief, Scott Pruitt, who resigned in July 2018 after a series of expense scandals.

According to transparency campaigners Maplight, Devon Energy and its employees gave over $150,000 to Pruitt and groups associated with him between 2010 and 2014. The company also drafted a letter on Pruitt’s behalf while he was Oklahoma Attorney General, the New York Times reported. The letter asked Obama’s EPA chief, Lisa Brown, to cut methane regulations, to the benefit of the company.

Meanwhile, the pension funds of Worcestershire, North Yorkshire, Kingston and Lothian councils all have investments in oil and gas giant, Hess Corporation. About 44 percent of Hess’ production comes from shale gas in Ohio and North Dakota, according to the company’s website.

Trump nominated one of Hess’ key lobbyists, Drew Maloney, to be the Assistant Secretary of the Treasury for legislative affairs in March 2017. He was reportedly a close ally of scandal-ridden Treasury Secretary Steve Mnuchin, who was recently compared to a “bond villain” after posing with sheets of dollar bills.

Maloney left the administration to become President of the American Investment Council trade association in August 2018.

Around 20 council’s pension funds have investments in EOG Resources, one of the top companies in the fracking industry. Thanks to the new tax bill passed by Republicans and President Donald Trump at the end of 2-17, EOG had an exceptionally strong year compared to 2016.

Without that gift from the GOP and Trump, EOG would have lost approximately $700 million between those two years. Instead they are $1.5 billion ahead of the game, DeSmogBlog previously reported.

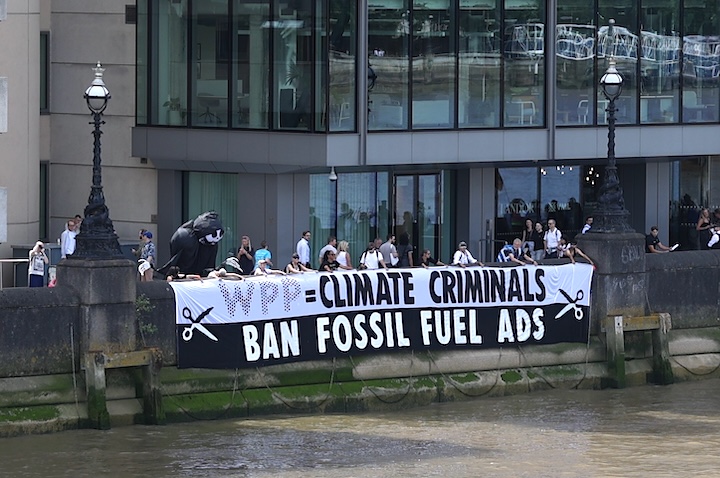

Main image: Mat Hope/DeSmog UK. Update 03/09/2018: A quote from Lancashire County Council was added.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts