By Leyla Larbi, Senior Campaigner for SumOfUs France.

Nobody’s sure what the future will look like once the coronavirus pandemic ends – but we do know that fossil fuels have no place in it. Unfortunately, that doesn’t seem to be a position the European Central Bank (ECB) agrees with.

Last week, the ECB announced a €600 billion increase to its bond-buying stimulus package, making a total of €1.7 trillion available to boost economies in the wake of Covid-19. With the right terms in place, this money could trigger a green industrial revolution that resets our economies on a path towards sustainable growth, and wean our industries off the fossil fuels that are driving us towards climate disaster.

However, regrettably, up to €220 billion of ECB money — equivalent to the entire GDP of Portugal — could be used to buy assets from polluting companies such as fossil fuel extractors, airlines and utilities, undermining Europe’s ambition to reach net-zero carbon emissions.

The ECB is missing a once in a generation opportunity to use this gigantic stimulus package to build back our economies for the better. It could set strict environmental criteria to decide which companies to invest in, helping to spur a green recovery. Instead, it is buying up shares in Shell and Total, both of which plan to increase their fossil fuel extraction over the next decade – further accelerating the destruction of our planet.

Like what you’re reading? Support DeSmog by becoming a patron today!

The ECB’s position simply doesn’t add up. That’s why over 115,000 SumOfUs members are calling on the ECB to stop pouring money into dirty fossil fuels.

The European Union has set a target to reach net-zero carbon emissions by 2050. In contrast to the ECB, and following a successful campaign by a coalition of NGOs, the European Commission (EC) recently pledged that its separate €750 billion coronavirus recovery plan will “do no harm” to the EU’s goals to tackle the climate crisis. The EC will provide new funding for green transport, clean industry and renovating homes. This is all clearly welcome – but the Commission’s ambitions risk being undermined by its own Central Bank’s decision to spray money at climate-wrecking companies.

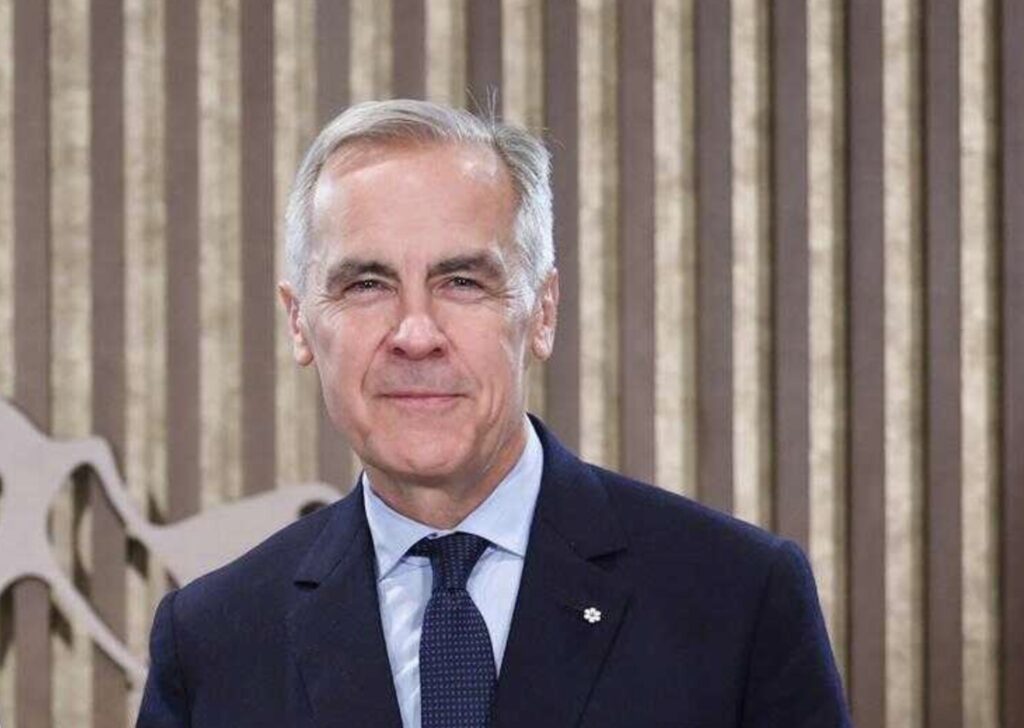

In April, 45 NGOs wrote to Christine Lagarde, the President of the ECB, asking her to align the Bank’s asset purchasing programmes with the Paris Climate Agreement. In her response, Lagarde acknowledged the urgent need to tackle climate change, but failed to commit to restricting the bank’s actions.

There are a raft of green policies the Bank should be urgently adopting – from working with the banking sector to boost sustainable bank lending and fill the green investment gap, to leading by example on climate disclosures and transparency.

NGO Reclaim Finance drew up clear recommendations of how the ECB could align with Europe’s climate plans in its latest report. For instance, the ECB has no ethical criteria at all – it currently buys bonds from two arms manufacturers (Dassault System and Thalès), as well as 38 fossil fuel companies. This needs to change.

The Bank should also abandon its principle of ‘market neutrality’ — the idea that monetary policy must be “neutral” in the market, which leads it to buying bonds from all manner of large corporations. Instead, the ECB should use its financial firepower for good, immediately excluding bonds from companies that plan on expanding fossil fuel production, and that do not commit to a 1.5°C trajectory.

Lagarde should use the strategic review of the ECB that she announced earlier this year to integrate climate in all of its operations. With the climate crisis looming, she must urgently use all of the ECB’s financial might to help transform Europe’s economy and lead a green recovery.

Continuing to funnel billions into fossil fuels is no longer a credible option.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts