Several environmental groups have filed a lawsuit against the U.S. Department of State and Secretary John Kerry over the permitting of a controversial border-crossing northern leg of a pipeline system that DeSmogBlog has called Enbridge‘s “Keystone XL Clone.”

The Keystone XL Clone is designed to accomplish the same goal as TransCanada‘s Keystone XL: bringing Alberta’s tar sands to Gulf coast refineries and export market. It consists of three legs: the Alberta Clipper expansion as the northern leg, the Flanagan South middle leg and the Seaway Twin southern leg.

Green groups have called the northern leg an “illegal scheme” because the Enbridge Alberta Clipper expansion proposal didn’t go through the normal State Department approval process. Instead, State allowed Enbridge to add pressure pumps to two separate-but-connected pipelines on each side of the border and send Alberta’s diluted bitumen (“dilbit”) to market.

Enbridge dodged a comprehensive State Department environmental review, which involves public hearings and public commenting periods. The groups say this is illegal under the National Environmental Policy Act (NEPA) and have demanded a re-do for Enbridge’s application process.

“The only thing worse than dirty oil is dirty oil backed by dirty tricks. This is the fossil fuel equivalent of money laundering,” Kieran Suckling, executive director of the Center for Biological Diversity, said in a press release announcing the lawsuit. “The Obama administration should be ashamed of itself for letting Enbridge illegally pump more dirty tar sands oil into the United States.”

The maneuver has a key beneficiary: former Obama Administration Secretary of the Treasury, Timothy Geithner, who now serves as President of the private equity giant Warburg Pincus.

Geithner’s connection to the lawsuit not only adds intrigue, but also reveals the purpose of Enbridge’s Keystone XL Clone: an export fast-track to the global market.

Timothy Geithner, MEG Energy, Warburg Pincus

Geithner departed as Secretary of the Treasury in January 2013 and in November of that year, Warburg Pincus named Geithner president of the firm. He assumed the role beginning March 2014 — a natural transition given the Warburg family played a key role in the creation of the U.S. Federal Reserve Bank.

But what do Geithner and Warburg Pincus have to do with any of this?

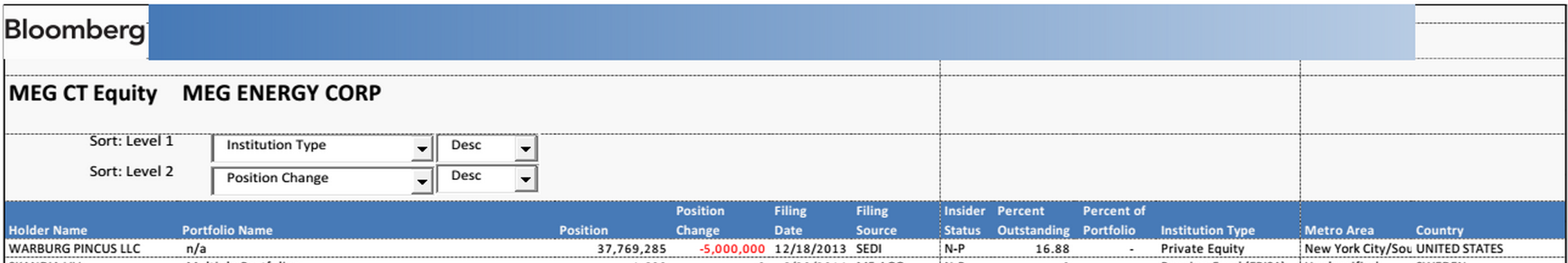

Enter tar sands production company MEG Energy. Bloomberg data shows that Warburg Pincus owns a 16.88 percent stake in MEG, the largest equity owner of the company by percentage.

MEG Energy, which went public in 2010 on the Toronto Stock Exchange, owns the Christina Lake Project, the Surmont Project and other prospective tar sands production land lease holdings.

Beyond owning tar sands production projects, MEG has a contract to send its tar sands through Enbridge’s Keystone XL Clone pipeline system, according to a recent article published in the Globe and Mail.

“MEG has booked capacity for 25,000 barrels a day on the [Flanagan South] pipeline, due to start up in early December, with potential to boost shipments to 100,000 b/d over time,” wrote Global and Mail reporter Jeffrey Jones.

A document posted on the U.S. Federal Energy Regulatory Commission (FERC) website confirms the contractual relationship between MEG and Enbridge. It began in December 2011, a month before President Obama kicked the can down the road on making a decision on Keystone XL‘s northern leg.

“MEG…contracted with Enbridge…to ship crude oil on Enbridge’s Gulf Coast Access Project for service from Flanagan, Illinois to Cushing, Oklahoma and on to the Texas Gulf Coast, pursuant to an executed Transportation Services Agreement (MEG TSA),” reads the FERC document.

MEG and Tar Sands Exports

On MEG‘s quarter three investor call, the company said it is considering applying for a permit to export tar sands from the Gulf coast.

“We certainly are looking at those types of things. We are well positioned,” Bill McCaffery, CEO of MEG Energy, said on the earnings call. He also noted that MEG has achieved record quarterly tar sands production rates.

“If you take the Flanagan/Seaway combination, obviously it lands us in Houston area and obviously you can move to other built areas…We have not applied that at this stage, but we are evaluating that,” McCaffery continued.

Enbridge also has skin in the tar sands export game via its subsidiary Tidal Energy Marketing and has already exported tar sands crude to Italy and Spain. Enbridge received a permit from the U.S. government to export “limited quantities” of tar sands crude this past spring.

Enterprise Products Partners, the co-owner of the Seaway Twin pipeline with Enbridge, also is a player in the oil exports game.

In June, the Obama Administration issued a permit to Enterprise to export oil condensate originating from the Eagle Ford Shale basin, the first U.S. unrefined oil product exported from the U.S. in over four decades.

“State Department Oil Services”

When 2016 Democratic Party presidential nominee Hillary Clinton served as Secretary of State, DeSmogBlog referred to the State Department’s backroom wheeling and dealing done on behalf of TransCanada and the proposed Keystone XL pipeline as “State Department Oil Services.”

It now appears Enbridge has taken a lesson from TransCanada’s playbook, with Geithner’s Warburg Pincus chomping at the bit for dilbit to flow through Enbridge’s Keystone XL Clone and to the global market.

“[T]he State Department must stop turning a blind eye to Big Oil schemes to bypass U.S. laws and nearly double the amount of corrosive, carbon-intensive tar sands crude it brings into our country,” said Michael Bosse, Sierra Club deputy national program director, in a press release. “Enbridge has been allowed to play by their own rules…at the expense of our water, air, and climate.”

Watch the animation created by Mark Fiore for DeSmogBlog in 2012 about Hillary Clinton’s State Department Oil Services:

Photo Credit: Wikimedia Commons

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts