Unfortunately, Secretary Chu’s interview on Wednesday revealed that the administration is going to use this false claim as political cover if (or, more realistically, when) they approve the construction of Keystone XL. Here’s the interview:

This is terribly cynical politics, as surely Secretary Chu – a Nobel-winning physicist and truly one of the world’s premier energy experts – knows the folly of this “energy security” argument.

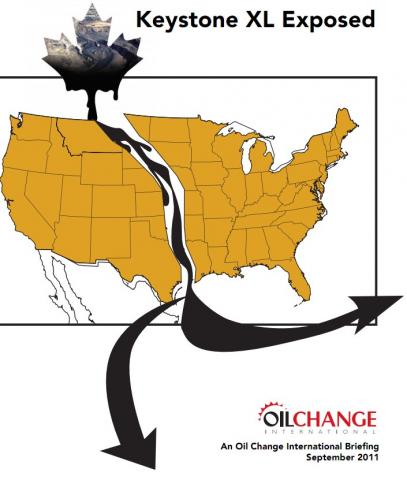

A report released earlier this week by Oil Change International highlights just how wrong the claim is. In “Exporting Energy Security: Keystone XL Exposed” (pdf), the authors look at Energy Information Administration data, corporate disclosures from TransCanada and Valero Energy, and oil market analyst reports, and conclude that “the idea that Keystone XL will decrease America’s dependence on foreign oil is demonstrably false.”

The report, which is worth reading in full, draws three stark conclusions:

- The Keystone XL pipeline is an export pipeline. The Gulf Coast refiners at the end of the pipeline’s route are focused on expanding exports, and the nature of the tar sands crude Keystone XL delivers enhances their capacity to do so.

- Valero, the top beneficiary of the Keystone XL pipeline, has recently explicitly detailed an export strategy to its investors. The nation’s top refiner has locked in at least 20 percent of the pipeline’s capacity, and, because its refinery in Port Arthur is within a Foreign Trade Zone, the company will accomplish its export strategy tax free.

- The oil market has changed markedly in the last several years, with U.S. demand decreasing, and U.S. production increasing for the first time in 40 years. Higher fuel economy standards and slow economic growth have led to a decline in U.S. gasoline demand, while technological advances have opened up new sources in the U.S. Increasingly, U.S. refiners are turning to export.

Earlier this week, Glenn Hurowitz, senior fellow at the Center for International Policy, made a similar, tangential case. Hurowitz argued, in fact, that “Drilling in North America is the single greatest threat to our nation’s energy security.”

He continues:

It’s important to contrast this depletion reality with the old canard that the oil industry and its backers continue to push: that drilling domestically somehow reduces the flow of money to the Middle East and other unstable oil suppliers. In practice, basic oil-industry economics show the opposite. Because Middle Eastern and Venezuelan oil is so much cheaper to produce and more plentiful than remaining domestic oil reserves, those countries can almost always outcompete domestic U.S. competitors and still maintain their enormous profit margins and high levels of production. Saudi and Iraqi oil, for instance, costs just $4-$6 per barrel to produce with another $2-$3 tacked on for transportation costs (costs are similar for Iranian oil). Production costs for tar-sands oil clock in at a minimum of $30 per barrel; costs for other domestic sources are similar

DeSmogBlog has been all over the Keystone XL story. For some background, check out this post on how the State Department’s Environmental Impact Statement was woefully incomplete, this post on the many problems with tar sands pipelines, and this great infographic on how TransCanada’s Keystone pipelines are “built to spill.” Also, this Keystone XL Tar Sands Pipeline Action page has links to just about every resource you could ever possibly hope to find.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts