Only Barack Obama knows the fate of the northern half of TransCanada’s Keystone XL tar sands pipeline. But in the meantime, TransCanada is preparing the southern half of the line to open for commercial operations on January 22.

And there’s a fork in that half of the pipeline that’s largely flown under the radar: TransCanada’s Houston Lateral Pipeline, which serves as a literal fork in the road of the southern half of Keystone XL‘s route to Gulf Coast refineries.

Rebranded the “Gulf Coast Pipeline” by TransCanada, the 485-mile southern half of Keystone XL brings a blend of Alberta’s tar sands crude, along with oil obtained via hydraulic fracturing (“fracking”) from North Dakota’s Bakken Shale basin, to refineries in Port Arthur, Texas. This area has been coined a “sacrifice zone” by investigative journalist Ted Genoways, describing the impacts on local communities as the tar sands crude is refined mainly for export markets.

But not all tar sands and fracked oil roads lead to Port Arthur. That’s where the Houston Lateral comes into play. A pipeline oriented westward from Liberty County, TX rather than eastward to Port Arthur, Houston Lateral ushers crude oil to Houston’s refinery row.

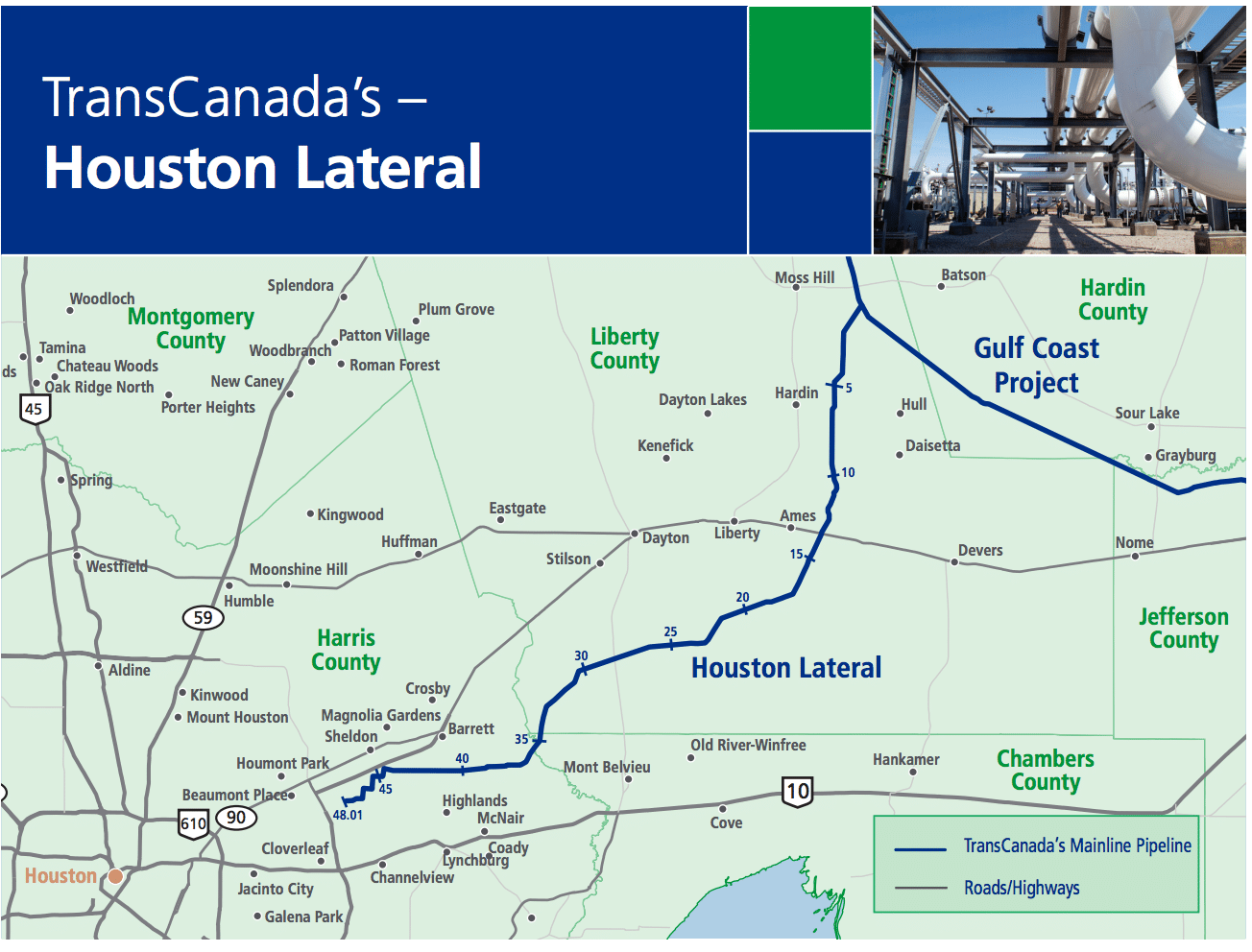

“The 48-mile (77-kilometre) Houston Lateral Project is an additional project under development to transport oil to refineries in the Houston, TX marketplace,” TransCanada’s website explains. “Upon completion, the Gulf Coast Project and the Houston Lateral Project will become an integrated component of the Keystone Pipeline System.”

Image Credit: TransCanada

Boon for Houston’s Refinery Row

Houston’s LyondellBasell refinery is retooling itself for the looming feast of tar sands crude and fracked oil bounty that awaits from the Houston Lateral’s completion.

“The company is spending $50 million to nearly triple its capacity to run heavy Canadian crude at the Houston refinery, to 175,000 bpd from 60,000 bpd,” explained a March article in Reuters.

LyondellBasell admits TransCanada’s Houston Lateral project is a lifeline ensuring its Houston refinery remains a profitable asset.

“Over time, heavy Canadian oil is going to be extremely important to this refinery,” the company’s spokesman David Harpole said in a February interview with Bloomberg. “It’s not all getting down there today but as time goes on, that will become more and more powerful to an asset like we have.”

But LyondellBasell’s not the only company with skin in the game. Valero — whose refining capacity is currently overflowing with fracked Eagle Ford shale oil — is also considering expanding its capacity to refine more tar sands crude.

Not “What If,” But “Right Now”

A financially lucrative asset to refining companies like LyondellBasell and Valero, Houston’s refineries are an issue of life or death for those living within the vicinity.

“In a December 2010 report, the Sierra Club linked tar sands refinery emissions to prenatal brain damage, asthma and emphysema,” a March Huffington Post article explained. “A recent Houston-area study found a 56 percent increased risk of acute lymphocytic leukemia among children living within two miles of the Houston Ship Channel, compared with children living more than 10 miles from the channel.”

Like Port Arthur, Houston — the headquarters for some of the biggest oil and gas companies in the world — is a major “sacrifice zone” for front-line communities, with many people suffering health impacts from the city’s four petrochemical refineries.

Photo Credit: Gulf Restoration Network

“Much of the debate around the Keystone XL pipeline has focused on the dangers of extracting and transporting the tar sands,” DeSmogBlog contributor Caroline Selle wrote in a May 2013 article. “Left out, however, are those in the United States who are guaranteed to feel the impacts of increased tar sands usage. Spill or no spill, anyone living near a tar sands refinery will bear the burden of the refining process.”

With Keystone XL‘s southern half currently being injected with oil and with TransCanada counting down the weeks until it opens for commercial operations, those living in front-line refinery neighborhoods face a daunting “survival of the fittest” task ahead.

“With toxic chemical exposure nearly certain, it is unclear what the next step will be for residents [living in refinery neighborhoods],” Selle wrote in her May article. “[T]his is a life or death struggle more immediate than the ‘what-if’ of a pipeline spill. And it’s not a ‘what-if, [but rather] the fight is ‘right now.’”

Image Credit: Wikimedia Commons

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts