Twitter is ablaze with the news that the State Department will announce today that the original TransCanada presidential permit application is dead in the water. Details are murky, so stay tuned for more, but what this likely means is that the State Department will allow TransCanada to re-apply for the permit with a new route that avoids the heart of Nebraska’s Ogallalla Aquifer.

While it’s good to see that President Obama is standing up to oil industry bullying and Republican pressure to fast-track the permit, this still means Keystone XL is very much in play. If it’s ever built, Keystone XL will allow the expansion of the Alberta tar sands that climate scientists worry will send us down a dangerous path of global warming pollution.

What’s more, the Keystone XL tar sands pipeline, if built, would increase oil prices in the American Midwest. That’s the shocking takeaway point from a bombshell report about Keystone XL as an export pipeline released today by the Natural Resources Defense Council and Oil Change International.

We’ve reported time and time again here on DeSmogBlog, the proposed Keystone XL tar sands pipeline would not improve America’s energy security, but never has that reality been more clearly conveyed than by this one real-world point that is worth repeating. The Keystone XL tar sands pipeline would increase oil prices in the Midwest.

To understand how, exactly, an increased supply of oil to America could increase oil prices domestically, you have to understand two things about the Keystone XL pipeline.

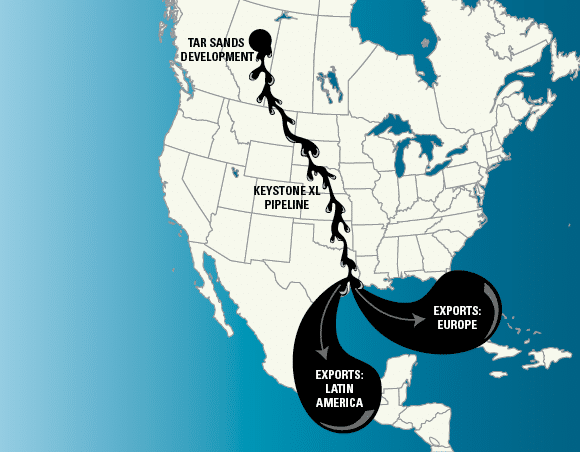

First, Keystone XL is is an export pipeline, funneling foreign crude through American soil to Gulf refineries that will profit most by processing the low-grade tar sands crude into diesel to sell to the booming international market.

If there was any doubt that Keystone XL will essentially operate as a bypass through America, TransCanada’s president Alex Pourbaix put it to rest last month in his testimony before Congress. As the report’s authors explain:

TransCanada recently refused to support a requirement that oil from Keystone XL be dedicated for use in the United States in a recent Congressional hearing.26 In December 2011, Representative Edward Markey asked TransCanada’s President, Alex Pourbaix, to support a condition that would require the oil on Keystone XL to be used in the United States. Mr. Pourbaix refused, saying that such a requirement would cause refineries to back out of their contracts.

So by diverting the oil that would have otherwise poured out into Midwestern refineries, the pipeline would actually reduce American oil supply, thereby increasing prices.

The second important point to understand is that the completion of Keystone XL will suck capacity off of existing pipelines (because Canada already has a huge excess of pipeline export capacity), and would be more expensive to operate than existing pipelines. This point is a little confusing, so I’ll leave it in the hands of the report’s authors.

Keystone XL will increase the cost to move crude oil by pipeline through the United States. TransCanada has acknowledged that because there is excess export pipeline capacity from Canada, Keystone XL will take oil off of existing cost-of-service pipelines, which will in turn be forced to recover their operating costs from a smaller volume, increasing the per barrel cost of moving oil.34 TransCanada estimated the cost to move the same amount of crude into the United States would increase by $1.37 billion in 2013. However, TransCanada pointed out that oil companies would recover these increased costs and make a profit because the U.S. market would be paying higher prices for Canadian crude.

Rather than providing the United States with more Canadian oil, Keystone XL will simply shift oil from the Midwest to the Gulf Coast, wher emuch of it can be exported to international buyers — decreasing U.S. energy supply and increasing the cost of oil in the American Midwest.

Once again, the Keystone XL would do nothing to improve American “energy security.” In fact, it would do quite a bit to undermine it. In the words of retired Brigadeer General Steven Anderson, who was in charge of logistics in Iraq, speaking at a press conference this morning, the pipeline “would set back our renewable energy efforts for at least two decades, and do absolutely nothing to move us off Middle East oil.”

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts