The tragic oil train explosion earlier this month in Lac-Megantic, Quebec has focused a spotlight on the growing role of rail in the transportation of North American crude. But even after that tragedy, the extent of rail’s expansion in transporting oil is still little understood by the typical driver at the pump.

So DeSmog is going to dedicate a couple of posts expanding on an earlier post about this staggering boom in crude-by-rail – why it’s happening, where the oil is going, what the risks are, and who stands to benefit most from the trend.

On November 7, 2011, the Bakken Oil Express loaded up its first railcar with North Dakota crude and started churning south towards a Gulf Coast refinery. This wasn’t the first crude-by-rail shipment in U.S. history (John D. Rockefeller might have something to say about that), nor the first time in recent history that shale crude was shuttled out of the Bakken by rail.

But if you’re looking for a pivot point in the transportation trends of North American crude, the christening of the Bakken Oil Express is a fitting one.

The Bakken Oil Express is just one piece of a rapidly expanding network of North American oil tanker trains, but it’s a particularly symbolic one, quickly brought online to handle the spiking production of North Dakota sweet crude.

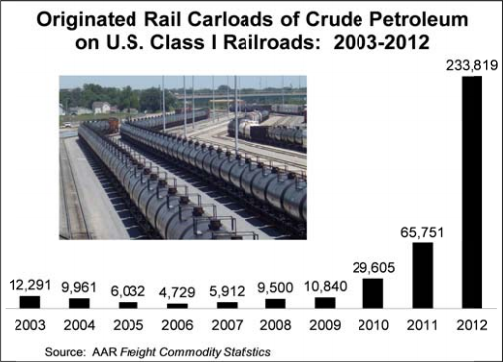

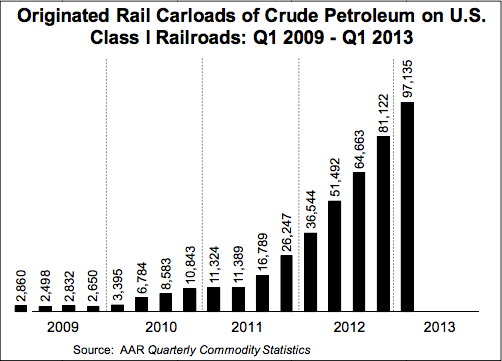

According to the Association of American Railroads (PDF), “In 2008, U.S. Class I railroads originated just 9,500 carloads of crude oil. In 2012, they originated nearly 234,000 carloads. Based on the more than 97,000 rail carloads of crude oil in the first quarter of this year, another big jump is expected in 2013.”

That’s nearly a 2400-percent increase in five short years, and the upward trend looks to be growing even faster in 2013.

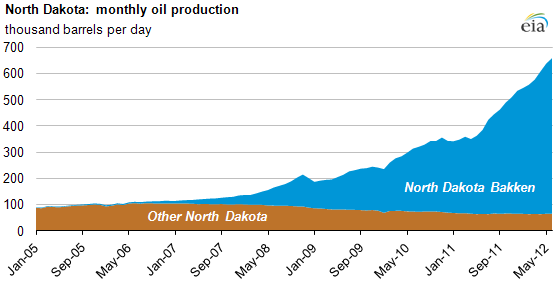

What’s driving this staggering increase in rail shipments? Look no further than the enormous increase in domestic crude production, which spiked by nearly 1 million barrels-per-day in 2012. Most of this increase has come from the Bakken shale plays that have been rapidly developed under the Obama administration. And not coincidentally, North Dakota, ground zero of the Bakken boom, is the epicenter of the crude-by-rail phenomenon.

Fracking for shale oil has boosted North Dakota to the second largest oil producing state in the nation.

Check out this chart from the EIA on oil production in the Bakken in recent years:

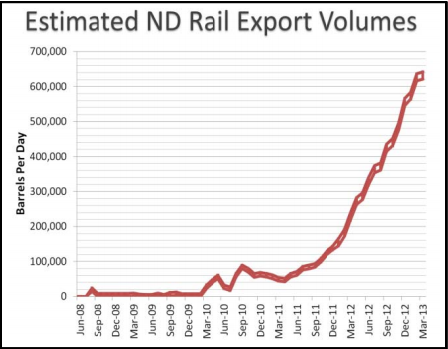

And compare it to this one from the Association of American Railroads about crude-by-rail exports from North Dakota over the past few years:

Notice how production almost plateaued in late 2009 and early 2010? Production was actually limited by transportation capacity at the time. But as you can see, as tanker cars came online in the region and the predecessors to the Bakken Oil Express started riding the rails, producers were able to increase production.

What about the pipelines? Yes, there are a couple of pipelines – owned by Enbridge and Kinder Morgan – that cross through the Bakken region, but as I wrote in that earlier post, those are maxed out. They’ve been operating at capacity for over five years now. Rather than sit on the oil and wait, the economists in the oil companies are happily tacking on the premium for rail shipment (in the neighborhood of $10-15-per-barrel) to get this bounty of crude to refineries on the East, West, and Gulf Coasts.

Here’s how the EIA describes the basic economics:

Much of the growth in shipping oil by rail is due to the rise in North Dakota’s oil production, which has more than tripled in the last three years. North Dakota surpassed California in December 2011 to become the third biggest oil producing state and took over the number two spot from Alaska in March 2012.

Shipping oil by rail costs an average $10 per barrel to $15 per barrel nationwide, up to three times more expensive than the $5 per barrel it costs to move oil by pipeline, according to estimates from Wolfe Trahan, a New York City-based research firm that focuses on freight transportation costs. Wolfe Trahan also notes that using rail tank cars allows oil producers to separate grades of crude more easily and ensure their purity than when different oils are mixed in a pipeline.

What’s more, even this oil train boom has been limited by its own capacity issues. Train manufacturers have literally run out of railcars, and as of last Fall there was a backlog of 40,000 cars on order. If you were an oil baron trying to order a tanker car to haul your Bakken crude out of North Dakota, you would have to wait about 18 months until it was delivered.

So expect crude-by-rail shipments to keep growing a whole lot as the shipping capacity catches up to both the supply and demand.

The crude-by-rail trend isn’t limited to the U.S., but is echoed to the north. According to the Railway Association of Canada, that nation’s railroads carried just 500 carloads of crude in 2009, and will carry over 130,000 this year. Some of the crude carried is the same Bakken shale that is flooding the U.S. railways – a lot of North Dakota crude travels to refineries in Eastern Canada. The Montreal, Maine & Atlantic (MMA) Railway train that exploded in Lac-Megantic was hauling Bakken crude to a refinery in New Brunswick.

That’s the birds-eye view of oil trains in North America. In subsequent posts, we’ll take a look at where exactly the oil trains are traveling – from where, to where, and look forward to a close look at how rail has revived a dying East Coast refinery landscape and how it is picking up the pipeline slack for both Bakken shale and Alberta tar sands bitumen. And, finally, we’ll investigate the players who are cashing in on this sudden spike in rail traffic.

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts