Companies with a history of environmental abuses and alleged labour violations, backed by private equity and with ties to foreign governments, stand to profit from North Sea oil and gas, new data shows.

Campaigners say the trend towards private ownership in the North Sea is potentially “catastrophic” for the UK’s plans for an equitable transition towards low carbon industries.

In March, the UK government ignored campaigners’ calls to end the issuance of offshore oil and gas licences and reverse its policy of maximising economic recovery of fossil fuels in the North Sea, leaving the door open for more privately-owned and less-transparent companies to purchase and profit from North Sea assets.

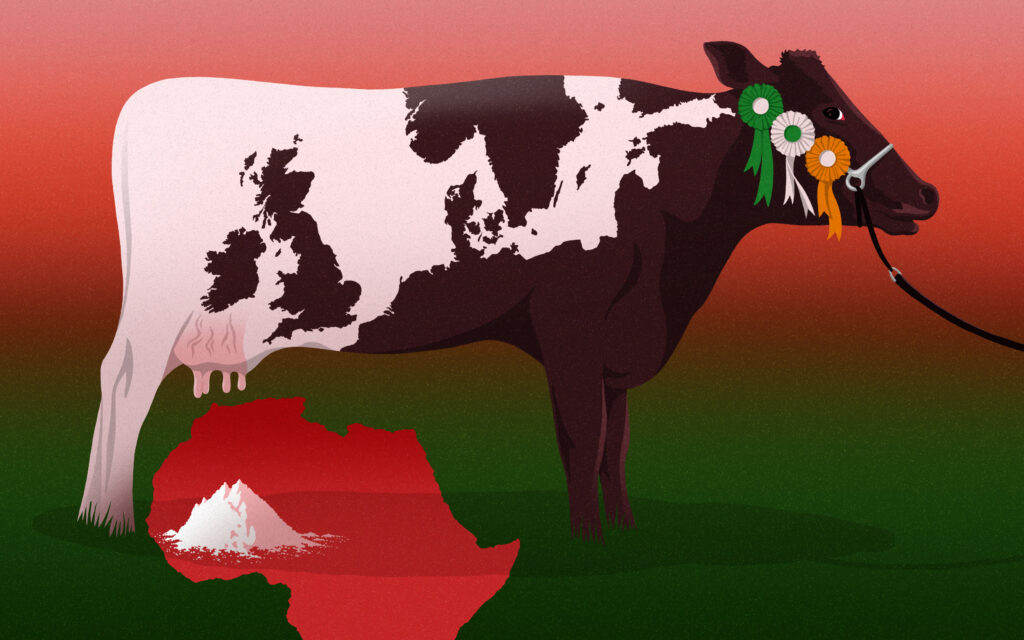

As larger players like BP and Shell offload these ageing assets, a new set of oil and gas producers – nearly a third of which are private companies – are taking hold of the UK’s energy ‘crown jewel’. Oil and gas production accounted for by private companies has more than trebled in the past ten years, from eight percent in 2010 to 30 percent in 2020.

Unlike the oil majors, many of these companies do not face public scrutiny, are not accountable to shareholder pressure, and have a lesser stake in the UK’s efforts to transition to a low carbon economy.

So who are these new North Sea players? Using data from the newly-launched interactive database Who Owns the North Sea? from think tank Common Wealth, DeSmog analysed 142 companies holding at least part-ownership of oil and gas licences in the North Sea. Of the 1,402 unique blocks in the region covered by Common Wealth’s map, 506 show a private or state-backed entity with a controlling stake.

“Shareholder activism or engagement strategies are severely limited when companies are privately held by ultra-wealthy owners or controlled by distant and often undemocratic foreign states,” said Mathew Lawrence, director of Common Wealth.

“Public campaigning is harder when the targets are often opaque, poorly known, or insulated from pressure; and the imperative to divest from fossil fuel ‘stranded assets’ that could harm corporate balance sheets in the decades ahead is less pressing if a company’s business model is explicitly maximising returns on their assets in the short-term,” he said.

The North Sea oil and gas industry became a net drain on taxpayer funds in 2016, with one report estimating that the UK government – and ultimately, taxpayers – has lost more £250 billion in 13 years by giving tax breaks to the industry. The UK’s tax regime makes it the world’s most profitable market for oil and gas producers to develop large fields, as of 2021.

DeSmog found owners that promote climate science denial, organisations accused of serious labour violations, companies with links to controversial projects like the Dakota Access Pipeline in the US, and state-owned fossil fuel companies with little incentive to help the UK reach its net zero goals, including China, Russia, and the United Arab Emirates.

“This shift towards private ownership in the North Sea is a gathering storm with the potential to be catastrophic for the prospects of a fair and rapid transition away from fossil fuels,” said Ryan Morrison, a Just Transition campaigner for Friends of the Earth Scotland.

In the cases of companies that have been shown to have acted in ways at odds with the UK’s social and environmental goals, he added, “the Government is standing by as these rogue firms, with no interest in the people likely to be impacted, gamble on extracting short-term profit from destroying the climate.”

Climate Denial and Anti-Climate Action Lobbying

A number of the new North Sea players have links to individuals and organisations known to promote misinformation on climate change and lobby against climate action.

Orcadian Energy (formerly Pharis Energy) is a UK-based oil and gas exploration company with interest in four North Sea licences. Steve Brown, Orcadian’s founder, regularly shared posts on social media from his recently-deleted Twitter account that cast doubt on climate policy and modelling, including content from the Global Warming Policy Foundation, the UK’s principal climate science denying group.

In May 2021, Brown tweeted out an article by Bjørn Lomborg – author of The Skeptical Environmentalist and Cool It, books that downplay the risks of global warming – about how “exaggerations about climate change” are “destroying our ability to make sensible decisions for the future”. Brown added: “This obsession with climate to the exclusion of many other issues will literally kill millions”.

In other tweets, he said the “climate emergency” was “fake” and claimed the main cause of climate change was solar activity, not greenhouse gas emissions, which he called “benign”.

Although the company has plans to reduce emissions when developing its latest heavy oil field and claims to be “fully committed” to the UK government’s 2050 net zero emissions goal, Orcadian’s company Twitter account also promotes a narrative popular with climate science deniers: that the world’s net-zero commitments will inevitably lead to poverty for millions. Orcardian recently tweeted about the International Energy Agency’s (IEA) recent “Net Zero by 2050” report, claiming that “If the world does this it will make energy poverty the prevailing state of being for all but the elites”.

Orcadian Energy did not respond when DeSmog presented these statements to the company, and Brown’s Twitter account was deactivated after DeSmog approached the company for comment.

Beyond promoting climate science denial, other companies have ties to organisations with histories of spreading misinformation about the fossil fuel industry or climate change.

Non-executive chairman of EnQuest, Martin Houston, which has an interest in 22 North Sea licences, is a council member of the US National Petroleum Council, an oil and natural gas advisory committee to the Secretary of Energy which knew about the dangers of climate change as far back as the 1970s but worked to publicly downplay the industry’s role.

Houston is also a member of the advisory board of the influential Global Energy Policy unit at Columbia University’s School of International and Public Affairs, which is funded by major oil and gas players including Exxon, BP, and Saudi Aramco.

Similarly, Jim House, CEO of Neptune Energy, which produces 12 percent of the UK’s gas supply and has interest in nine North Sea licences, served on the Upstream Committee of the American Petroleum Institute (API). The API is the US oil and gas industry’s largest trade association, spending over $98 million on direct lobbying activities since 1998 and funding organisations that oppose regulations aimed at tackling climate change.

In a recent undercover investigation by Unearthed, a senior lobbyist for ExxonMobil admitted that the company uses trade associations including the API as the “public face” for its lobbying efforts in Congress to secure favourable legislation on toxic “forever chemicals”. EnQuest did not respond to DeSmog’s request to comment for this story. Neptune Energy did not respond to DeSmog’s request for comment in time for publication, but has since told DeSmog that it does not consider its activities ‘rogue’ in any way and says that it is a “responsible owner of assets in the UK North Sea with robust corporate governance and carbon reduction policies in place”.

Find out more about Neptune Energy in its company profile

Harbour Energy, now the UK’s largest listed independent oil and gas company, was formed after the merging of Chrysaor and Premier Oil earlier this year and inherited interest in 80 North Sea licences from Chrysaor and 29 from Premier Oil.

When asked by DeSmog about its position on continued licensing in the North Sea, a spokesperson for Harbour said that the company has had “a long and constructive dialogue with government and other trade organisations” and has “reached a meaningful agreement on emissions reduction which balances the need to meet the UKs climate ambitions with a continued focus on energy production and job security”.

Phil Kirk, President and CEO (Europe) and former CEO of Chrysaor, is on the board of Oil and Gas UK (OGUK), the most prominent oil and gas industry group in the UK, alongside representatives from three fellow North Sea producers: Repsol Sinopec, CNOOC International, and Neptune Energy.

OGUK met with Kwasi Kwarteng, the Secretary of State for Business, Energy and Industrial Strategy, on 2 July and 15 July 2020 to discuss the North Sea Transition Deal — an agreement between the government and the oil and gas industry to invest £16 billion into the sector, support 40,000 jobs, and encourage North Sea companies to cut their emissions by 50 percent by 2030 with the goal of creating a “net zero basin” by 2050. The deal disappointed campaigners, with Greenpeace claiming the deal props up a “volatile and polluting sector”.

Find out more about Oil and Gas UK in its profile

When asked by DeSmog about continued licensing in the North Sea in light of reports that the world must wind down coal, oil, and gas production by the end of 2021 to reach net zero by 2050, OGUK External Relations Director Jenny Stanning said:

“Every scenario from the UK Government’s independent advisory body, the Climate Change Committee, shows the UK is still going to need oil and gas for its energy supply for some decades yet. It therefore makes sense to continue providing licences in the North Sea so the UK can produce it domestically, rather than importing oil and gas from countries over whose emissions we have no control, and whose environmental standards may be far lower.”

Stanning also said that the industry is “committed to making the North Sea a net zero basin” and welcomes the newly introduced climate compatibility checkpoints, and added that the North Sea Transition Deal would “accelerate cleaner technologies” like hydrogen and carbon capture & storage, while “dramatically reducing emissions in the oil and gas sector”.

OGUK’s CEO, Dierdre Michie, recently argued in an op-ed that developing the Cambo field will “actually help the UK cut its carbon emissions” and suggested that climate campaigners would be more effective if they pushed governments to “urgently develop the policies that are needed to significantly reduce consumer emissions”, for example from vehicles and gas boilers, instead of focusing their efforts on the oil and gas industry.

Chrysaor also met with Kwarteng on 3 September 2020 to discuss a “review of oil and gas licensing” when the government was considering whether or not to continue issuing new licences in the North Sea. The government ultimately decided to continue issuing new licences in the region for projects that pass a climate compatibility test.

Find out more about Harbour Energy in its company profile

A DeSmog analysis found in June that companies and individuals involved in North Sea oil and gas donated a total of £419,900 to the Conservatives immediately ahead of and during the licensing review.

One donor was EnQuest’s CEO Amjad Bseisu, who gave at least £28,500 to the Conservative Party in the first half of 2017 and has also donated to Vaccines Minister Nadhim Zahawi, a Conservative MP who previously worked in the fossil fuel industry and has received more than £1 million from the fossil fuel industry during his time in Parliament.

As of late 2019, Bseisu was part of the Leader’s Group, an elite club of super-wealthy donors to the Conservative Party that receive access to high level Tory figures including the Prime Minister.

Bseisu has been publicly supportive of continued exploration for fossil fuels in the North Sea, saying that there are “a lot of discoveries waiting to be found” in the region. In 2021 EnQuest acquired stakes from Suncor Energy and Whalsay Energy in two additional North Sea fields — one of which is for heavy oil — with the goal of securing “long-term potential development opportunities”.

Bseisu and EnQuest did not respond to DeSmog’s requests for comment on this story.

Find out more about EnQuest in its company profile

Meanwhile, Apache Corporation, which is headquartered in the United States and has an interest in 23 North Sea licences, has a political action committee (PAC) that regularly donates to US congressional candidates known to be friendly to the oil and gas industry, including Rep. August Lee Pfluger (R-TX) and Rep. Henry Cuellar (D-TX).

In January 2021, Pfluger introduced his first piece of legislation in the House, the Saving America’s Energy Future Act, which “prohibits the Biden administration from declaring a moratorium on issuing new oil and gas permits for drilling on federal lands”. Cuellar has been called “Big Oil’s favorite Democrat”, accepting $145,000 from PACs linked to oil and gas corporations in the 2018 election cycle and taking $711,627 from the industry over the course of his career, according to The Intercept.

Apache’s PAC also donated to Rep. Dan Crenshaw (R-TX), a Republican congressman who has called for climate policies that don’t “kill jobs”. Crenshaw will have the chance to shape climate policy in the US and beyond later this year as he joins the House Environment and Climate Change Subcommittee of the Energy and Commerce Committee.

Apache did not respond to DeSmog’s request to comment on this story.

Labour Violations, Pollution, and Alleged Abuses

Beyond climate science denial and lobbying, other North Sea companies have histories of labour violations, damaging environmental practices, and connections to human rights abuses, which campaigners argue make them unsuitable to operate in the North Sea.

Perenco, based in London and Paris, is one of the world’s largest family-owned oil companies and has an interest in 23 North Sea licences. The company is owned entirely by the “discreet” Perrodo family, which this year was ranked by the Times as the 43rd richest family in Britain with a net wealth of nearly £4 billion.

Perenco has been accused of numerous unproven questionable environmental, labour, and business practices, including encroaching on the territories of voluntarily isolated peoples in the Amazon, funding Colombian paramilitary groups, and bribing Venezuelan state officials for preferential treatment.

The company faced criticism in 2018 from students and staff at Oxford University’s St. Peter’s College after the Perrodo family donated £5 million for “improvements”, with some groups expressing discomfort at accepting the money after hearing allegations against the company.

French-Guatemalan environmental group Collectif has also criticised Perenco’s outdated drilling techniques and Colombian newspaper El Spectador accused the company of illegally outsourcing work in an attempt to undercut unionising workers. Tunisian NGO Sherpa and Friends of the Earth France have also alleged that Perenco is the cause of serious environmental damage in the Democratic Republic of Congo (DRC), where it is the only oil operator.

In an interview with The Africa Report earlier this year, Perenco’s managing director Benoît de la Fouchardière outlined the company’s deliberate shift to buying “mature fields” put up for sale by other companies, such as those in the North Sea. He also dismissed many of the claims made by NGOs against Perenco, saying: “We are not accountable to organisations that are responsible for our relationships, some of which are essentially based on the pure and simple disappearance of the oil industry”.

Find out more about Perenco in its company profile

Another North Sea firm with a questionable labour record is DNO, a Norwegian company with interest in 13 North Sea licences. In 2016, labour unions Industri Energi and DNO Yemen Union accused DNO of firing Yemeni workers without notice, obstructing their right to organise and collectively bargain, and failing to pay them severance after a civil conflict broke out in the country in 2015.

Industri Energi filed a complaint against DNO with the OECD, and the body ultimately concluded that DNO had “fulfilled the expectations on the right to join a trade union” but “recommends that DNO in future should carry out risk-based due diligence and enhance the transparency of its guidelines and procedures for responsible business conduct.

Perenco and DNO did not respond to DeSmog’s request to comment for this story.

State-Owned Oil Companies

The companies themselves aren’t the only ones with problematic environmental and labour credentials – many of the new North Sea players also have ties to countries and state-owned companies known for their climate obstructionism and questionable environmental and human rights records.

State-owned operators are increasingly purchasing oil and gas assets that oil majors no longer want, meaning the assets end up in the hands of companies that are less susceptible to public scrutiny and generally less transparent.

Two Chinese state-owned oil companies play a big role in North Sea oil and gas production. Earlier this year, China’s latest five-year climate plan to reach net zero by 2060 was roundly criticised for not doing enough to phase out coal use or sufficiently reduce emissions, though a more recent study found that China’s plan was “largely consistent” with the Paris Agreement goal of limiting warming to 1.5 degrees.

Sinopec, also known as China Petroleum & Chemical Corporation, is a state-owned oil and gas company and the world’s biggest refiner by capacity. Its part-subsidiary, Repsol Sinopec UK, is a joint Spanish-Chinese venture with interest in 35 North Sea licences.

Sinopec has estimated that China is on track to become the world’s largest oil refiner by 2025. China is already responsible for a quarter of the world’s annual greenhouse emissions, the highest percentage in the world, raising questions about how continued investment in fossil fuels conflicts with the country’s domestic and international climate commitments.

In February, an investigation by Unearthed found that Repsol Sinopec was the company responsible for the most emissions by venting and flaring from oil and gas facilities in the North Sea between 2015 and 2019. The company produced 2,132,322 tonnes of CO2e over the five year period, accounting for more than 10% of total emissions from venting and flaring in the North Sea. Fellow North Sea producer EnQuest was ranked fifth on the list, after oil majors Total, Shell and BP.

Later that month, Repsol Sinopec formed an alliance with Petrofac and TechnipFMC to “maximise oil and gas recovery” in the UK Continental Shelf, and in April the company was criticised by regulators over the condition of wells on several of its North Sea fields.

In 2020, Sinopec and Sibur (a Russian petrochemicals producer) began work on what will be “the world’s largest polymer plant”, an $11 billion venture that will produce more than 2.3 million metric tons of plastic each year once it opens in 2024. According to a 2021 report by the Australia-based Minderoo Foundation, Sinopec is already the world’s third-largest producer of plastic waste.

When asked by DeSmog about continued oil and gas licensing in the North Sea, a spokesperson from Repsol Sinopec said: “As an industry we must get better at recognising the benefits of utilising existing North Sea infrastructure and industry collaborations to maximise the economic recovery of the basin, minimise carbon emissions and transition to a lower carbon economy. The North Sea Transition Deal facilitates this.”

The spokesperson also said that the company is “focussed on reducing our emissions and carbon intensity of our operations” and is “committed to exploring projects that contribute to achieving net zero targets”.

CNOOC Limited is another Chinese state-owned oil and gas company, with an interest in 11 North Sea licences. CNOOC claims to be one of the largest oil producers in the UK North Sea and that it contributes more than 25 percent of the UK’s oil. DeSmog has previously reported on CNOOC’s activities in Kenya, where its brief exploration for oil damaged key roads and paid “exploitative” wages to workers, and Uganda, where the company’s planned pipeline has disrupted the livelihoods of the local landowners, impacting their human rights.

CNOOC did not respond to DeSmog’s request to comment for this story.

Explore the data in Common Wealth’s interactive map

China isn’t the only country with state-owned entities producing in the North Sea.

Russia, a laggard on both domestic climate policy and international climate commitments, is also represented among North Sea oil and gas producers. According to Climate Action Tracker, Russia’s commitments on climate change are “critically insufficient” and its hesitation to implement climate policy threatens to “hamstring” global climate action.

In 2020 the Russian government published a plan that aimed to adapt its economy and population to climate change while also planning to utilise the “advantages” of warmer temperatures.

Gazprom, which has an interest in three North Sea licences, is majority-owned by the Russian government. It was the top provider of gifts and hospitality given by energy companies to UK Export Finance, the UK’s export credit agency, between 2001 and 2019 according to a 2020 investigation by Global Witness. UKEF has faced criticism in recent years due to its continued backing of oil and gas projects, which the government has recently pledged to end.

DeSmog has previously reported on Gazprom’s funding of FIFA and top football clubs, which campaigners claim it uses to “sportswash” its image, as well as Russian delegates’ role in weakening the language used to introduce the International Panel on Climate Change’s landmark 1.5 degrees report in 2018.

The United Arab Emirates (UAE), whose emissions are expected to continue increasing as it develops new sources of fossil fuel based energy, also has a state-owned company operating in the North Sea – TAQA. According to Climate Action Tracker, the UAE’s original nationally determined contribution (NDC) under the Paris Agreement and its updated 2020 commitment are both “highly insufficient” to meet the Paris Agreement’s goals.

TAQA, also known as Abu Dhabi National Energy Company, has an interest in 19 North Sea licences and is 98.6 percent owned by Abu Dhabi Power Corporation, a subsidiary of government-owned investment company ADQ.

Gazprom and TAQA did not respond to DeSmog’s request to comment for this story.

Private Equity Funding North Sea Oil and Gas

Opaque funding and questionable tax practices are not hard to find among the new North Sea players. Many North Sea oil and gas companies are now privately owned or funded by private equity firms and big-name investors, allowing them to avoid public scrutiny and pressure to act in a socially- and environmentally-conscious way.

The shift of North Sea assets from publicly-listed oil majors to private hands has been happening since at least 2018, raising concerns about transparency and accountability. While publicly-listed companies can be held accountable by shareholders and the public due to legal reporting requirements and corporate financial disclosure, privately held companies have fewer legal reporting obligations and can aggressively pursue profit over any environmental or social good in the short- and long-term.

Private equity investors use debt to acquire (often struggling) companies, turn them around, and sell them for a profit. One survey found that value creation is the “top driver of responsible investment and ESG [environmental, social, and governance] activity” by private equity firms.

The same survey found that less than half of respondents were reportedly undertaking work to “understand how [their] portfolio may be at risk” from climate change, and only 36 percent considered climate risk at the due diligence stage.

The use of private equity has surged in recent years, especially during the financial fallout of the COVID-19 pandemic. Baroness Altmann, a Tory peer and former pensions minister, recently warned that the government must be “on the lookout” for private equity “pandemic plunderers”.

Siccar Point Energy, with 24 North Sea licences, is funded by private equity, including by firms BlueWaterEnergy and Blackstone Energy Partners.

Blackstone has a long record of funding fossil fuel projects. Its founder Stephen Schwarzman, a close ally of former US President Donald Trump, is a committed investor to the oil and gas industry. Under Schwarzman’s leadership the company has poured billions of dollars into oil and gas projects, including controversial pipelines like the Dakota Access Pipeline (DAPL).

Schwarzman was also the subject of criticism in 2019 after donating £150 million to the University of Oxford. Academics, local councillors, students and community members signed an open letter saying the proposed “Schwarzman Centre” would be “built with the proceeds of the exploitation and disenfranchisement of vulnerable people across the world”.

Siccar Point Energy has requested permission to develop a new oil and gas field off the coast of Shetland with its partner Shell, which recently received a ruling from Dutch courts that it must cut its greenhouse gas emissions by 45 percent by 2030 compared to 2019 levels.

Shell has confirmed that it is appealing the landmark ruling, with its Chief Executive Ben van Beurden arguing that “a court judgment, against a single company, is not effective” and that “clear, ambitious policies that will drive fundamental change across the whole energy system” are needed to combat climate change.

The Cambo field is expected to produce oil and gas until 2050 – the year the UK government plans to be net zero – with oil production expected to begin in 2025.

Read more about Siccar Point in its company profile

Though its initial exploration licence was awarded in 2001, Cambo would be one of the most significant new UK oil and gas developments to go ahead since the International Energy Agency (IEA) announced that no new oil, gas, or coal projects could be developed if the world is to meet its target of net zero emissions by 2050.

The government confirmed in June that the Cambo field, along with other potential oil and gas projects, would not be subject to the industry’s new “climate compatibility checkpoint” because the licences have already been awarded, meaning more than 1.7 billion barrels of oil would not be subject to scrutiny about whether they align with the UK’s climate goals.

Siccar Point’s CEO Jonathan Roger has said that the project “supports the country’s clean energy transition” by maintaining “secure” oil and gas supply, and that the company has “proactively taken significant steps to minimise the emissions footprint” of the field by making it “’electrification-ready’, with the potential to use onshore renewable power when it becomes available in the future”. Blackstone and Schwarzman did not respond to DeSmog’s request to comment for this story.

Just last week, the US Special Presidential Envoy for Climate, John Kerry, spoke about the need for urgent global action on climate change to an audience at Kew Gardens. When asked about the government’s expected approval of the Cambo oil and gas field ahead of COP26, Kerry referenced the IEA’s Pathway to Net Zero, saying: “I’m mindful of what the IEA has said, that we don’t need new oil and gas projects,” adding that the government should “measure the need very, very carefully” in making decisions to approve new oil and gas developments.

Until recently, Whalsay Energy, which had one core North Sea asset, was owned by funds run by global asset management company BlackRock. BlackRock has faced criticism for its role in funding the climate crisis and has been accused of “greenwashing”. In March, BlackRock indicated that it would cut the net greenhouse-gas emissions of its portfolio to zero by 2050.

In May, BlackRock withheld its vote during annual general meeting of Barclays bank, of which it is a major shareholder, regarding the company’s climate strategy, saying in a vote bulletin that while it was “supportive of the broad ask of the resolution”, BlackRock was unable to support it due to “imprecise and ambiguous wording”, particularly because the resolution would be legally binding. In July 2021, EnQuest acquired Whalsay’s subsidiary, Whalsay Energy Limited, and its one North Sea asset, the Bentley field, one of the largest undeveloped heavy oil fields in the North Sea.

At Exxon’s annual shareholder meeting in May, BlackRock (which holds a 6.7 percent share in the company) backed three board candidates put forward by Engine No. 1 – a hedge fund that has been publicly pushing Exxon to cut its carbon emissions more quickly.

BlackRock is also an investor in Tullow Oil, which has licences for two north sea wells that it is decommissioning. DeSmog has previously revealed social and environmental issues with Tullow’s activities in East Africa.

Read more about Tullow in its company profile

Whalsay’s Executive Chairman Paul Warwick was also a member of the supervisory board of Naftogaz, Ukraine’s largest state-owned oil company. Naftogaz was recently embroiled in controversy when Ukraine’s Prime Minister Shmyhal suspended the Naftogaz Supervisory Board and fired the company’s CEO, drawing criticism from the international community amid concerns about corruption.

BlackRock did not provide a comment when contacted and Whalsay did not respond to DeSmog’s request to comment for this story.

Independent Oil and Gas (IOG) is a UK-based developer and producer with interest in 11 North licences and backing for a new North Sea gas development from CalEnergy Resources, a subsidiary of Warren Buffet’s holding company Berkshire Hathaway Energy Company. CalEnergy has a 50 percent stake in the Thames Pipeline Area development, as well as an active subsidiary in the region, CalEnergy Gas Holdings, which has interest in 12 licences. CalEnergy Resources declined to comment on this story, while IOG did not respond to requests for comment.

In May 2021, Buffett helped to defeat a shareholder resolution that would have required his conglomerate, Berkshire Hathaway, to disclose climate change-related risks to the business to investors. In a discussion with shareholders ahead of the annual meeting, Buffett said that Chevron “is not an evil company” and that he had “no compunction — in the least — about owning Chevron”. According to the Climate Accountability Institute, Chevron was the investor-owned company with the greatest contribution to the world’s energy-related carbon dioxide and methane emissions from 1965 – 2018.

Buffett has also helped fuel the development of oil and gas projects over the years, including betting big on the future of fracked oil in the US’s controversial Permian Basin. He was also recently singled out by ProPublica as the multi-billionaire who paid the least US income tax between 2014 – 2018, paying only 0.10 percent in federal income tax of his total wealth in that period.

Berkshire Hathaway declined to comment on this story.

The Future of the North Sea

Climate campaigners and politicians have raised questions about the compatibility of continued exploration and production in the North Sea and the UK’s legally-enshrined climate commitments. Greenpeace has threatened legal action against the government if it grants Shell and Siccar Point Energy permission to develop the Cambo oil and gas field.

A High Court legal challenge launched by campaigners in May against the government’s maximum economic recovery (MER) requirement in the North Sea was recently given the green light to be heard in court, with the case expected to be heard by the end of the year and a decision reached in early 2022.

When asked by DeSmog about continued oil and gas licensing and the development of the Cambo field, a BEIS spokesperson said: “The original licensing approval for the Cambo oil field dates back to 2001. The Secretary of State is not involved in the decision whether to grant consent for the Cambo oil field.” They added: “While we are working hard to drive down demand for fossil fuels, there will continue to be ongoing demand for oil and gas over the coming years, as recognised by the independent Climate Change Committee.”

While the Climate Change Committee (CCC), the UK’s independent adviser on climate change, told DeSmog that it does not comment on specific projects or campaigns, a representative said that “meeting Net Zero and UK carbon budgets will entail transitioning almost entirely away from the unabated use of fossil fuels”.

The CCC also noted that “some fossil fuels may be needed” during the transition to Net Zero, particularly for the transport sector, and recommended that “existing policies such as the North Sea Transition Deal will need to be strengthened to be consistent with the [CCC’s] Sixth Carbon Budget recommendation of reducing emissions by 68% by 2035”.

A representative for the Oil and Gas Authority (OGA) also declined to comment on specific questions about policy, but said that the UK is expected to be a net importer of oil and gas until 2050 and that “domestic gas production has less than half the carbon footprint of imported [liquified natural gas] LNG, so it makes sense to produce our own as long as that demand is there, and as we transition to cleaner forms of energy”.

The representative added that oil and gas “must be produced more cleanly” and that the North Sea Transition deal supports emissions reductions and provides £16bn of new investment in technologies including electrification, carbon capture and storage, and hydrogen.

Campaigners are unconvinced the government is doing enough, however.

“Allowing firms to continue with the exploration and exploitation of oil and gas is incompatible with our climate commitments,” said Friends of the Earth’s Morrison. “The Government needs to get a grip of this vital transition and develop a clear plan shaped by workers and communities that lays out how we will shift to renewable energy.”

“These companies’ history of human rights abuses, funding climate denial or funnelling profits into tax havens provides little evidence that they will be concerned about workers or communities who need a secure future beyond oil and gas,” he added.

Common Wealth’s Lawrence agreed that profit-driven companies risked dampening the UK’s drive for a just transition away from fossil fuels. He said: “Whether businesses are public, private, or state-owned, so long as the UK’s fossil fuel assets are controlled by corporate actors whose primary goal is the maximisation of profits, then our ability to secure a just transition in the North Sea at the speed and scale required is put at risk.”

Rosemary Harris, a just transition campaigner from environmental campaign group Platform, agrees that these companies’ increasing control of the UK’s North Sea assets is worrying for workers: “Power, resources and wealth are controlled in the hands of a few, both nationally and internationally, and this research highlights how this is true for the oil and gas industry,” she said.

That’s why Platform is calling for “an end to the private ownership of energy supply and an end to poor working conditions and exploitation in the energy industry.”

She adds: “The only way to ensure a fairer future through renewable energy is to centre power in the hands of workers and communities.”

Updated 04/08/2021: A line was added to reflect a post-publication exchange between DeSmog and a spokesperson from Neptune Energy.

Edited by Mat Hope

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts